An open ended debt scheme predominantly investing in AA and below rated corporate bonds (Excluding AA+ rated corporate bonds).

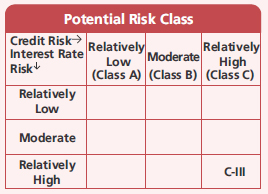

A relatively high interest rate risk and relatively high credit risk.

An open ended debt scheme predominantly investing in AA and below rated corporate bonds (Excluding AA+ rated corporate bonds).

A relatively high interest rate risk and relatively high credit risk.

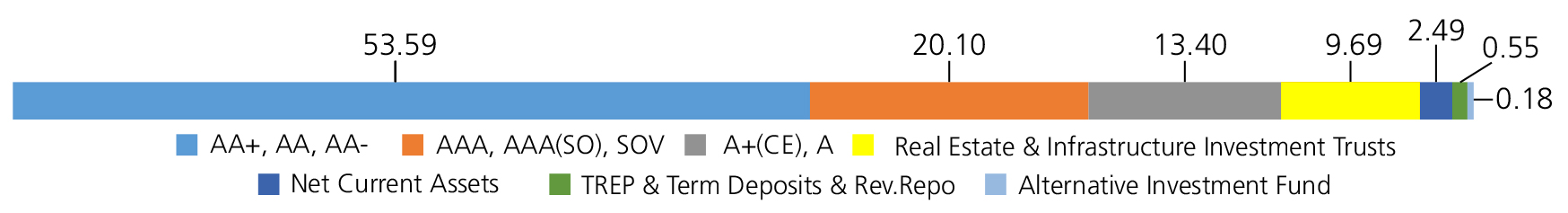

| Issuer/Instrument | Rating | % to Net Assets |

|---|---|---|

| Debt Instruments | ||

| Debentures and Bonds | ||

| Government Dated Securities | ||

| 7.18% Central Government | SOV | 8.85 |

| 7.10% Central Government | SOV | 1.80 |

| Government Dated Securities - Total | 10.65 | |

| Public Sector Undertakings | ||

| NATIONAL BANK FOR AGRICULTURE & RURAL DEVELOPMENT | CRISIL AAA | 3.57 |

| U P Power Corporation Ltd ( Guaranteed By UP State Government ) | CRISIL A+(CE) | 3.48 |

| THDC India Ltd. (THDCIL) | CARE AA | 1.42 |

| Public Sector Undertakings - Total | 8.47 | |

| Corporate Debt/Financial Institutions | ||

| GODREJ INDUSTRIES LTD | ICRA AA+ | 7.20 |

| TATA PROJECTS LTD. | CRISIL AA | 7.11 |

| BAMBOO HOTEL AND GLOBAL CENTRE (DELHI) PRIVATE LTD | ICRA A+(CE) | 7.08 |

| VEDANTA LTD. | ICRA AA | 7.07 |

| ADITYA BIRLA REAL ESTATE LTD | CRISIL AA | 6.76 |

| ADITYA BIRLA RENEWABLES LIMITED | CRISIL AA | 5.71 |

| AADHAR HOUSING FINANCE LIMITED | ICRA AA | 5.71 |

| INDOSTAR CAPITAL FINANCE LIMITED | CRISIL AA- | 5.65 |

| AU SMALL FINANCE BANK LTD. | CRISIL AA | 4.27 |

| PTC VAJRA TRUST (SERIES A1) 20/02/2029 (MAT 20/02/2027)(VAJRA TRUST) | ICRA AAA(SO) | 3.67 |

| PRESTIGE PROJECTS PVT. LTD | ICRA A | 2.84 |

| TATA PROJECTS LTD. | FITCH AA | 1.98 |

| PTC SANSAR TRUST (SERIES A1) 25/06/2030 ( MAT 31/08/2027)(SANSAR TRUST) | CRISIL AAA(SO) | 1.61 |

| Nirma Ltd. | CRISIL AA | 0.71 |

| PTC DHRUVA TRUST (SERIES A1) 24/03/2030 (MAT 24/10/2029)(DHRUVA TRUST) | ICRA AAA(SO) | 0.60 |

| Corporate Debt/Financial Institutions - Total | 67.97 | |

| Triparty Repo | 0.18 | |

| Alternative Investment Fund | ||

| CORPORATE DEBT MARKET DEVELOPMENT FUND - CLASS A2 | Alternative Investment Fund | 0.55 |

| Alternative Investment Fund - Total | 0.55 | |

| Real Estate & Infrastructure Investment Trusts | ||

| Embassy Office Parks REIT | Realty | 4.14 |

| INDUS INFRA TRUST | Transport Infrastructure | 3.30 |

| BROOKFIELD INDIA REAL ESTATE TRUST | Realty | 2.25 |

| Real Estate & Infrastructure Investment Trusts - Total | 9.69 | |

| Net Current Assets/(Liabilities) | 2.49 | |

| Grand Total | 100.00 | |

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 18,00,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on Apr 30, 2025 (₹) | 31,14,496 | 16,53,176 | 10,41,402 | 7,00,605 | 4,02,549 | 1,25,110 |

| Scheme Returns (%) | 6.95 | 6.24 | 6.05 | 6.15 | 7.41 | 8.08 |

| CRISIL Credit Risk Debt B-II Index Returns (%) | 8.46 | 7.99 | 7.94 | 7.77 | 8.60 | 9.64 |

| Alpha* | -1.51 | -1.74 | -1.89 | -1.62 | -1.19 | -1.56 |

| CRISIL Credit Risk Debt B-II Index (₹)# | 35,29,499 | 18,11,275 | 11,13,852 | 7,29,640 | 4,09,685 | 1,26,085 |

| CRISIL 10 Year Gilt Index (₹)^ | 31,05,116 | 17,00,250 | 10,80,928 | 7,23,067 | 4,18,630 | 1,28,112 |

| CRISIL 10 Year Gilt Index (%) | 6.91 | 6.78 | 7.10 | 7.41 | 10.07 | 12.91 |

| Regular | Direct | |

| Growth | Rs29.0293 | Rs32.6035 |

| Annual IDCW | Rs12.6245 | Rs24.4884 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Deepak Agrawal, Mr. Sunit Garg |

| Benchmark*** | CRISIL Credit Risk Debt B-II Index |

| Allotment date | May 11, 2010 |

| AAUM | Rs709.47 crs |

| AUM | Rs709.25 crs |

| Folio count | 6,416 |

At discretion of trustees

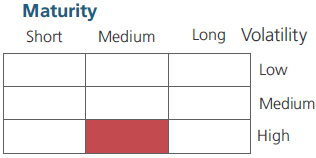

| Average Maturity | 3.00 yrs |

| Modified Duration | 2.36 yrs |

| Macaulay Duration | 2.49 yrs |

| Annualised YTM* | 8.25% |

| $Standard Deviation | 1.58% |

Source: $ICRA MFI Explorer.

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 2-3 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:a) For redemption / switch out

of upto 6% of the initial investment

amount (limit) purchased or switched in

within 1 year from the date of allotment:

Nil.

b) If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%

c) If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL

| Regular Plan: | 1.71% |

| Direct Plan: | 0.81% |

Folio Count data as on 31st March 2025.

Fund

Benchmark: CRISIL Credit Risk Debt B-II Index

This product is suitable for investors who are seeking*:

- Income over a medium term investment horizon

- Investment predominantly in in AA and below rated corporate bonds (Excluding AA+ rated corporate bonds)

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'