Investment Objective

The investment objective of the scheme is to provide returns that, before expenses, corresponding to the total returns of the securities as represented by the

underlying index, subject to tracking errors. However, there is no guarantee or assurance that the investment objective of the scheme will be achieved.

The investment objective of the scheme is to provide returns that, before expenses, corresponding to the total returns of the securities as represented by the

underlying index, subject to tracking errors. However, there is no guarantee or assurance that the investment objective of the scheme will be achieved.

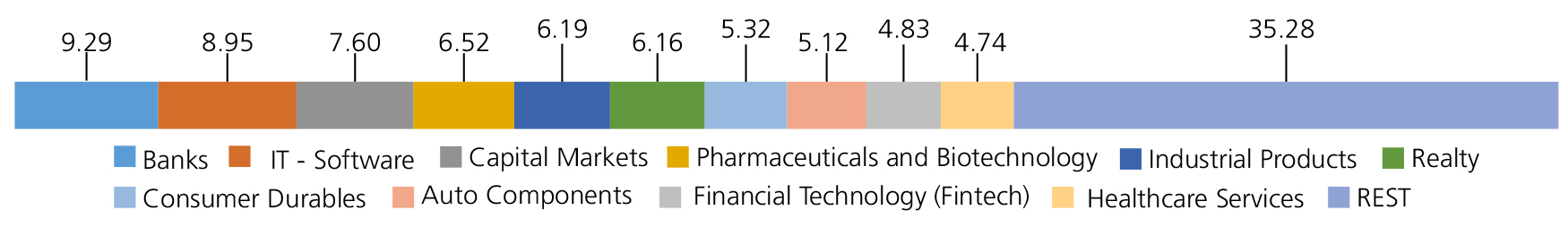

| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity Related | ||

| Banks | 9.29 | |

| FEDERAL BANK LTD. | 2.80 | |

| IDFC First Bank Limited | 2.34 | |

| AU Small Finance Bank Ltd. | 2.21 | |

| YES BANK LTD | 1.94 | |

| IT - Software | 8.95 | |

| PERSISTENT SYSTEMS LIMITED | 3.29 | |

| Coforge Limited | 2.83 | |

| Mphasis Ltd | 1.63 | |

| Oracle Financial Services Software Ltd | 1.20 | |

| Capital Markets | 7.60 | |

| BSE LTD. | 5.02 | |

| HDFC Asset Management Company Ltd. | 2.58 | |

| Pharmaceuticals and Biotechnology | 6.52 | |

| Lupin Ltd. | 2.94 | |

| Aurobindo Pharma Ltd. | 2.00 | |

| Alkem Laboratories Ltd. | 1.58 | |

| Industrial Products | 6.19 | |

| Cummins India Ltd. | 2.28 | |

| Polycab India Ltd. | 1.62 | |

| SUPREME INDUSTRIES LIMITED | 1.33 | |

| Astral Ltd. | 0.96 | |

| Realty | 6.16 | |

| GODREJ PROPERTIES LIMITED | 1.89 | |

| PHOENIX MILLS LTD. | 1.80 | |

| PRESTIGE ESTATES PROJECTS LIMITED | 1.35 | |

| Oberoi Realty Ltd | 1.12 | |

| Consumer Durables | 5.32 | |

| Dixon Technologies India Ltd. | 3.69 | |

| Voltas Ltd. | 1.63 | |

| Auto Components | 5.12 | |

| TUBE INVESTMENTS OF INDIA LTD. | 1.81 | |

| Bharat Forge Ltd. | 1.71 | |

| MRF Limited | 1.60 | |

| Financial Technology (Fintech) | 4.83 | |

| PB FINTECH LTD. | 3.12 | |

| ONE 97 COMMUNICATIONS LTD. | 1.71 | |

| Healthcare Services | 4.74 | |

| MAX HEALTHCARE INSTITUTE LTD. | 4.74 | |

| Telecom - Services | 4.27 | |

| Indus Towers Ltd. | 3.13 | |

| Vodafone Idea Ltd | 1.14 | |

| Power | 3.28 | |

| TORRENT POWER LTD | 1.70 | |

| NHPC LIMITED | 1.58 | |

| Finance | 2.87 | |

| SBI Cards & Payment Services Pvt. Ltd. | 1.52 | |

| Muthoot Finance Ltd | 1.35 | |

| Chemicals and Petrochemicals | 2.54 | |

| SRF Ltd. | 2.54 | |

| Agricultural Food and other Product | 2.18 | |

| Marico Ltd. | 2.18 | |

| Petroleum Products | 2.11 | |

| HINDUSTAN PETROLEUM CORPORATION LTD | 2.11 | |

| Personal Products | 1.98 | |

| Colgate Palmolive (India ) Ltd. | 1.98 | |

| Agricultural, Commercial and Construction Vehicles | 1.87 | |

| Ashok Leyland Ltd. | 1.87 | |

| Transport Infrastructure | 1.82 | |

| GMR AIRPORTS LIMITED | 1.82 | |

| Fertilizers and Agrochemicals | 1.71 | |

| P I Industries Ltd | 1.71 | |

| Electrical Equipment | 1.69 | |

| Bharat Heavy Electricals Ltd. | 1.69 | |

| Textiles and Apparels | 1.67 | |

| Page Industries Ltd | 1.67 | |

| Gas | 1.37 | |

| Petronet LNG Ltd. | 1.37 | |

| Leisure Services | 1.32 | |

| Indian Railway Catering And Tourism Corporation Ltd. | 1.32 | |

| Minerals and Mining | 1.30 | |

| NMDC Ltd. | 1.30 | |

| Oil | 1.30 | |

| OIL INDIA LIMITED | 1.30 | |

| Transport Services | 1.08 | |

| Container Corporation of India Ltd. | 1.08 | |

| Ferrous Metals | 0.96 | |

| Steel Authority of India Ltd. | 0.96 | |

| Equity & Equity related - Total | 100.04 | |

| Net Current Assets/(Liabilities) | -0.04 | |

| Grand Total | 100.00 | |

Net Asset Value (NAV)

| Regular | Direct | |

| Growth | Rs9.3580 | Rs9.3990 |

| IDCW | Rs9.3580 | Rs9.3990 |

Available Plans/Options

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Devender Singhal, Mr. Satish Dondapati, Mr. Abhishek Bisen |

| Benchmark | Nifty Midcap 50 Index TRI |

| AAUM | Rs50.05 crs |

| AUM | Rs52.27 crs |

| Allotment date | August 16, 2024 |

| Folio count | 22,215 |

IDCW Frequency

Trustee's Discretion

Ratios

| Portfolio Turnover : | 58.04% |

| Tracking Error: | 0.23% |

Minimum Investment Amount

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

Ideal Investments Horizon

• 5 years & above

Load Structure

Entry Load: Nil. (applicable for all plans)

Exit Load:

Nil. (applicable for all plans)

Total Expense Ratio**

| Regular Plan: | 0.86% |

| Direct Plan: | 0.25% |

Data as on 30th April, 2025 unless

otherwise specified.

Folio Count data as on 31st March 2025.

Folio Count data as on 31st March 2025.

Fund

Benchmark : Nifty Midcap 50 Index TRI

This product is suitable for investors who are seeking*:

- Long term capital growth

- Return that corresponds to the performance of NIFTY Midcap 50 Index subject to tracking error.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

Total Expense Ratio includes applicable B30 fee and GST

The scheme has not completed 6 month since inception