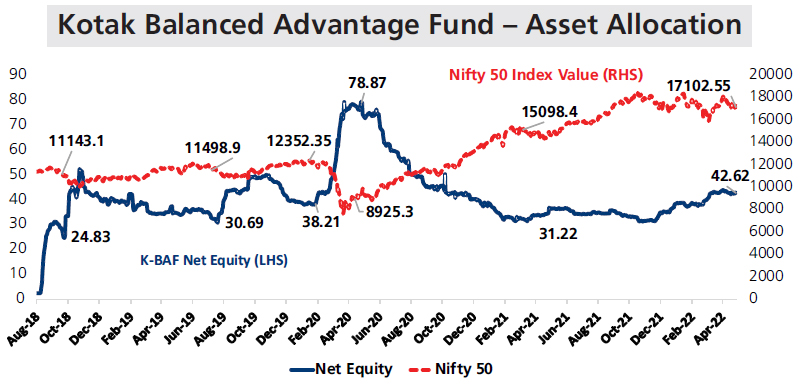

The investment objective of the scheme is to generate capital appreciation by investing in a dynamically balanced portfolio of equity & equity related securities and debt & money market securities. There is no assurance or guarantee that the investment objective of the scheme will be achieved.

The investment objective of the scheme is to generate capital appreciation by investing in a dynamically balanced portfolio of equity & equity related securities and debt & money market securities. There is no assurance or guarantee that the investment objective of the scheme will be achieved.

Source: Internal Analysis. As on 29th April 2022. Automatic: A fund that gives you freedom from managing equity and debt

allocation manually during the market ups and down, giving you a balanced growth.

Mutual fund investment are subject to market risk, read all scheme related documents carefully

| Issuer/ Instrument |

Industry/ Rating |

% to Net Assets |

% to Net Assets Derivatives |

| Equity & Equity related | |||

| Adani Port and Special Economic Zone Ltd. | Transport Infrastructure | 3.97 | -3.99 |

| Reliance Industries Ltd. | Petroleum Products | 3.68 | |

| ICICI Bank Ltd. | Banks | 2.65 | |

| HDFC Bank Ltd. | Banks | 2.44 | |

| Infosys Ltd. | IT - Software | 2.28 | |

| Tata Steel Ltd. | Ferrous Metals | 1.85 | -1.85 |

| Adani Enterprises Ltd. | Metals & Minerals Trading | 1.76 | -1.77 |

| Bharti Airtel Ltd | Telecom - Services | 1.74 | -1.74 |

| Maruti Suzuki India Limited | Automobiles | 1.49 | |

| Persistent Systems Limited | IT - Software | 1.48 | |

| Others | 43.94 | -15.56 | |

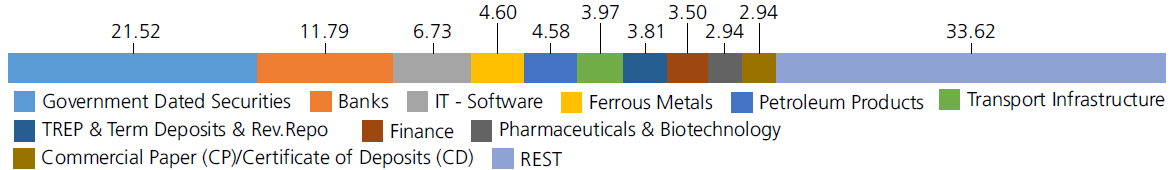

| Equity & Equity related - Total | 67.28 | -24.91 | |

| Mutual Fund Units | 2.67 | ||

| Debt Instruments | |||

| Debentures and Bonds | 1.44 | ||

| Money Market Instruments | 21.52 | ||

| Commercial Paper(CP)/Certificate of Deposits(CD) | 2.94 | ||

| Triparty Repo | 3.81 | ||

| Net Current Assets/(Liabilities) | 0.34 | ||

| Grand Total | 100.00 | ||

For detailed portfolio log on to

https://www.kotakmf.com/Products/funds/hybrid-funds/Kotak-Balanced-Advantage-Fund/Dir-G

Mutual Fund Units as provided above is towards margin for derivatives transactions.

Equity Derivative Exposuer is 24.91%

| Monthly SIP of (₹) 10000 | Since Inception | 3 years | 1 year |

| Total amount invested (Rs) | 4,50,000 | 3,60,000 | 1,20,000 |

| Total Value as on Apr 30, 2022 (Rs) | 5,56,809 | 4,28,542 | 1,21,504 |

| Scheme Returns (%) | 11.41 | 11.71 | 2.36 |

| NIFTY 50 Hybrid Composite Debt 50:50 Index Returns (%) | 13.03 | 13.44 | 3.82 |

| Alpha* | -1.63 | -1.73 | -1.46 |

| NIFTY 50 Hybrid Composite Debt 50:50 Index (Rs)# | 5,73,541 | 4,39,387 | 1,22,429 |

| Nifty 50 (TRI) (Rs)^ | 6,32,019 | 4,87,261 | 1,23,610 |

| Nifty 50 (TRI) Returns (%) | 18.44 | 20.77 | 5.70 |

*All payouts during the period have been reinvested in the units of the scheme at the then prevailing NAV. Returns >= 1 year: CAGR (Compounded Annualised Growth Rate). N.A stands for data not available.

Note: Point to Point (PTP) Returns in INR shows the value of Rs 10,000/- investment made at inception. Source: ICRA MFI Explorer. # Name of Scheme Benchmark. ## Name of Additional Benchmark.

*Alpha is difference of scheme return with benchmark return.

| Growth option | Rs14.9160 |

| Direct Growth option | Rs14.9160 |

| Reg-Plan-IDCW | Rs 14.2730 |

| Dir-Plan-IDCW | Rs 14.9160 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager | Mr. Harish Krishnan Mr. Hiten Shah Mr. Abhishek Bisen & Mr. Arjun Khanna* (Dedicated fund manager for investments in foreign securities) |

| Benchmark | NIFTY 50 Hybrid Composite Debt 50:50 Index |

| Allotment date | August 3, 2018 |

| AAUM | Rs13,549.62 crs |

| AUM | Rs13,572.62 crs |

| Folio count | 2,28,009 |

Trustee's Discretion

| Portfolio Turnover | 25.29% |

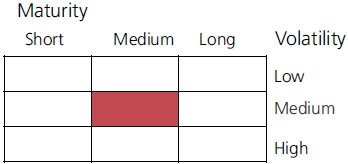

| Portfolio Average Maturity | 7.81 yrs |

| IRS Average Maturity* | 0.23 yrs |

| Net Average Maturity | 8.04 yrs |

| Portfolio Modified Duration | 3.42 yrs |

| IRS Modified Duration* | 0.19 yrs |

| Net Modified Duration | 3.61 yrs |

| Portfolio Macaulay Duration | 3.54 yrs |

| IRS Macaulay Duration* | 0.20 yrs |

| Net Macaulay Duration | 3.74 yrs |

| YTM | 6.08% |

| $Beta | 1.14 |

| $Sharpe@@ | 0.86 |

| $Standard Deviation | 13.05% |

Initial Investment: Rs1000 and in multiple of

Rs1 for purchase and of Rs0.01 for switches

Additional Investment: Rs1000 & in

multiples of Rs1

Ideal Investments Horizon: 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

a) For redemption/switch out of upto 8%

of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

b) If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%.

c) If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL

Regular: 1.75%; Direct: 0.45%

Fund

Benchmark

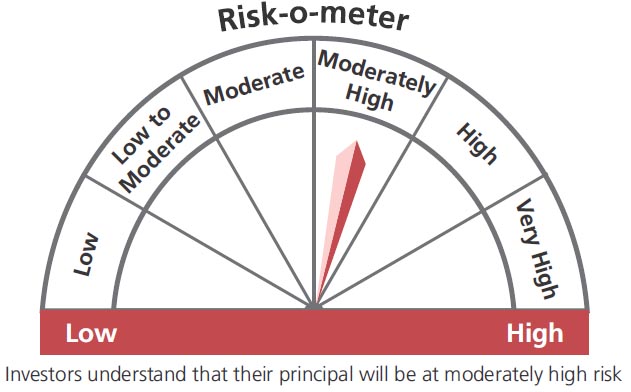

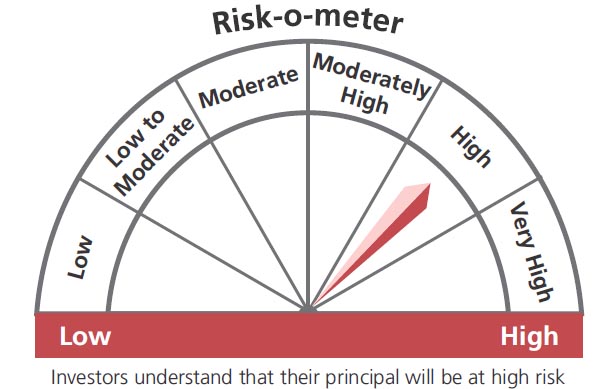

This product is suitable for investors who are seeking*:

- Wealth creation over a long period of time.

- Investment in equity, equity related securities & debt, money market instruments while managing risk through active allocation.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

(^) Fully or Party blocked against Interest Rate Swap (IRS) Hedging Position through Interest Rate Swaps as on 30 Apr 2022 is 1.42 of the net assets.

Mr. Hiten Shah has been managing the fund since 03/10/2019.

@@Risk rate assumed to be 3.93% (FBIL Overnight MIBOR rate as on 30th April 2022).

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'