An open-ended equity scheme following Transportation & Logistics theme

An open-ended equity scheme following Transportation & Logistics theme

The investment objective of the scheme is to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in transportation & logistics and related activities. However, there is no assurance that the objective of the scheme will be achieved.

The investment objective of the scheme is to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in transportation & logistics and related activities. However, there is no assurance that the objective of the scheme will be achieved.

| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

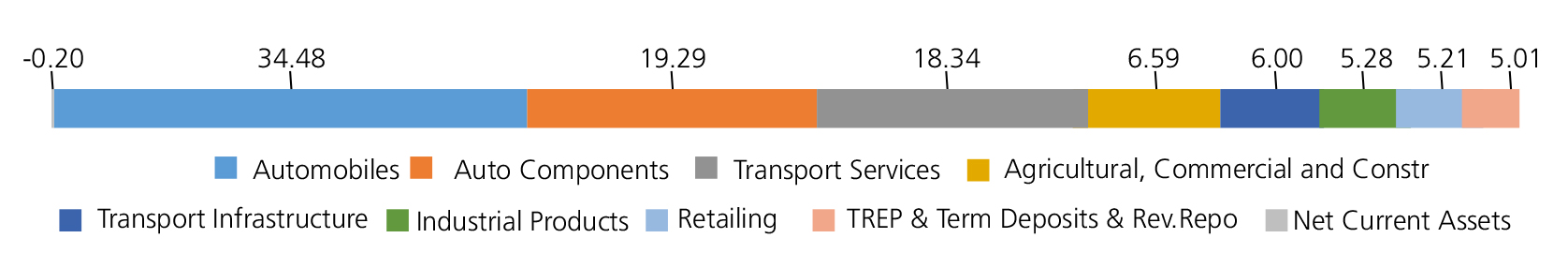

| Automobiles | 34.48 | |

| Maruti Suzuki India Limited | 9.67 | |

| Bajaj Auto Ltd. | 6.93 | |

| Mahindra & Mahindra Ltd. | 6.50 | |

| Hero MotoCorp Ltd. | 4.72 | |

| Tata Motors Ltd. | 4.13 | |

| HYUNDAI MOTORS INDIA LTD | 2.53 | |

| Auto Components | 19.29 | |

| ZF Commercial Vehicle Control Systems India Limited | 6.18 | |

| Igarashi Motors India Ltd. | 2.64 | |

| Sundaram Fasteners Ltd. | 2.26 | |

| Bosch Ltd. | 2.18 | |

| Sansera Engineering Ltd. | 2.14 | |

| Apollo Tyres Ltd. | 1.55 | |

| AMARA RAJA ENERGY MOB LTD. | 1.33 | |

| KROSS LIMITED | 1.01 | |

| Transport Services | 18.34 | |

| Inter Globe Aviation Ltd | 7.77 | |

| Blue Dart Express Ltd. | 3.06 | |

| Great Eastern Shipping Company Ltd | 1.72 | |

| Container Corporation of India Ltd. | 1.66 | |

| DELHIVERY LTD | 1.51 | |

| MAHINDRA LOGISTICS LTD | 1.49 | |

| WESTERN CARRIERS (INDIA) LTD | 1.13 | |

| Agricultural, Commercial and Construction Vehicles | 6.59 | |

| Ashok Leyland Ltd. | 3.95 | |

| V.S.T Tillers Tractors Ltd | 2.64 | |

| Transport Infrastructure | 6.00 | |

| Adani Port and Special Economic Zone Ltd. | 6.00 | |

| Industrial Products | 5.28 | |

| Subros Ltd. | 5.14 | |

| QUADRANT FUTURE TEK LIMITED | 0.14 | |

| Retailing | 5.21 | |

| ETERNAL LIMITED | 2.87 | |

| SWIGGY LTD | 2.34 | |

| Equity & Equity related - Total | 95.19 | |

| Triparty Repo | 5.01 | |

| Net Current Assets/(Liabilities) | -0.20 | |

| Grand Total | 100.00 | |

| | ||

| Regular | Direct | |

| Growth | Rs9.3000 | Rs9.3560 |

| IDCW | Rs9.3000 | Rs9.3550 |

A) Regular Plan B) Direct Plan

Options: Growth and Income Distribution

cum capital withdrawal (IDCW) (Payout and

Reinvestment)

| Fund Manager* |

Mr. Nalin Rasik Bhatt & Mr. Abhishek Bisen |

| Benchmark | Nifty Transportation & Logistics Index TRI |

| Allotment date | December 16, 2024 |

| AAUM | Rs 359.61 crs |

| AUM | Rs 364.98 crs |

| Folio count | 28,330 |

Trustee's Discretion

| ^^(P/E) | 27.06 |

| ^^P/BV | 4.84 |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

• For redemption / switch out within 90

days from the date of allotment: 0.5%

• If units are redeemed or switched out on

or after 90 days from the date of allotment -

Nil

| Regular Plan: | 2.41% |

| Direct Plan: | 0.84% |

Folio Count data as on 31st March 2025.

Benchmark : Nifty Transportation & Logistics Index TRI

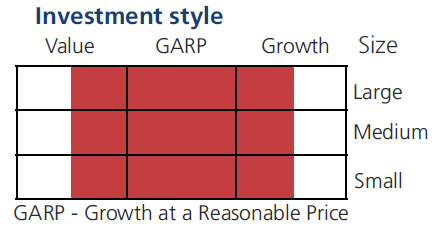

This product is suitable for investors who are seeking*:

- Long-term capital growth

- Investment in portfolio of predominantly equity and equity related securities of companies engaged in Transportation & Logistics and related activities

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'