An open-ended debt scheme investing in instruments such that the Macaulay duration of the portfolio is greater than 7 Years.

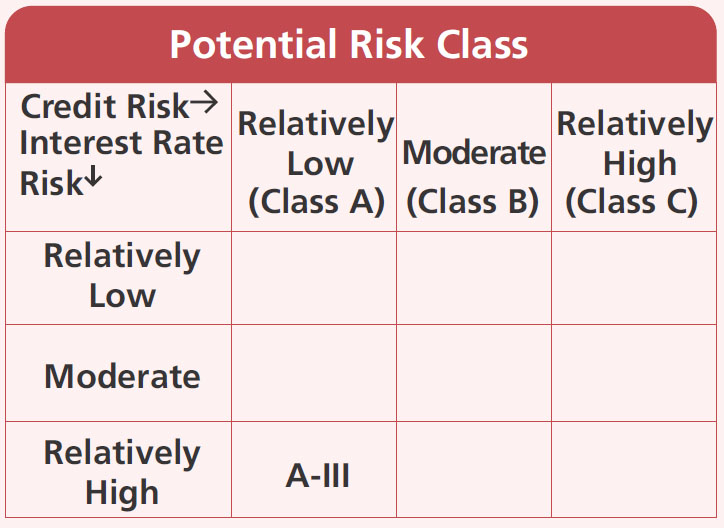

A relatively high interest rate risk and relatively low credit risk.

An open-ended debt scheme investing in instruments such that the Macaulay duration of the portfolio is greater than 7 Years.

A relatively high interest rate risk and relatively low credit risk.

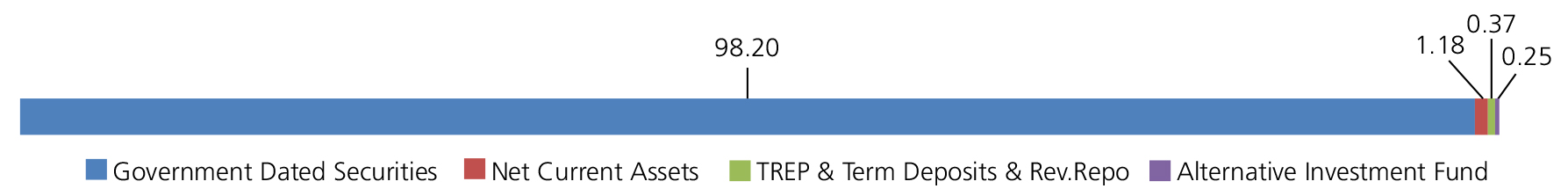

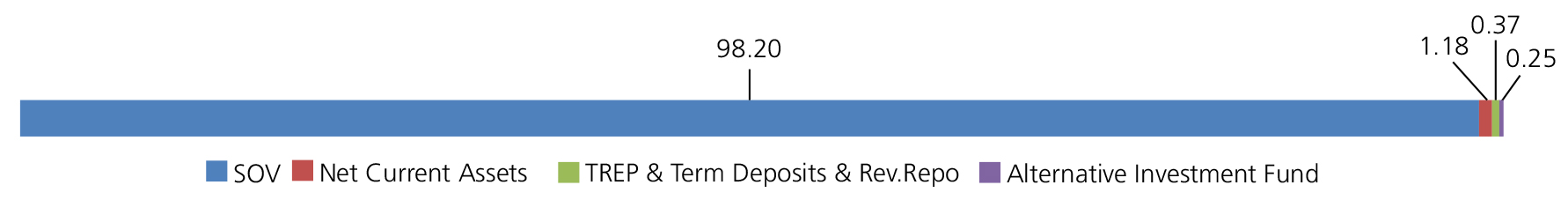

| Issuer/Instrument | Rating | % to Net Assets |

|---|---|---|

| Government Dated Securities | ||

| 7.30% Central Government | SOV | 32.96 |

| 7.34% Central Government | SOV | 28.13 |

| 7.09% Central Government | SOV | 17.99 |

| GS CG 06/11/2037 - (STRIPS) | SOV | 4.83 |

| GS CG 25/05/2038 - (STRIPS) | SOV | 3.48 |

| GS CG 25/11/2038 - (STRIPS) | SOV | 3.37 |

| GS CG 22/10/2038 - (STRIPS) | SOV | 2.23 |

| GS CG 25/11/2042 - (STRIPS) | SOV | 0.93 |

| GS CG 22/10/2041 - (STRIPS) | SOV | 0.91 |

| GS CG 25/05/2043 - (STRIPS) | SOV | 0.89 |

| GS CG 25/11/2043 - (STRIPS) | SOV | 0.86 |

| GS CG 25/05/2044 - (STRIPS) | SOV | 0.82 |

| GS CG 25/11/2044 - (STRIPS) | SOV | 0.80 |

| Government Dated Securities - Total | 98.20 | |

| Triparty Repo | 0.37 | |

| Alternative Investment Fund | ||

| CORPORATE DEBT MARKET DEVELOPMENT FUND - CLASS A2 | Alternative Investment Fund | 0.25 |

| Alternative Investment Fund - Total | 0.25 | |

| Net Current Assets/(Liabilities) | 1.18 | |

| Grand Total | 100.00 | |

| Monthly SIP of Rs 10000 | Since Inception | 6 months |

| Total amount invested (₹) | 1,30,000 | 1,20,000 |

| Total Value as on Apr 30, 2025 (₹) | 1,50,595 | 1,28,126 |

| Scheme Returns (%) | 12.45 | 12.94 |

| CRISIL Long Duration Debt A-III Index Returns (%) | 10.96 | 11.34 |

| Alpha* | 1.49 | 1.59 |

| CRISIL Long Duration Debt A-III Index Returns (₹)# | 1,49,337 | 1,27,140 |

| CRISIL 10 Year Gilt Index (₹)^ | 1,50,602 | 1,28,112 |

| CRISIL 10 Year Gilt Index (%) | 12.46 | 12.91 |

| Regular | Direct | |

| Growth | Rs11.2238 | Rs11.2599 |

| IDCW | Rs11.2240 | Rs11.2608 |

A) Regular Plan B) Direct Plan

Options: Growth and Income Distribution cum capital withdrawal (IDCW) (Payout and Reinvestment)

| Fund Manager* | Mr. Abhishek Bisen |

| Benchmark | CRISIL Long Duration Debt A-III Index |

| Allotment date | March 11, 2024 |

| AAUM | Rs166.81 crs |

| AUM | Rs190.57 crs |

| Folio count | 5,642 |

Trustee's Discretion

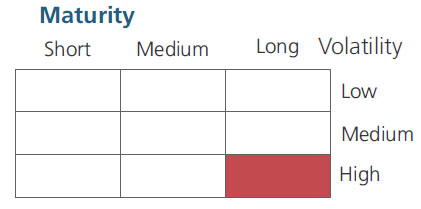

| Average Maturity | 28.36 yrs |

| Modified Duration | 12.68 yrs |

| Macaulay Duration | 13.10 yrs |

| Annualised YTM* | 6.87% |

| $Standard Deviation | 3.96% |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 3 years & above

Entry Load:

Nil. (applicable for all plans)

Exit Load: Nil

No exit load will be chargeable in case of

switches made between different

plans/options of the scheme.

| Regular Plan: | 0.62% |

| Direct Plan: | 0.34% |

Folio Count data as on 31st March 2025.

Fund

Benchmark: CRISIL Long Duration Debt A-III Index

This product is suitable for investors who are seeking*:

- Long term wealth creation

- To generate income / capital appreciation through investments in debt and money market instruments.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

***As per para 1.9 of of SEBI Master circular No. SEBI/HO/IMD/IMD-PoD-1/P/CIR/2024/90 dated June 27, 2024 The first tier benchmark is reflective of the category of the scheme and the second tier benchmark is demonstrative of the investment style / strategy of the Fund Manager within the category.

**Total Expense Ratio includes applicable B30 fee and GST

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'