| KOTAK DYNAMIC BOND FUND

An open ended dynamic debt scheme investing across duration.

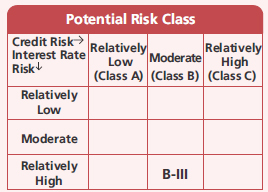

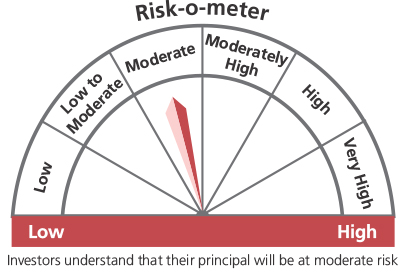

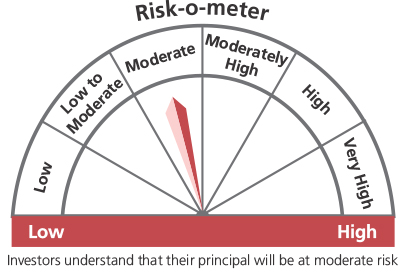

A relatively high interest rate risk and moderate credit risk.

An open ended dynamic debt scheme investing across duration.

A relatively high interest rate risk and moderate credit risk.

| KOTAK DYNAMIC BOND FUND

An open ended dynamic debt scheme investing across duration.

A relatively high interest rate risk and moderate credit risk.

*Interest Rate Swap

Source: $ICRAMFI Explorer. Standard

Deviation is calculated on Annualised basis

using 3 years history of monthly returns.

This product is suitable for investors who are seeking*:

An open ended dynamic debt scheme investing across duration.

A relatively high interest rate risk and moderate credit risk.

Investment Objective

The investment objective of the Scheme is

to maximise returns through an active

management of a portfolio of debt and

money market securities. There is no

assurance or guarantee that the investment

objective of the scheme will be achieved.

The investment objective of the Scheme is

to maximise returns through an active

management of a portfolio of debt and

money market securities. There is no

assurance or guarantee that the investment

objective of the scheme will be achieved.

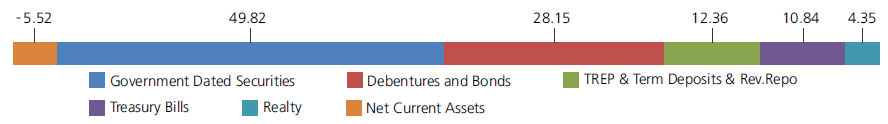

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Mutual Fund Units | ||

| Mutual Fund Units - Total | 4.35 | |

| Embassy Office Parks REIT | Realty | 3.43 |

| Brookfield India Real Estate Trust | Realty | 0.63 |

| Mindspace Business Parks REIT | Realty | 0.29 |

| Debt Instruments | ||

| Debentures and Bonds | ||

| Government Dated Securities | ||

| 5.53% Central Government(^) | SOV | 21.67 |

| 8.03% Gujarat State Govt-Gujarat | SOV | 8.62 |

| 7.26% Central Government | SOV | 7.91 |

| 8.17% Karnataka State Govt-Karnataka | SOV | 2.35 |

| 4.81% Central Government | SOV | 2.34 |

| 6.44% Maharashtra State Govt-Maharashtra | SOV | 2.16 |

| 7.25% Gujarat State Govt-Gujarat | SOV | 1.13 |

| 6.89% Bihar State Govt-Bihar | SOV | 1.11 |

| 1.44% Central Government | SOV | 0.90 |

| 7.23% Karnataka State Govt-Karnataka | SOV | 0.67 |

| 6.67% Central Government | SOV | 0.33 |

| 4.93% Central Government | SOV | 0.28 |

| 7.16% Central Government | SOV | 0.16 |

| 5.85% Central Government | SOV | 0.13 |

| 6.53% Tamil Nadu State Govt-Tamil Nadu | SOV | 0.03 |

| 6.52% Karnataka State Govt-Karnataka | SOV | 0.02 |

| 6.62% Uttar Pradesh State Govt-Uttar Pradesh | SOV | 0.01 |

| Government Dated Securities - Total | 49.82 | |

| Public Sector Undertakings | ||

| National Bank for Agriculture & Rural Development | CRISIL AAA | 4.36 |

| Bank Of Baroda(Basel III TIER I Bonds) | CRISIL AA+ | 2.74 |

| Power Finance Corporation Ltd. | CRISIL AAA | 1.62 |

| Rural Electrification Corporation Ltd. | CRISIL AAA | 1.01 |

| Union Bank of India(Basel III TIER I Bonds) | FITCH IND AA | 0.80 |

| Public Sector Undertakings - Total | 10.53 | |

| Corporate Debt/Financial Institutions | ||

| Sikka Ports & Terminals Ltd. ( Mukesh Ambani Group ) | CRISIL AAA | 4.92 |

| HDFC Ltd. | CRISIL AAA | 3.08 |

| Muthoot Finance Ltd. | CRISIL AA+ | 2.72 |

| LIC Housing Finance Ltd. | CRISIL AAA | 2.39 |

| PTC First Business Receivables Trust (Series 23) 01/10/2025(First Business Receivables Trust) | CRISIL AAA(SO) | 2.34 |

| Jamnagar Utilities & Power Private Limited ( Mukesh Ambani Group ) | CRISIL AAA | 2.17 |

| Corporate Debt/Financial Institutions - Total | 17.62 | |

| Treasury Bills | ||

| 182 Days Treasury Bill 25/08/2022 | SOV | 6.39 |

| 91 Days Treasury Bill 16/06/2022 | SOV | 4.45 |

| Treasury Bills - Total | 10.84 | |

| Triparty Repo | 12.36 | |

| Net Current Assets/(Liabilities) | -5.52 | |

| Grand Total | 100.00 | |

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (Rs) | 16,80,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on Apr 30, 2022 (Rs) | 30,85,358 | 18,11,702 | 10,94,061 | 7,14,014 | 3,89,917 | 1,21,495 |

| Scheme Returns (%) | 8.24 | 8.00 | 7.44 | 6.91 | 5.28 | 2.35 |

| Nifty Composite Debt Index BIII Returns (%) | 8.12 | 7.93 | 7.47 | 7.34 | 6.57 | 2.90 |

| Alpha | 0.13 | 0.07 | -0.02 | -0.43 | -1.29 | -0.55 |

| Nifty Composite Debt Index BIII (Rs)# | 30,55,865 | 18,05,412 | 10,95,010 | 7,21,686 | 3,97,488 | 1,21,841 |

| Nifty Composite Debt Index Returns (%) | 7.94 | 7.78 | 7.26 | 7.00 | 5.51 | 1.76 |

| Alpha | 0.30 | 0.22 | 0.18 | -0.09 | -0.24 | 0.59 |

| Nifty Composite Debt Index (Rs)# | 30,14,390 | 17,90,960 | 10,86,933 | 7,15,634 | 3,91,287 | 1,21,121 |

| CRISIL 10 Year Gilt Index (Rs)^ | 26,05,695 | 16,20,416 | 10,01,030 | 6,67,566 | 3,68,767 | 1,17,498 |

| CRISIL 10 Year Gilt Index (%) | 6.02 | 5.86 | 4.95 | 4.23 | 1.58 | -3.90 |

Scheme Inception : - May 26, 2008. The returns are calculated by XIRR approach assuming investment of Rs 10,000/- on the 1st working day of every month. XIRR helps in calculating return on investments given an initial and

final value and a series of cash inflows and outflows and taking the time of investment into consideration. Since inception returns are assumed to be starting from the beginning of the subsequent month from the date of

inception. # Benchmark ; ^ Additional Benchmark.

Alpha is difference of scheme return with benchmark return.

Alpha is difference of scheme return with benchmark return.

NAV

| Growth Option | Rs30.2398 |

| Direct Growth Option | Rs32.1092 |

| Quarterly-Reg-Plan-IDCW | Rs11.3927 |

| Quarterly-Dir-Plan-IDCW | Rs11.2694 |

| Fund Manager | Mr. Deepak Agrawal &

Mr. Vihag Mishra* (Dedicated fund manager for investments in foreign securities) |

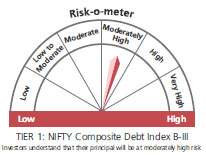

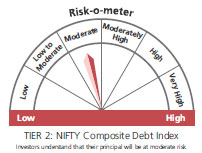

| Benchmark*** | Nifty Composite Debt Index B-III (Tier 1) Nifty Composite Debt Index (Tier 2) |

| Allotment date | May 26, 2008 |

| AAUM | Rs2,256.12 crs |

| AUM | Rs2,237.98 crs |

| Folio count | 26,207 |

Available Plans/Options

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth

(applicable for all plans)

IDCW Frequency

At discretion of trustees

Ratios

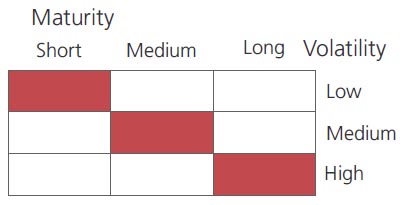

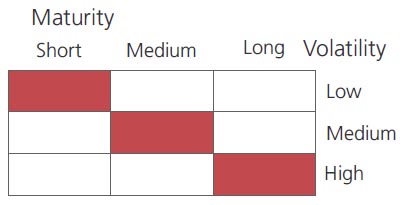

| Portfolio Average Maturity | 5.79 yrs |

| IRS Average Maturity* | 0.80 yrs |

| Net Average Maturity | 6.60 yrs |

| Portfolio Modified Duration | 2.24 yrs |

| IRS Modified Duration* | 0.70 yrs |

| Net Modified Duration | 2.93 yrs |

| Portfolio Macaulay Duration | 2.34 yrs |

| IRS Macaulay Duration* | 0.72 yrs |

| Net Macaulay Duration | 3.06 yrs |

| YTM | 6.06% |

| $Standard Deviation | 1.41% |

Minimum Investment Amount

Initial Investment:Rs5000 and in multiple

of Rs1 for purchase and for Rs0.01 for

switches

Additional Investment: Rs1000 & in multiples

of Rs1

Ideal Investment Horizon: 2-3 years

Load Structure

Entry Load: Nil. (applicable for all plans)

Exit Load: Nil.

Total Expense Ratio**

Regular: 1.20%; Direct: 0.22%

Data as on April 30, 2022

Fund

Benchmark

Benchmark

This product is suitable for investors who are seeking*:

- Income over a medium term investment horizon

- Investment in debt & money market securities across durations.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

(^) Fully or Party blocked against Interest Rate Swap (IRS) Hedging Position through Interest Rate Swaps as on 30 Apr 2022 is 20.81% of the net assets.

**Total Expense Ratio includes applicable B30 fee and GST

***As per SEBI circular no. SEBI/HO/IMD/IMD-11 DF3/P/CIR/2021 /652 dated October 27, 2021; AMFI letter no. 35P/MEM-COR/70/2021-22 dated November 25, 2021 and AMFI letter no. 35P/ MEM-COR/ 131 / 2021-22 dated March 31, 2022 with effect from April 01, 2022 ("Effective date"), the first tier benchmark index of the scheme. Existing benchmark will be Second Tier benchmark for aforementioned scheme.

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'

**Total Expense Ratio includes applicable B30 fee and GST

***As per SEBI circular no. SEBI/HO/IMD/IMD-11 DF3/P/CIR/2021 /652 dated October 27, 2021; AMFI letter no. 35P/MEM-COR/70/2021-22 dated November 25, 2021 and AMFI letter no. 35P/ MEM-COR/ 131 / 2021-22 dated March 31, 2022 with effect from April 01, 2022 ("Effective date"), the first tier benchmark index of the scheme. Existing benchmark will be Second Tier benchmark for aforementioned scheme.

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'