An Open Ended Scheme investing in Equity, Debt & Money Market Instruments, Commodity ETFs and Exchange Traded Commodity Derivatives.

An Open Ended Scheme investing in Equity, Debt & Money Market Instruments, Commodity ETFs and Exchange Traded Commodity Derivatives.

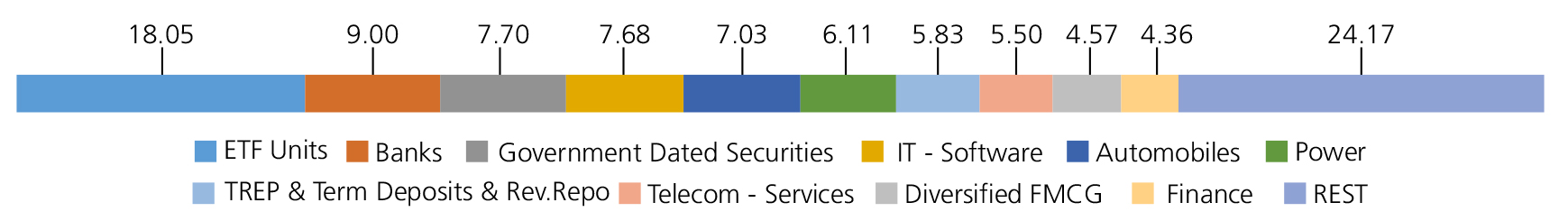

| Issuer/Instrument | Rating | % to Net Assets |

|---|---|---|

| Equity & Equity related | ||

| Banks | 9.00 | |

| State Bank Of India | 3.27 | |

| Bank Of Baroda | 2.41 | |

| HDFC Bank Ltd. | 1.91 | |

| ICICI Bank Ltd. | 0.86 | |

| JAMMU AND KASHMIR BANK LTD. | 0.55 | |

| IT - Software | 7.68 | |

| Infosys Ltd. | 2.61 | |

| Tech Mahindra Ltd. | 1.98 | |

| Oracle Financial Services Software Ltd | 1.19 | |

| Mphasis Ltd | 0.84 | |

| PERSISTENT SYSTEMS LIMITED | 0.61 | |

| Wipro Ltd. | 0.45 | |

| Automobiles | 7.03 | |

| Maruti Suzuki India Limited | 4.57 | |

| Hero MotoCorp Ltd. | 2.46 | |

| Power | 6.11 | |

| NTPC LTD | 3.58 | |

| NLC India Ltd. | 1.77 | |

| NTPC GREEN ENERGY LIMITED | 0.76 | |

| Telecom - Services | 5.50 | |

| Bharti Airtel Ltd | 2.64 | |

| Indus Towers Ltd. | 2.10 | |

| Vodafone Idea Ltd | 0.76 | |

| Diversified FMCG | 4.57 | |

| ITC Ltd. | 2.52 | |

| Hindustan Unilever Ltd. | 2.05 | |

| Finance | 4.36 | |

| Power Finance Corporation Ltd. | 2.25 | |

| POONAWALLA FINCORP LTD. | 1.55 | |

| Mahindra & Mahindra Financial Services Ltd. | 0.56 | |

| Retailing | 3.90 | |

| ETERNAL LIMITED | 1.46 | |

| SWIGGY LTD | 1.44 | |

| FSN E-COMMERCE VENTURES LTD. | 1.00 | |

| Petroleum Products | 2.04 | |

| RELIANCE INDUSTRIES LTD. | 2.04 | |

| Leisure Services | 1.61 | |

| SAPPHIRE FOODS INDIA LTD. | 1.61 | |

| Industrial Manufacturing | 1.52 | |

| DEE DEVELOPMENT ENGINEEERS LTD | 0.39 | |

| JYOTI CNC AUTOMATION LTD | 1.13 | |

| Beverages | 1.35 | |

| Radico Khaitan Ltd. | 1.35 | |

| Entertainment | 1.27 | |

| PVR INOX LIMITED | 0.72 | |

| Sun TV Network Ltd. | 0.55 | |

| Cement and Cement Products | 1.18 | |

| Ambuja Cements Ltd. | 1.18 | |

| Gas | 1.17 | |

| GAIL (India) Ltd. | 1.17 | |

| Personal Products | 1.09 | |

| Dabur India Ltd. | 0.25 | |

| Emami Ltd. | 0.84 | |

| Healthcare Services | 1.04 | |

| Fortis Healthcare India Ltd | 0.84 | |

| GPT HEALTHCARE LIMITED | 0.20 | |

| Auto Components | 1.03 | |

| SAMVARDHANA MOTHERSON INTERNATIONAL LIMITED | 1.03 | |

| Chemicals and Petrochemicals | 0.75 | |

| Tata Chemicals Ltd | 0.75 | |

| Transport Services | 0.73 | |

| Inter Globe Aviation Ltd | 0.73 | |

| Insurance | 0.71 | |

| LIFE INSURANCE CORPORATION OF INDIA LTD. | 0.71 | |

| Pharmaceuticals and Biotechnology | 0.70 | |

| ORCHID PHARMA LTD. | 0.70 | |

| Industrial Products | 0.64 | |

| Subros Ltd. | 0.39 | |

| QUADRANT FUTURE TEK LIMITED | 0.25 | |

| Construction | 0.59 | |

| Ashoka Buildcon Limited | 0.59 | |

| Other Utilities | 0.44 | |

| CONCORD ENVIRO SYSTEMS LIMITED | 0.44 | |

| Printing and Publication | 0.29 | |

| Navneet Education Ltd. | 0.29 | |

| Agricultural, Commercial and Construction Vehicles | 0.17 | |

| V.S.T Tillers Tractors Ltd | 0.17 | |

| Minerals and Mining | 0.02 | |

| NMDC Ltd. | 0.02 | |

| Equity & Equity related - Total | 66.49 | |

| Futures | ||

| POONAWALLA FINCORP LTD. | Finance | 0.55 |

| Wipro Ltd. | IT - Software | 0.37 |

| Vodafone Idea Ltd | Telecom - Services | -0.76 |

| NMDC Ltd. | Minerals and Mining | -0.02 |

| Mutual Fund Units | ||

| KOTAK MUTUAL FUND - KOTAK SILVER ETF | ETF Units | 12.66 |

| KOTAK MUTUAL FUND - KOTAK GOLD ETF | ETF Units | 5.39 |

| Kotak Liquid Direct Growth | Mutual Fund | 0.34 |

| Mutual Fund Units - Total | 18.39 | |

| Debt Instruments | ||

| Debentures and Bonds | ||

| Corporate Debt/Financial Institutions | ||

| INDIA GRID TRUST | CRISIL AAA | 0.66 |

| BAJAJ FINANCE LTD. | CRISIL AAA | 0.33 |

| HDFC BANK LTD. | CRISIL AAA | 0.06 |

| Corporate Debt/Financial Institutions - Total | 1.05 | |

| Public Sector Undertakings | ||

| REC LTD | CRISIL AAA | 0.35 |

| SMALL INDUSTRIES DEVELOPMENT BANK OF INDIA | CRISIL AAA | 0.13 |

| Public Sector Undertakings - Total | 0.48 | |

| Government Dated Securities | ||

| 7.18% Central Government | SOV | 2.98 |

| 7.34% Central Government | SOV | 1.72 |

| 7.06% Central Government | SOV | 1.65 |

| 7.32% Central Government | SOV | 0.68 |

| 6.99% Central Government | SOV | 0.33 |

| 7.09% Central Government | SOV | 0.20 |

| 7.30% Central Government | SOV | 0.14 |

| Government Dated Securities - Total | 7.70 | |

| Triparty Repo | 5.83 | |

| Real Estate & Infrastructure Investment Trusts | ||

| INDUS INFRA TRUST | Transport Infrastructure | 0.05 |

| Real Estate & Infrastructure Investment Trusts - Total | 0.05 | |

| Net Current Assets/(Liabilities) | 0.01 | |

| Grand Total | 100.00 | |

| Monthly SIP of (Rs) 10000 | Since Inception | 1 Year |

| Total amount invested (₹) | 2,00,000 | 1,20,000 |

| Total Value as on Apr 30, 2025 (₹) | 2,13,445 | 1,19,418 |

| Scheme Returns (%) | 7.73 | -0.91 |

| NIFTY 500 TRI 65% + NIFTY Short Duration Debt Index 25% + Domestic Price of Gold 5% + Domestic Price of Silver 5% Returns (%) | 11.25 | 4.92 |

| Alpha* | -3.53 | -5.83 |

| NIFTY 500 TRI 65% + NIFTY Short Duration Debt Index 25% + Domestic Price of Gold 5% + Domestic Price of Silver 5% (₹)# | 2,19,623 | 1,23,127 |

| Nifty 50 (TRI) (₹)^ | 2,18,106 | 1,22,955 |

| Nifty 50 (TRI) Returns (%) | 10.39 | 4.65 |

| Regular | Direct | |

| Growth | Rs 12.5110 | Rs12.8030 |

| IDCW | Rs 12.5110 | Rs12.8020 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Devender Singhal, Mr. Abhishek Bisen, Mr. Hiten Shah & Mr. Jeetu Valechha Sonar |

| Benchmark | Nifty 500 TRI (65%) + Nifty Short Duration Debt Index (25%) + Domestic Price of Gold (5%) + Domestic Price of Silver (5%) |

| Allotment date | September 22, 2023 |

| AAUM | Rs7,664.95 crs |

| AUM | Rs7,771.75 crs |

| Folio count | 1,75,805 |

Trustee's Discretion

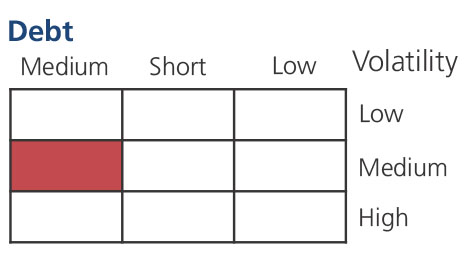

| Average Maturity | 8.32 yrs |

| Modified Duration | 4.12 yrs |

| Macaulay Duration | 4.27 yrs |

| Annualised YTM* | 6.38% |

| $Standard Deviation | 10.05% |

| $Beta | 1.02 |

| $ Sharpe## | 0.87 |

| ^^P/E$$ | 24.34 |

| ^^P/BV$$ | 2.93 |

| Portfolio Turnover | 148.23% |

$$Equity Component of the Portfolio.

Source: $ICRA MFI Explorer, ^^Bloomberg

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

• For redemption / switch out of upto 30%

of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

• If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%

• If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL

| Regular Plan: | 1.74% |

| Direct Plan: | 0.45% |

Folio Count data as on 31st March 2025.

Fund

Benchmark: Nifty 500 TRI (65%) + Nifty Short Duration Debt Index (25%) + Domestic Price of Gold (5%) + Domestic Price of Silver (5%)

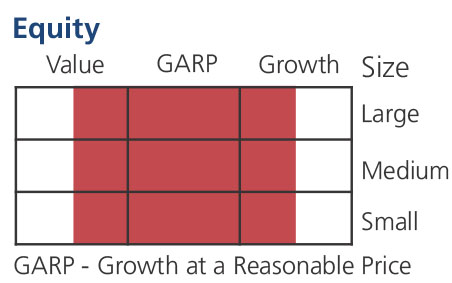

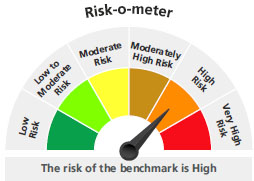

This product is suitable for investors who are seeking*:

- Long-term capital growth

- Equity & Equity related Securities, Debt & Money Market Instruments, Commodity ETFs and Exchange Traded Commodity Derivatives.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

## Risk rate assumed to be 6.00% (FBIL Overnight MIBOR rate as on 30th Apr 2025). **Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'