An open ended fund of fund scheme investing in units of SMAM ASIA REIT Sub Trust fund and/or other similar overseas REIT funds.

An open ended fund of fund scheme investing in units of SMAM ASIA REIT Sub Trust fund and/or other similar overseas REIT funds.

| Issuer/Instrument | Rating | % to Net Assets |

|---|---|---|

| Mutual Fund Units | ||

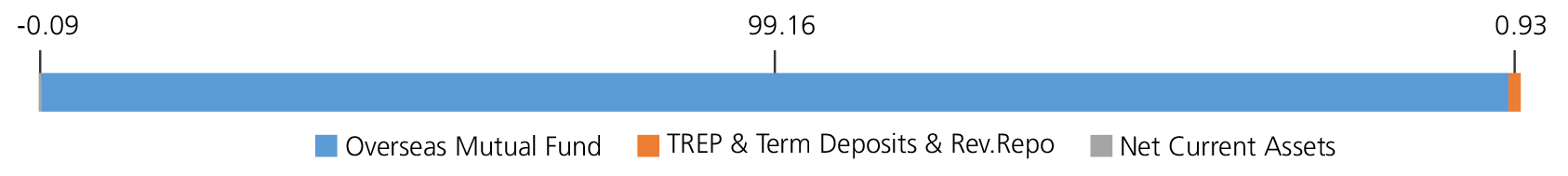

| SMAM ASIA REIT Sub Trust | Overseas Mutual Fund | 99.16 |

| Mutual Fund Units - Total | 99.16 | |

| Triparty Repo | 0.93 | |

| Net Current Assets/(Liabilities) | -0.09 | |

| Grand Total | 100.00 | |

| Regular | Direct | |

| Growth | Rs9.7033 | Rs10.0925 |

| IDCW | Rs9.7035 | Rs10.0924 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

Trustee’s Discretion

| Fund Manager* | Mr. Arjun Khanna |

| Benchmark | S&P Asia Pacific ex Japan REIT TRI |

| Allotment date | December 29, 2020 |

| AAUM | Rs41.57 crs |

| AUM | Rs42.79 crs |

| Folio count | 5,543 |

| Portfolio Turnover : | 4.60% |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

8% of the units allotted shall

be redeemed without any Exit Load on or

before completion of 1 Year from the date

of allotment of units. Any redemption in

excess of such limit within 1 Year from the

date of allotment shall be subject to the

following Exit Load:

a) If redeemed or

switched out on or before completion of 1

Year from the date of allotment of units-

1.00%.

b) If redeemed or switched out

after completion of 1 Year from the date of

allotment of units-NIL

| Regular Plan: | 1.36% |

| Direct Plan: | 0.53% |

Folio Count data as on 31st March 2025.

Fund

Benchmark : S&P Asia Pacific ex Japan REIT TRI

This product is suitable for investors who are seeking*:

- Long term capital growth

- Long term capital appreciation and income by investing in units of SMAM ASIA REIT Sub Trust Fund and/or other similar overseas REIT funds.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'