| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

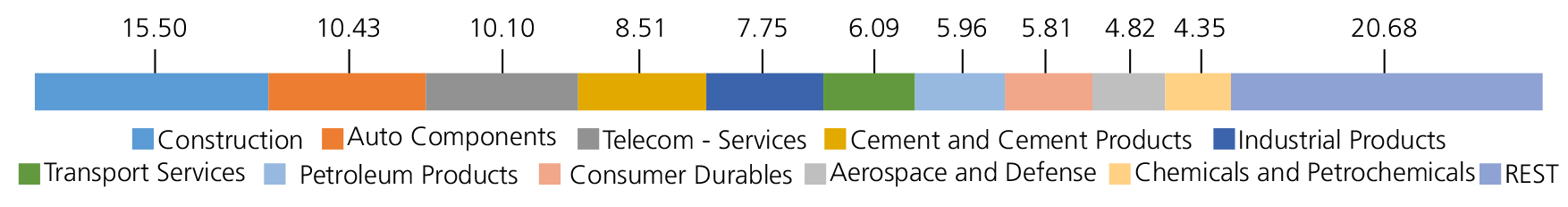

| Construction | 15.50 | |

| Larsen And Toubro Ltd. | 4.75 | |

| KALPATARU PROJECTS INTERNATIONAL LIMITED | 2.85 | |

| Ashoka Buildcon Limited | 2.11 | |

| G R Infraprojects Limited | 1.72 | |

| Engineers India Ltd. | 1.47 | |

| CEIGALL INDIA LIMITED | 0.97 | |

| H G Infra Engineering Ltd. | 0.97 | |

| PNC Infratech Ltd | 0.66 | |

| Auto Components | 10.43 | |

| Bosch Ltd. | 2.36 | |

| Apollo Tyres Ltd. | 1.75 | |

| SAMVARDHANA MOTHERSON INTERNATIONAL LIMITED | 1.43 | |

| Schaeffler India Ltd | 1.35 | |

| Bharat Forge Ltd. | 1.13 | |

| Sansera Engineering Ltd. | 0.96 | |

| Exide Industries Ltd | 0.95 | |

| Rolex Rings Ltd. | 0.50 | |

| Telecom - Services | 10.10 | |

| Bharti Airtel Ltd | 7.93 | |

| BHARTI HEXACOM LTD. | 2.17 | |

| Cement and Cement Products | 8.51 | |

| Shree Cement Ltd. | 4.77 | |

| Ultratech Cement Ltd. | 3.74 | |

| Industrial Products | 7.75 | |

| Cummins India Ltd. | 2.12 | |

| Ratnamani Metals & Tubes Ltd. | 1.85 | |

| AIA Engineering Limited. | 1.67 | |

| WPIL LTD | 0.81 | |

| SUPREME INDUSTRIES LIMITED | 0.69 | |

| Carborundum Universal Ltd. | 0.61 | |

| Transport Services | 6.09 | |

| Inter Globe Aviation Ltd | 2.17 | |

| MAHINDRA LOGISTICS LTD | 2 | |

| Container Corporation of India Ltd. | 1.92 | |

| Petroleum Products | 5.96 | |

| RELIANCE INDUSTRIES LTD. | 4.06 | |

| Indian Oil Corporation Ltd | 1.90 | |

| Consumer Durables | 5.81 | |

| Kajaria Ceramics Ltd. | 2.21 | |

| GREENPANEL INDUSTRIES LTD | 2.11 | |

| V-Guard Industries Ltd. | 1.49 | |

| Aerospace and Defense | 4.82 | |

| ZEN TECHNOLOGIES LTD | 2.24 | |

| Bharat Electronics Ltd. | 1.44 | |

| ASTRA MICROWAVE PRODUCTS LTD. | 1.14 | |

| Chemicals and Petrochemicals | 4.35 | |

| SOLAR INDUSTRIES INDIA LIMITED | 4.35 | |

| Agricultural, Commercial and Construction Vehicles | 3.69 | |

| V.S.T Tillers Tractors Ltd | 2.14 | |

| Ashok Leyland Ltd. | 1.55 | |

| Industrial Manufacturing | 3.55 | |

| JYOTI CNC AUTOMATION LTD | 2.22 | |

| Tega Industries Ltd. | 0.91 | |

| JNK INDIA LIMITED | 0.42 | |

| Electrical Equipment | 3.36 | |

| AZAD ENGINEERING LTD | 2.08 | |

| ABB India Ltd | 1.28 | |

| Power | 2.86 | |

| NTPC GREEN ENERGY LIMITED | 2.13 | |

| NTPC LTD | 0.73 | |

| Finance | 2.34 | |

| Power Finance Corporation Ltd. | 2.34 | |

| Realty | 1.78 | |

| Mahindra Lifespace Developers Ltd | 0.97 | |

| BRIGADE ENTERPRISES LIMITED | 0.81 | |

| Gas | 1.49 | |

| Gujarat State Petronet Ltd. | 1.49 | |

| Other Utilities | 0.77 | |

| CONCORD ENVIRO SYSTEMS LIMITED | 0.77 | |

| Equity & Equity related - Total | 99.16 | |

| Triparty Repo | 1.15 | |

| Net Current Assets/(Liabilities) | -0.31 | |

| Grand Total | 100.00 | |

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 20,70,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on Apr 30, 2025 (₹) | 93,07,531 | 30,39,429 | 18,18,515 | 10,80,821 | 4,59,609 | 1,09,137 |

| Scheme Returns (%) | 15.59 | 17.69 | 21.70 | 23.79 | 16.56 | -16.50 |

| Nifty Infrastructure (TRI) Returns (%) | 11.58 | 17.35 | 21.38 | 23.17 | 22.38 | 1.16 |

| Alpha* | 4.01 | 0.35 | 0.31 | 0.62 | -5.82 | -17.65 |

| Nifty Infrastructure (TRI) (₹)# | 61,82,136 | 29,83,016 | 17,98,419 | 10,64,739 | 4,98,544 | 1,20,739 |

| Nifty 50 (TRI) (₹)^ | 73,70,092 | 25,57,171 | 14,49,505 | 8,84,890 | 4,43,673 | 1,22,955 |

| Nifty 50 (TRI) Returns (%) | 13.31 | 14.48 | 15.32 | 15.56 | 14.09 | 4.65 |

| Regular | Direct | |

| Growth | Rs59.1660 | Rs69.6190 |

| IDCW | Rs47.3190 | Rs68.8220 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Nalin Rasik Bhatt |

| Benchmark | Nifty Infrastructure TRI (Tier 1) |

| Allotment date | February 25, 2008 |

| AAUM | Rs2,135.46 crs |

| AUM | Rs2,180.72 crs |

| Folio count | 1,50,670 |

Trustee's Discretion

| Portfolio Turnover | 21.83% |

| $Beta | 0.88 |

| $Sharpe ## | 0.86 |

| $Standard Deviation | 18.11% |

| ^^(P/E) | 29.26 |

| ^^P/BV | 4.25 |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load:

Nil. (applicable for all plans)

Exit Load:

• For redemption / switch out within 90

days from the date of allotment: 0.5%

• If units are redeemed or switched out on

or after 90 days from the date of allotment -

Nil.

| Regular Plan: | 2.02% |

| Direct Plan: | 0.71% |

Folio Count data as on 31st March 2025.

Benchmark - Tier 1 : Nifty Infrastructure TRI

This product is suitable for investors who are seeking*:

- Long term capital growth

- Long term capital appreciation by investing in equity and equity related instruments of companies contributing to infrastructure and economic development of India.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

## Risk rate assumed to be 6.00% (FBIL Overnight MIBOR rate as on 30th Apr 2025).**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'