An open-ended Equity Scheme following Environment, Social and Governance (ESG) theme

An open-ended Equity Scheme following Environment, Social and Governance (ESG) theme

The scheme shall seek to generate capital

appreciation by investing in a diversified

portfolio of companies that follow

Environmental, Social and Governance

parameters.

However, there can be no assurance that

the investment objective of the Scheme will

be realized.

The scheme shall seek to generate capital

appreciation by investing in a diversified

portfolio of companies that follow

Environmental, Social and Governance

parameters.

However, there can be no assurance that

the investment objective of the Scheme will

be realized.

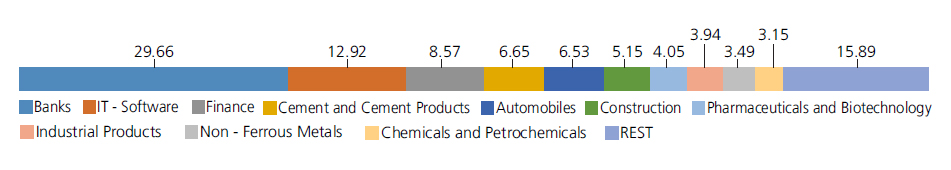

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

| Banks | 29.66 | |

| State Bank Of India | 8.61 | |

| ICICI Bank Ltd. | 7.95 | |

| HDFC Bank Ltd. | 4.42 | |

| Axis Bank Ltd. | 3.44 | |

| AU Small Finance Bank Ltd. | 3.24 | |

| Bank Of Baroda | 2.00 | |

| IT - Software | 12.92 | |

| Infosys Ltd. | 6.01 | |

| Tata Consultancy Services Ltd. | 4.86 | |

| Wipro Ltd. | 2.05 | |

| Finance | 8.57 | |

| HDFC Ltd. | 4.44 | |

| Bajaj Finance Ltd. | 4.13 | |

| Cement and Cement Products | 6.65 | |

| Ultratech Cement Ltd. | 3.16 | |

| Ambuja Cements Ltd. | 2.29 | |

| JK Cement Ltd. | 1.20 | |

| Automobiles | 6.53 | |

| Mahindra & Mahindra Ltd. | 2.45 | |

| Eicher Motors Ltd. | 1.76 | |

| Maruti Suzuki India Limited | 1.30 | |

| Hero MotoCorp Ltd. | 1.02 | |

| Construction | 5.15 | |

| Larsen And Toubro Ltd. | 5.15 | |

| Pharmaceuticals and Biotechnology | 4.05 | |

| Sun Pharmaceuticals Industries Ltd. | 1.67 | |

| Abbott India Ltd. | 0.99 | |

| Cipla Ltd. | 0.81 | |

| Divi s Laboratories Ltd. | 0.58 | |

| Industrial Products | 3.94 | |

| Bharat Forge Ltd. | 2.14 | |

| Ratnamani Metals & Tubes Ltd. | 1.07 | |

| Supreme Industries Limited | 0.73 | |

| Non - Ferrous Metals | 3.49 | |

| Hindalco Industries Ltd | 3.49 | |

| Chemicals and Petrochemicals | 3.15 | |

| Linde India Ltd. | 3.15 | |

| Telecom - Services | 2.93 | |

| Bharti Airtel Ltd | 2.80 | |

| Bharti Airtel Ltd - Partly Paid Shares | 0.13 | |

| Diversified FMCG | 1.86 | |

| Hindustan Unilever Ltd. | 1.86 | |

| Agricultural Food and other Product | 1.85 | |

| Balrampur Chini Mills Ltd. | 1.85 | |

| Transport Services | 1.62 | |

| Inter Globe Aviation Ltd | 1.35 | |

| Container Corporation of India Ltd. | 0.27 | |

| Petroleum Products | 1.61 | |

| Reliance Industries Ltd. | 1.61 | |

| Auto Components | 1.38 | |

| Bosch Ltd. | 1.29 | |

| Balkrishna Industries Ltd. | 0.09 | |

| Consumer Durables | 1.24 | |

| VIP Industries Ltd. | 1.17 | |

| Bata India Ltd. | 0.07 | |

| Ferrous Metals | 1.04 | |

| Jindal Steel & Power Ltd. | 1.04 | |

| Healthcare Services | 0.61 | |

| DR.Lal Pathlabs Ltd. | 0.61 | |

| Retailing | 0.35 | |

| V-Mart Retail Ltd. | 0.35 | |

| Fertilizers and Agrochemicals | 0.03 | |

| Dhanuka Agritech Ltd. | 0.03 | |

| Equity & Equity related - Total | 98.63 | |

| Mutual Fund Units | ||

| Kotak Liquid Scheme Direct Plan Growth | Mutual Fund industry | 0.65 |

| Mutual Fund Units - Total | 0.65 | |

| Triparty Repo | 0.98 | |

| Net Current Assets/(Liabilities) | -0.26 | |

| Grand Total | 100.00 | |

| | ||

| Reg-Plan-IDCW | Rs11.8300 |

| Dir-Plan-IDCW | Rs12.3290 |

| Growth option | Rs11.8300 |

| Direct Growth option | Rs12.3290 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Harsha Upadhyaya & Mr.Arjun Khanna (Dedicated fund manager for investments in foreign securities) |

| Benchmark | Nifty 100 ESG Index TRI |

| Allotment date | December 11, 2020 |

| AAUM | Rs1,112.79 crs |

| AUM | Rs1,125.47 crs |

| Folio count | 43,280 |

Trustee's Discretion

| Portfolio Turnover | 20.81% |

Initial Investment: Rs5000 and in multiple of

Rs1 for purchase and of Rs0.01 for switches

Additional Investment: Rs1000 & in

multiples of Rs1

Ideal Investments Horizon: 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

10% of the units allotted shall be redeemed

without any Exit Load on or before

completion of 1 Year from the date of

allotment of units.

Any redemption in excess of such limit

within 1 Year from the date of allotment

shall be subject to the following Exit Load:

a) If redeemed or switched out on or before

completion of 1 Year from the date of

allotment of units-1.00%

b) If redeemed or switched out after

completion of 1 Year from the date of

allotment of units-NIL

Regular:2.13%; Direct: 0.40%

Benchmark

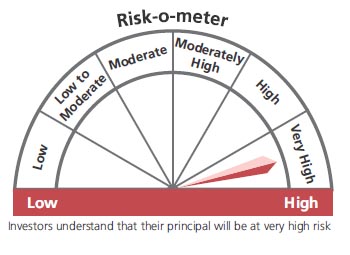

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in Portfolio of predominantly equity & equity related securities of companies following environmental, social and governance (ESG) criteria.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 30th April, 2023. An addendum may be issued or updated on the website for new riskometer.

* For Fund Manager experience, please refer 'Our Fund Managers'

For scheme performance, please refer 'Scheme Performances'