Mid Cap Fund - An open ended equity scheme predominantly investing in mid cap stocks

Mid Cap Fund - An open ended equity scheme predominantly investing in mid cap stocks

| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

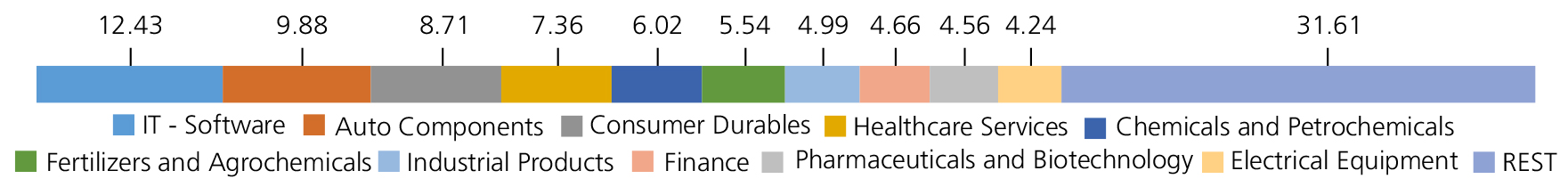

| IT - Software | 12.43 | |

| Mphasis Ltd | 3.07 | |

| Oracle Financial Services Software Ltd | 2.69 | |

| PERSISTENT SYSTEMS LIMITED | 2.33 | |

| Wipro Ltd. | 1.84 | |

| Birlasoft Ltd. | 1.46 | |

| Tech Mahindra Ltd. | 0.66 | |

| HEXAWARE TECHNOLOGIES LTD. | 0.38 | |

| Auto Components | 9.88 | |

| Schaeffler India Ltd | 2.03 | |

| Exide Industries Ltd | 1.59 | |

| Bharat Forge Ltd. | 1.29 | |

| UNO MINDA LIMITED | 1.25 | |

| MRF Limited | 1.15 | |

| Apollo Tyres Ltd. | 0.98 | |

| ZF Commercial Vehicle Control Systems India Limited | 0.91 | |

| Balkrishna Industries Ltd. | 0.68 | |

| Consumer Durables | 8.71 | |

| Dixon Technologies India Ltd. | 2.50 | |

| BLUE STAR LTD. | 1.75 | |

| Metro Brands Ltd. | 1.38 | |

| Voltas Ltd. | 1.19 | |

| Kajaria Ceramics Ltd. | 1.05 | |

| V-Guard Industries Ltd. | 0.79 | |

| Amber Enterprises India Ltd. | 0.05 | |

| Healthcare Services | 7.36 | |

| Fortis Healthcare India Ltd | 3.41 | |

| Global Health Ltd. | 1.81 | |

| MAX HEALTHCARE INSTITUTE LTD. | 1.70 | |

| ASTER DM HEALTHCARE LTD | 0.44 | |

| Chemicals and Petrochemicals | 6.02 | |

| SOLAR INDUSTRIES INDIA LIMITED | 2.93 | |

| Deepak Nitrite Ltd. | 1.55 | |

| SRF Ltd. | 1.54 | |

| Fertilizers and Agrochemicals | 5.54 | |

| Coromandel International Ltd. | 3.46 | |

| P I Industries Ltd | 2.08 | |

| Industrial Products | 4.99 | |

| KEI INDUSTRIES LTD. | 1.33 | |

| Polycab India Ltd. | 1.10 | |

| Ratnamani Metals & Tubes Ltd. | 1.02 | |

| APL APOLLO TUBES LTD. | 0.91 | |

| SUPREME INDUSTRIES LIMITED | 0.63 | |

| Finance | 4.66 | |

| Power Finance Corporation Ltd. | 2.03 | |

| LIC Housing Finance Ltd. | 1.54 | |

| REC LTD | 0.69 | |

| Mahindra & Mahindra Financial Services Ltd. | 0.40 | |

| Pharmaceuticals and Biotechnology | 4.56 | |

| Ipca Laboratories Ltd. | 3.20 | |

| JB CHEMICALS & PHARMACEUTICALS LTD. | 1.30 | |

| Torrent Pharmaceuticals Ltd. | 0.06 | |

| Electrical Equipment | 4.24 | |

| GE VERNOVA T&D INDIA LIMITED | 2.24 | |

| Apar Industries Limited | 1.06 | |

| Thermax Ltd. | 0.94 | |

| Cement and Cement Products | 3.52 | |

| JK Cement Ltd. | 2.50 | |

| The Ramco Cements Ltd | 1.02 | |

| Retailing | 3.52 | |

| SWIGGY LTD | 1.39 | |

| VISHAL MEGA MART LIMITED | 1.16 | |

| ETERNAL LIMITED | 0.97 | |

| Capital Markets | 3.01 | |

| BSE LTD. | 1.13 | |

| NUVAMA WEALTH MANAGEMENT LIMITED | 1.04 | |

| Prudent Corporate Advisory Services Ltd. | 0.84 | |

| Insurance | 2.92 | |

| ICICI Lombard General Insurance Company Ltd | 1.61 | |

| Max Financial Services Ltd. | 1.31 | |

| Realty | 2.65 | |

| Oberoi Realty Ltd | 2.65 | |

| Telecom - Services | 2.23 | |

| BHARTI HEXACOM LTD. | 2.23 | |

| Aerospace and Defense | 2.13 | |

| Bharat Electronics Ltd. | 2.13 | |

| Petroleum Products | 1.85 | |

| HINDUSTAN PETROLEUM CORPORATION LTD | 1.85 | |

| Personal Products | 1.46 | |

| Emami Ltd. | 1.46 | |

| Banks | 1.39 | |

| FEDERAL BANK LTD. | 1.39 | |

| Oil | 1.26 | |

| OIL INDIA LIMITED | 1.26 | |

| Power | 0.66 | |

| NTPC GREEN ENERGY LIMITED | 0.66 | |

| Construction | 0.54 | |

| TECHNO ELECTRIC & ENGINEERING COMPANY LIMITED | 0.54 | |

| Equity & Equity related - Total | 95.53 | |

| Mutual Fund Units | ||

| Kotak Liquid Direct Growth | 0.21 | |

| Mutual Fund Units - Total | 0.21 | |

| Triparty Repo | 3.65 | |

| Net Current Assets/(Liabilities) | 0.61 | |

| Grand Total | 100.00 | |

Note: Large Cap, Midcap, Small cap and Debt and Money Market stocks as a % age of Net Assets: 11.53, 69.29, 14.71 & 4.47.

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 21,80,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on Apr 30, 2025 (₹) | 1,39,92,545 | 32,08,181 | 17,95,473 | 10,26,958 | 4,70,739 | 1,16,170 |

| Scheme Returns (%) | 17.97 | 18.70 | 21.34 | 21.67 | 18.26 | -5.92 |

| Nifty Midcap 150 (TRI) Returns (%) | 17.91 | 19.80 | 22.88 | 24.06 | 21.01 | -3.92 |

| Alpha* | 0.06 | -1.10 | -1.55 | -2.39 | -2.75 | -2.00 |

| Nifty Midcap 150 (TRI) (₹)# | 1,38,97,353 | 34,04,249 | 18,96,628 | 10,87,818 | 4,89,196 | 1,17,471 |

| Nifty Midcap 100 (TRI) Returns (%) | 17.18 | 19.18 | 23.15 | 25.17 | 22.44 | -2.09 |

| Alpha* | 0.79 | -0.48 | -1.82 | -3.50 | -4.19 | -3.83 |

| Nifty Midcap 100 (TRI) (₹)# | 1,28,13,209 | 32,92,673 | 19,14,833 | 11,17,093 | 4,98,986 | 1,18,656 |

| Nifty 50 (TRI) (₹)^ | 80,86,041 | 25,57,171 | 14,49,505 | 8,84,890 | 4,43,673 | 1,22,955 |

| Nifty 50 (TRI) Returns (%) | 12.98 | 14.48 | 15.32 | 15.56 | 14.09 | 4.65 |

| Regular | Direct | |

| Growth | Rs120.7830 | Rs139.4990 |

| IDCW | Rs66.3370 | Rs83.1120 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager* |

Mr. Atul Bhole |

| Benchmark*** | NIFTY Midcap 150 TRI (Tier 1), Nifty Midcap 100 TRI (Tier 2) |

| Allotment date | March 30, 2007 |

| AAUM | Rs47,906.37 crs |

| AUM | Rs49,645.85 crs |

| Folio count | 19,14,735 |

Trustee's Discretion

| Portfolio Turnover | 42.94% |

| $Beta | 0.90 |

| $Sharpe ## | 0.76 |

| $Standard Deviation | 16.45% |

| ^^(P/E) | 32.11 |

| ^^P/BV | 5.04 |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

• For redemption / switch out of upto 10%

of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

• If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%

• If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL.

| Regular Plan: | 1.44% |

| Direct Plan: | 0.44% |

Folio Count data as on 31st March 2025.

Benchmark - Tier 1: Nifty Midcap 150 TRI

Benchmark - Tier 2: Nifty Midcap 100 TRI

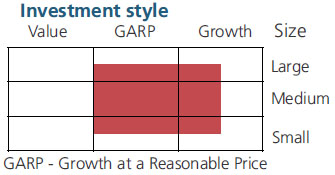

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in equity & equity related securities predominantly in mid cap companies.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

***As per para 1.9 of of SEBI Master circular No. SEBI/HO/IMD/IMD-PoD-1/P/CIR/2024/90 dated June 27, 2024 The first tier benchmark is reflective of the category of the scheme and the second tier benchmark is demonstrative of the investment style / strategy of the Fund Manager within the category.

## Risk rate assumed to be 6.00% (FBIL Overnight MIBOR rate as on 30th Apr 2025).**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'