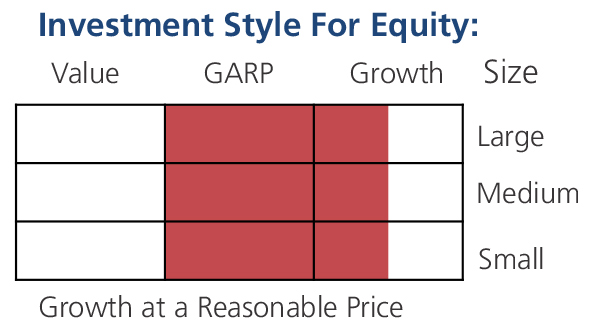

An open ended fund of fund scheme investing in units of Kotak Mahindra Mutual Fund schemes & ETFs / Index schemes (Domestic & Offshore Funds including Gold ETFs schemes.

An open ended fund of fund scheme investing in units of Kotak Mahindra Mutual Fund schemes & ETFs / Index schemes (Domestic & Offshore Funds including Gold ETFs schemes.

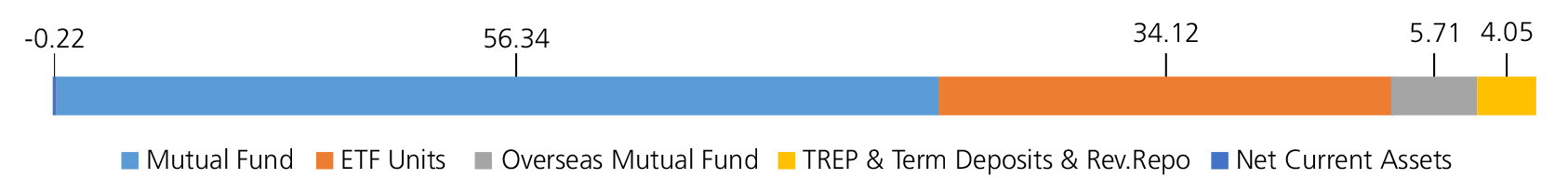

| Issuer/Instrument | Rating | % to Net Assets |

|---|---|---|

| Mutual Fund Units | ||

| Kotak Consumption Fund Growth | Mutual Fund | 11.17 |

| Kotak Infrastructure & Economic Reform Fund Direct Growth | Mutual Fund | 10.03 |

| KOTAK PSU BANK ETF | ETF Units | 9.29 |

| KOTAK NIFTY 50 ETF | ETF Units | 8.55 |

| Kotak Gilt Fund Direct Growth | Mutual Fund | 8.19 |

| KOTAK MUTUAL FUND - KOTAK GOLD ETF | ETF Units | 7.18 |

| Kotak Bond Direct Plan Growth | Mutual Fund | 6.48 |

| KOTAK NIFTY BANK ETF | ETF Units | 6.29 |

| Kotak Quant Fund Growth | Mutual Fund | 5.94 |

| Ishares Nasdaq 100 UCITS ETF USD | Overseas Mutual Fund | 5.71 |

| Kotak Manufacture In India Fund | Mutual Fund | 4.36 |

| Kotak India EQ Contra Fund Direct Growth | Mutual Fund | 4.30 |

| Kotak Technology Fund Growth | Mutual Fund | 3.47 |

| KOTAK NIFTY IT ETF | ETF Units | 2.81 |

| Kotak Transportation & Logistics Fund | Mutual Fund | 2.40 |

| Mutual Fund Units - Total | 96.17 | |

| Triparty Repo | 4.05 | |

| Net Current Assets/(Liabilities) | -0.22 | |

| Grand Total | 100.00 | |

| Monthly SIP of Rs 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 24,90,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on Apr 30, 2025 (₹) | 1,36,37,863 | 28,05,232 | 16,04,333 | 9,40,517 | 4,63,205 | 1,22,783 |

| Scheme Returns (%) | 14.34 | 16.21 | 18.17 | 18.05 | 17.11 | 4.37 |

| 90% Nifty 50 Hybrid Composite Debt 50:50 Index + 5% price of Physical Gold + 5% MSCI World Index (%) | NA | 11.96 | 12.44 | 12.24 | 12.85 | 9.46 |

| Alpha* | NA | 4.25 | 5.74 | 5.81 | 4.26 | -5.08 |

| 90% Nifty 50 Hybrid Composite Debt 50:50 Index + 5% price of Physical Gold + 5% MSCI World Index (₹)# | NA | 22,34,930 | 13,07,679 | 8,15,431 | 4,35,864 | 1,25,969 |

| Nifty 50 TRI (₹)^ | 1,19,03,680 | 25,57,356 | 14,49,968 | 8,84,781 | 4,43,598 | 1,22,880 |

| Nifty 50 TRI Returns (%) | 13.28 | 14.48 | 15.33 | 15.55 | 14.07 | 4.53 |

# Benchmark; ^ Additional Benchmark.TRI – Total Return Index, In terms of para 6.14 of SEBI Master circular No. SEBI/HO/IMD/IMD-PoD-1/P/CIR/2024/90 dated June 27, 2024, the performance of the scheme is benchmarked to the Total Return variant (TRI) of the Benchmark Index instead of Price Return Variant (PRI). Alpha is difference of scheme return with benchmark return.

*All payouts during the period have been reinvested in the units of the scheme at the then prevailing NAV. Source: ICRA MFI Explorer.

| Regular | Direct | |

| Growth | Rs222.1210 | Rs238.6990 |

| IDCW | Rs216.2140 | Rs234.4040 |

A)Regular Plan B)Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager*^ | Mr. Devender Singhal,

Mr. Abhishek Bisen |

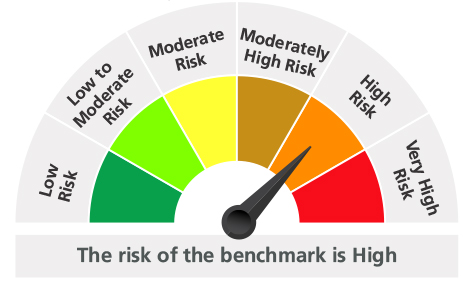

| Benchmark | 90% Nifty 50 Hybrid Composite Debt 50:50 Index + 5% price of Physical Gold +5 % MSCI World Index |

| Allotment date | August 9, 2004 |

| AAUM | Rs1,664.66 crs |

| AUM | Rs1,707.83 crs |

| Folio count | 38,943 |

Trustee's Discretion

| Portfolio Turnover | 40.43% |

| $Beta | 1.24 |

| $Sharpe ## | 1.18 |

| $Standard Deviation | 9.19% |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load:

Nil. (applicable for all plans)

Exit Load: 8% of the units allotted shall

be redeemed without any Exit Load on or

before completion of 1 Year from the date

of allotment of units. Any redemption in

excess of such limit within 1 Year from the

date of allotment shall be subject to the

following Exit Load:

a) If redeemed or switched out on or before

completion of 1 Year from the date of

allotment of units-1.00%

b) If redeemed or switched out after

completion of 1 Year from the date of

allotment of units-NIL

| Regular Plan: | 0.99% |

| Direct Plan: | 0.31% |

Folio Count data as on 31st March 2025.

Fund

Benchmark : 90% Nifty 50 Hybrid Composite Debt 50:50 Index + 5% price of Physical Gold + 5% MSCI World Index

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in Kotak Mahindra Mutual Fund schemes & ETFs/Index schemes (Domestic & Offshore Funds including Gold ETFs)

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

## Risk rate assumed to be 6.00% (FBIL Overnight MIBOR rate as on 30th Apr 2025).

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'