An open-ended equity scheme following Multi-national Companies (MNC) theme

An open-ended equity scheme following Multi-national Companies (MNC) theme

The investment objective of the scheme is to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity related securities of multi-national companies (MNC). However, there is no assurance that the objective of the scheme will be achieved.

The investment objective of the scheme is to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity related securities of multi-national companies (MNC). However, there is no assurance that the objective of the scheme will be achieved.

| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

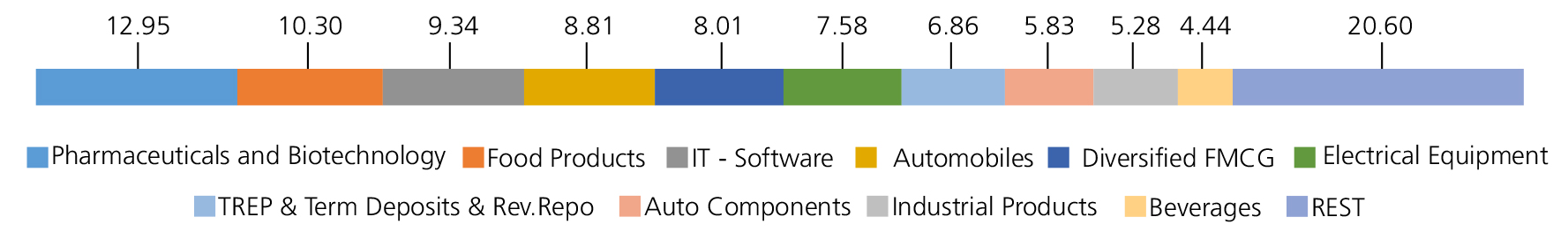

| Pharmaceuticals and Biotechnology | 12.95 | |

| JB CHEMICALS & PHARMACEUTICALS LTD. | 2.77 | |

| Sun Pharmaceuticals Industries Ltd. | 2.52 | |

| Marksans Pharma Ltd | 2.03 | |

| Glenmark Pharmaceuticals Ltd | 1.84 | |

| JUBILANT PHARMOVA LIMITED | 1.51 | |

| AMI ORGANICS LTD | 1.05 | |

| ORCHID PHARMA LTD. | 0.69 | |

| SAI LIFE SCIENCES LIMITED | 0.54 | |

| Food Products | 10.30 | |

| Britannia Industries Ltd. | 6.51 | |

| NESTLE INDIA LTD. | 3.79 | |

| IT - Software | 9.34 | |

| Oracle Financial Services Software Ltd | 2.89 | |

| Tech Mahindra Ltd. | 2.58 | |

| Infosys Ltd. | 2.23 | |

| Mphasis Ltd | 1.64 | |

| Automobiles | 8.81 | |

| Maruti Suzuki India Limited | 8.81 | |

| Diversified FMCG | 8.01 | |

| Hindustan Unilever Ltd. | 8.01 | |

| Electrical Equipment | 7.58 | |

| AZAD ENGINEERING LTD | 2.48 | |

| ABB India Ltd | 1.89 | |

| Siemens Ltd. | 1.66 | |

| GE VERNOVA T&D INDIA LIMITED | 1.55 | |

| Auto Components | 5.83 | |

| Schaeffler India Ltd | 1.90 | |

| Bosch Ltd. | 1.27 | |

| ZF Commercial Vehicle Control Systems India Limited | 1.18 | |

| SAMVARDHANA MOTHERSON INTERNATIONAL LIMITED | 0.80 | |

| SONA BLW PRECISION FORGINGS LTD | 0.68 | |

| Industrial Products | 5.28 | |

| Timken India Ltd. | 1.52 | |

| Cummins India Ltd. | 1.50 | |

| Grindwell Norton Ltd. | 1.43 | |

| KSB LTD | 0.83 | |

| Beverages | 4.44 | |

| UNITED SPIRITS LTD. | 4.44 | |

| Healthcare Services | 3.40 | |

| ASTER DM HEALTHCARE LTD | 1.80 | |

| Fortis Healthcare India Ltd | 1.60 | |

| Telecom - Services | 3.03 | |

| Bharti Airtel Ltd | 3.03 | |

| Chemicals and Petrochemicals | 2.11 | |

| Tata Chemicals Ltd | 2.11 | |

| Retailing | 1.97 | |

| SWIGGY LTD | 1.97 | |

| Agricultural, Commercial and Construction Vehicles | 1.90 | |

| Ashok Leyland Ltd. | 1.90 | |

| Capital Markets | 1.82 | |

| Nippon Life India Asset Management Ltd. | 1.82 | |

| Power | 1.42 | |

| SIEMENS ENERGY INDIA LTD | 1.42 | |

| Personal Products | 1.38 | |

| Colgate Palmolive (India ) Ltd. | 1.38 | |

| Finance | 1.25 | |

| CRISIL Ltd. | 1.25 | |

| Aerospace and Defense | 1.15 | |

| MTAR Technologies Ltd. | 1.15 | |

| Industrial Manufacturing | 1.13 | |

| Tega Industries Ltd. | 1.13 | |

| Leisure Services | 0.20 | |

| JUNIPER HOTELS LIMITED | 0.20 | |

| Equity & Equity related - Total | 93.30 | |

| Triparty Repo | 6.86 | |

| Net Current Assets/(Liabilities) | -0.16 | |

| Grand Total | 100.00 | |

| | ||

| Monthly SIP of Rs 10000 | Since Inception | 6 months |

| Total amount invested (Rs) | 70,000 | 60,000 |

| Total Value as on Apr 30, 2025 (Rs) | 67,726 | 58,423 |

| Scheme Returns (%) | -10.02 | -9.03 |

| Nifty MNC Index Returns (%) | -5.29 | -2.73 |

| Alpha* | -4.73 | -6.31 |

| Nifty MNC Index (TRI) (Rs)# | 68,818 | 59,534 |

| Nifty 50 (TRI) (Rs)^ | 72,477 | 62,439 |

| Nifty 50 (TRI) Returns (%) | 11.66 | 15.09 |

| Regular | Direct | |

| Growth | Rs9.3030 | Rs9.3720 |

| IDCW | Rs9.3030 | Rs9.3730 |

A) Regular Plan B) Direct Plan

Options: Growth and Income Distribution

cum capital withdrawal (IDCW) (Payout and

Reinvestment)

| Fund Manager* |

Mr. Harsha Upadhyaya, Mr. Dhananjay Tikariha & Mr. Abhishek Bisen |

| Benchmark | Nifty MNC Index TRI |

| Allotment date | October 28, 2024 |

| AAUM | Rs2,096.56 crs |

| AUM | Rs2,157.23 crs |

| Folio count | 1,22,761 |

Trustee's Discretion

| $Beta | 1.07 |

| $Sharpe ## | -0.66 |

| $Standard Deviation | 19.66% |

| ^^(P/E) | 51.64 |

| ^^P/BV | 6.34 |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

• For redemption / switch out within 90

days from the date of allotment: 0.5%

• If units are redeemed or switched out on

or after 90 days from the date of allotment -

Nil

| Regular Plan: | 2.00% |

| Direct Plan: | 0.56% |

Folio Count data as on 31st March 2025.

Benchmark : Nifty MNC Index TRI

This product is suitable for investors who are seeking*:

- Long-term capital growth

- Investment in portfolio of predominantly in equity and equity related securities of multi-national companies (MNC).

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

Scheme has not completed 6 months since inception

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'