An open-ended hybrid scheme investing predominantly in equity and equity related instruments

An open-ended hybrid scheme investing predominantly in equity and equity related instruments

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

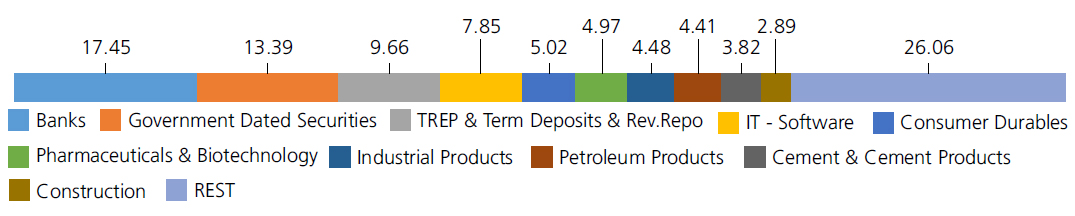

| Banks | 17.45 | |

| ICICI Bank Ltd. | 5.02 | |

| HDFC Bank Ltd. | 3.79 | |

| State Bank Of India | 3.53 | |

| Axis Bank Ltd. | 2.24 | |

| Kotak Mahindra Bank Ltd. | 2.19 | |

| AU Small Finance Bank Ltd. | 0.68 | |

| IT - Software | 7.85 | |

| Infosys Ltd. | 3.93 | |

| Tata Consultancy Services Ltd. | 1.84 | |

| Tech Mahindra Ltd. | 1.31 | |

| Oracle Financial Services Software Ltd | 0.77 | |

| Consumer Durables | 5.02 | |

| Century Plyboards (India) Ltd. | 2.29 | |

| Sheela Foam Ltd | 1.64 | |

| Kajaria Ceramics Ltd. | 0.60 | |

| Whirlpool of India Ltd. | 0.49 | |

| Pharmaceuticals & Biotechnology | 4.97 | |

| Sun Pharmaceuticals Industries Ltd. | 1.55 | |

| Dr Reddys Laboratories Ltd. | 1.07 | |

| Cipla Ltd. | 0.95 | |

| Torrent Pharmaceuticals Ltd. | 0.93 | |

| Zydus Lifesciences Limited | 0.47 | |

| Industrial Products | 4.48 | |

| Supreme Industries Limited | 1.38 | |

| Bharat Forge Ltd. | 1.29 | |

| Cummins India Ltd. | 1.19 | |

| Carborundum Universal Ltd. | 0.62 | |

| Petroleum Products | 4.41 | |

| Reliance Industries Ltd. | 2.95 | |

| Bharat Petroleum Corporation Ltd. | 0.77 | |

| Indian Oil Corporation Ltd | 0.69 | |

| Cement & Cement Products | 3.82 | |

| Shree Cement Ltd. | 1.51 | |

| JK Cement Ltd. | 1.40 | |

| The Ramco Cements Ltd | 0.91 | |

| Construction | 2.89 | |

| Larsen And Toubro Ltd. | 1.66 | |

| Techno Electric & Engineering Company Limited | 0.90 | |

| JMC Projects (India) Ltd. | 0.33 | |

| Chemicals & Petrochemicals | 2.68 | |

| Solar Industries India Limited | 1.82 | |

| Galaxy Surfactants Ltd. | 0.86 | |

| Realty | 2.32 | |

| Mahindra Lifespace Developers Ltd | 1.53 | |

| Oberoi Realty Ltd | 0.79 | |

| Auto Components | 2.32 | |

| Schaeffler India Ltd | 1.37 | |

| Motherson Sumi Systems Ltd. | 0.88 | |

| Rolex Rings Ltd. | 0.07 | |

| Electrical Equipment | 2.31 | |

| Thermax Ltd. | 2.31 | |

| Automobiles | 2.01 | |

| Maruti Suzuki India Limited | 1.14 | |

| Mahindra & Mahindra Ltd. | 0.87 | |

| Diversified FMCG | 2.01 | |

| ITC Ltd. | 1.42 | |

| Hindustan Unilever Ltd. | 0.59 | |

| Beverages | 1.80 | |

| United Spirits Ltd. | 1.80 | |

| Fertilizers & Agrochemicals | 1.39 | |

| Coromandel International Ltd. | 0.82 | |

| P I Industries Ltd | 0.57 | |

| Finance | 1.33 | |

| HDFC Ltd. | 1.33 | |

| Insurance | 1.19 | |

| ICICI Lombard General Insurance Company Ltd | 0.89 | |

| HDFC Life Insurance Company Ltd. | 0.30 | |

| Gas | 1.03 | |

| Petronet LNG Ltd. | 0.52 | |

| Gujarat Gas Ltd. | 0.51 | |

| Power | 1.00 | |

| National Thermal Power Corporation Limited | 1.00 | |

| Personal Products | 0.70 | |

| Emami Ltd. | 0.70 | |

| Transport Services | 0.62 | |

| Blue Dart Express Ltd. | 0.62 | |

| Agricultural, Commercial & Construction Vehicles | 0.59 | |

| V.S.T Tillers Tractors Ltd | 0.59 | |

| Non - Ferrous Metals | 0.47 | |

| Hindalco Industries Ltd | 0.47 | |

| Ferrous Metals | 0.42 | |

| Shyam Metalics and Energy Ltd | 0.42 | |

| Equity & Equity related - Total | 75.08 | |

| Mutual Fund Units | ||

| Brookfield India Real Estate Trust | Realty | 0.29 |

| Mutual Fund Units - Total | 0.29 | |

| Debt Instruments | ||

| Debentures and Bonds | ||

| Corporate Debt/Financial Institutions | ||

| LIC Housing Finance Ltd. | CRISIL AAA | 0.02 |

| Corporate Debt/Financial Institutions - Total | 0.02 | |

| Public Sector Undertakings | ||

| U P Power Corporation Ltd ( Guaranteed By UP State Government ) | CRISIL A+(CE) | 0.74 |

| THDC India Ltd. (THDCIL) ( ) | ICRA AA | 0.39 |

| Public Sector Undertakings - Total | 1.13 | |

| Government Dated Securities | ||

| 5.53% Central Government(^) | SOV | 5.24 |

| 6.54% Central Government | SOV | 3.57 |

| 6.1% Central Government | SOV | 1.64 |

| 4.81% Central Government | SOV | 0.78 |

| 4.93% Central Government | SOV | 0.61 |

| GS CG 22 Aug 2028 - (STRIPS) | SOV | 0.49 |

| 6.67% Central Government | SOV | 0.24 |

| GS CG 17 Jun 2027 - (STRIPS) | SOV | 0.19 |

| GS CG 22 Aug 2029 - (STRIPS) | SOV | 0.09 |

| GS CG 22 Aug 2030 - (STRIPS) | SOV | 0.09 |

| GS CG 22 Feb 2030 - (STRIPS) | SOV | 0.09 |

| GS CG 22 Aug 2022 - (STRIPS) | SOV | 0.04 |

| GS CG 22 Aug 2036 - (STRIPS) | SOV | 0.04 |

| GS CG 22 Feb 2036 - (STRIPS) | SOV | 0.04 |

| GS CG 22 Aug 2026 - (STRIPS) | SOV | 0.03 |

| GS CG 22 Aug 2027 - (STRIPS) | SOV | 0.03 |

| GS CG 22 Feb 2028 - (STRIPS) | SOV | 0.03 |

| GS CG 23/12/2025 - (STRIPS) | SOV | 0.03 |

| GS CG 22 Aug 2031 - (STRIPS) | SOV | 0.02 |

| GS CG 22 Aug 2032 - (STRIPS) | SOV | 0.02 |

| GS CG 22 Feb 2029 - (STRIPS) | SOV | 0.02 |

| GS CG 22 Feb 2032 - (STRIPS) | SOV | 0.02 |

| GS CG 22 Aug 2043 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Feb 2027 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Feb 2043 - (STRIPS) | SOV | 0.01 |

| GS CG 22 Feb 2044 - (STRIPS) | SOV | 0.01 |

| Government Dated Securities - Total | 13.39 | |

| Triparty Repo | 9.66 | |

| Net Current Assets/(Liabilities) | 0.43 | |

| Grand Total | 100.00 | |

| | ||

Term Deposit as provided above is towards margin for derivatives transactions

| Monthly SIP of (₹) 10000 | Since Inception | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (Rs) | 9,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on Apr 30, 2022 (Rs) | 15,11,724 | 13,83,039 | 8,91,377 | 4,91,443 | 1,24,411 |

| Scheme Returns (%) | 13.55 | 14.02 | 15.88 | 21.40 | 6.98 |

| NIFTY 50 Hybrid Composite Debt 65:35 Index Returns (%) | 12.46 | 12.83 | 13.50 | 15.78 | 4.41 |

| Alpha* | 1.09 | 1.19 | 2.37 | 5.62 | 2.57 |

| NIFTY 50 Hybrid Composite Debt 65:35 Index (Rs)# | 14,49,571 | 13,25,604 | 8,40,919 | 4,54,242 | 1,22,798 |

| Nifty 50 (TRI) (Rs)^ | 15,64,375 | 14,34,057 | 8,97,773 | 4,87,888 | 1,23,610 |

| Nifty 50 (TRI) Returns (%) | 14.44 | 15.04 | 16.17 | 20.87 | 5.70 |

Alpha is difference of scheme return with benchmark return. *All payouts during the period have been reinvested in the units of the scheme at the then prevailing NAV. Returns >= 1 year: CAGR (Compounded Annualised Growth Rate). N.A stands for data not available. Note: Point to Point (PTP) Returns in INR shows the value of 10,000/- investment made at inception. Source: ICRA MFI Explorer.

(^) Fully or Party blocked against Interest Rate Swap (IRS) Hedging Position through Interest Rate Swaps as on 30 Apr 2022 is 0.95% of the net assets.

| Reg-Plan-IDCW | Rs23.2510 |

| Dir-Plan-IDCW | Rs27.2650 |

| Growth Option | Rs39.5640 |

| Direct Growth Option | Rs44.4770 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of IDCW & Growth (applicable for all plans)

| Fund Manager | Mr. Pankaj Tibrewal

Mr. Abhishek Bisen & Mr. Arjun Khanna* (Dedicated fund manager for investments in foreign securities) |

| Benchmark | NIFTY 50 Hybrid Composite Debt 65:35 Index |

| Allotment date | November 25, 1999 |

| AAUM | Rs2,552.55 crs |

| AUM | Rs2,554.09 crs |

| Folio count | 72,419 |

Half Yearly (25th of Mar/Sep)

| Portfolio Turnover | 6.77% |

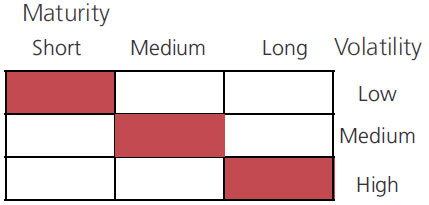

| Portfolio Average Maturity | 5.74 yrs |

| IRS Average Maturity* | 0.19 yrs |

| Net Average Maturity | 5.93 yrs |

| Portfolio Modified Duration | 2.20 yrs |

| IRS Modified Duration* | 0.16 yrs |

| Net Modified Duration | 2.36 yrs |

| Portfolio Macaulay Duration | 2.28 yrs |

| IRS Macaulay Duration* | 0.16 yrs |

| Net Macaulay Duration | 2.44 yrs |

| YTM | 5.52% |

| $Beta | 1.22 |

| $Sharpe## | 0.75 |

| $Standard Deviation | 18.00% |

Initial Investment: Rs5000 and in multiple of

Rs1 for purchase and for Rs0.01 for switches

Additional Investment: Rs1000 & in

multiples of Rs1

Ideal Investments Horizon: 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

a) For redemption/switch out of upto 8%

of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

b) If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%.

c) If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL

Regular: 2.11%; Direct: 0.66%

Fund

Benchmark

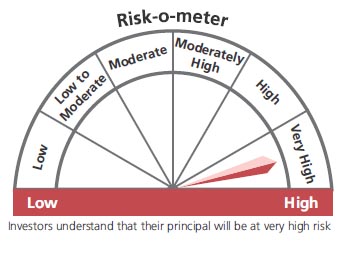

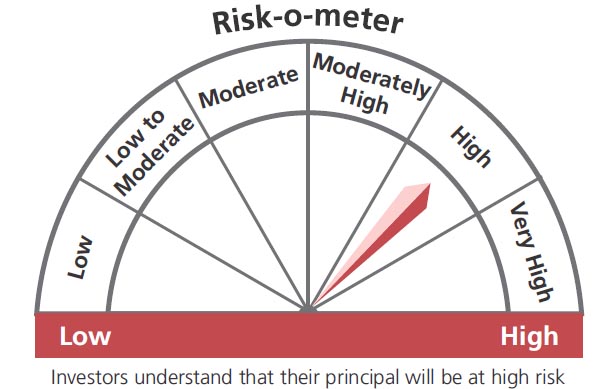

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in equity & equity related securities balanced with income generation by investing in debt & money.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

(^) Fully or Party blocked against Interest Rate Swap (IRS) Hedging Position through Interest Rate Swaps as on 30 Apr 2022 is 0.95% of the net assets.

## Risk rate assumed to be 3.93% (FBIL Overnight MIBOR rate as on 29th April 2022).**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'