| KOTAK NIFTY AAA BOND JUN 2025 HTM INDEX FUND

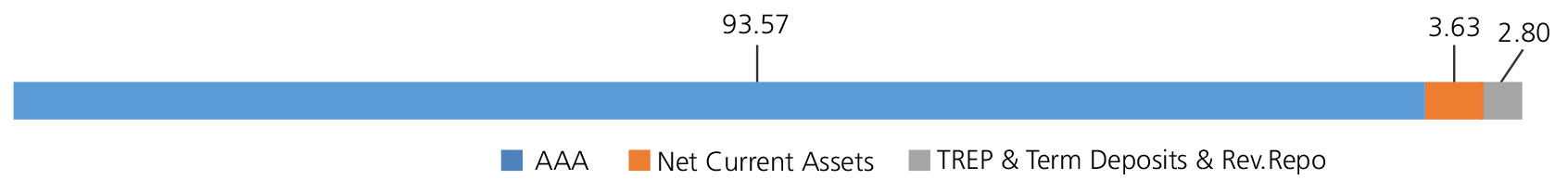

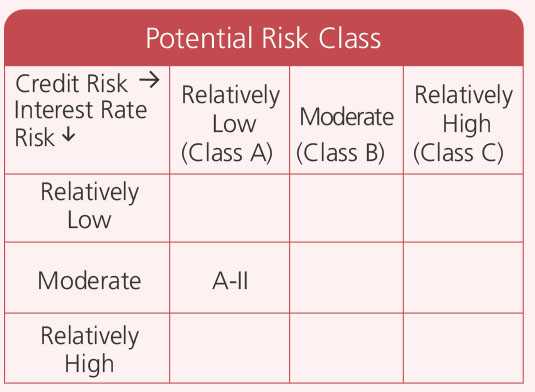

An open-ended Target Maturity Index Fund investing in constituents of NIFTY AAA BOND JUN 2025 HTM Index subject to tracking errors. A moderate interest rate risk and relatively low credit risk.

An open-ended Target Maturity Index Fund investing in constituents of NIFTY AAA BOND JUN 2025 HTM Index subject to tracking errors. A moderate interest rate risk and relatively low credit risk.

| KOTAK NIFTY AAA BOND JUN 2025 HTM INDEX FUND

An open-ended Target Maturity Index Fund investing in constituents of NIFTY AAA BOND JUN 2025 HTM Index subject to tracking errors. A moderate interest rate risk and relatively low credit risk.

An open-ended Target Maturity Index Fund investing in constituents of NIFTY AAA BOND JUN 2025 HTM Index subject to tracking errors. A moderate interest rate risk and relatively low credit risk.

Investment Objective

The investment objective of the scheme is to generate returns that are commensurate (before fees and expenses) with the performance of Nifty AAA Bond Jun 2025

HTM Index, which seeks to track the performance of AAA rated bond issued by Public Sector Undertakings (PSUs), Housing Finance Companies (HFCs), Non-Banking Financial Companies

(NBFCs) and Banks maturing near target date of the index, subject to tracking errors. However, there can be no assurance that the investment objective of the Scheme will be achieved.

The investment objective of the scheme is to generate returns that are commensurate (before fees and expenses) with the performance of Nifty AAA Bond Jun 2025

HTM Index, which seeks to track the performance of AAA rated bond issued by Public Sector Undertakings (PSUs), Housing Finance Companies (HFCs), Non-Banking Financial Companies

(NBFCs) and Banks maturing near target date of the index, subject to tracking errors. However, there can be no assurance that the investment objective of the Scheme will be achieved.

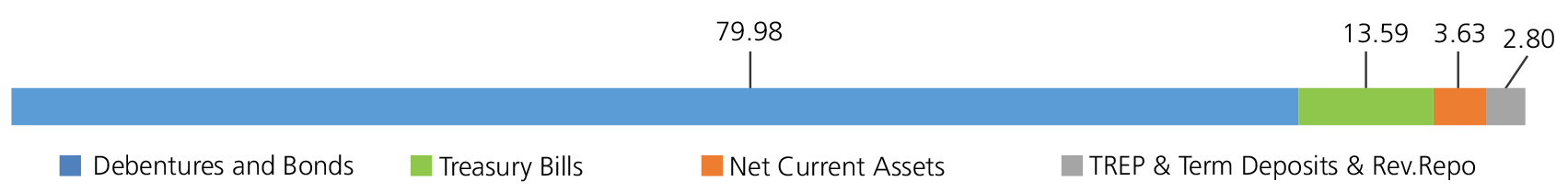

| Issuer/Instrument | Rating | % to Net Assets |

|---|---|---|

| Debt Instruments | ||

| Debentures and Bonds | ||

| Public Sector Undertakings | ||

| NHPC Ltd. | FITCH AAA | 12.41 |

| Export-Import Bank of India | CRISIL AAA | 12.21 |

| Power Finance Corporation Ltd. | CRISIL AAA | 11.12 |

| Power Grid Corporation of India Ltd. | CRISIL AAA | 7.14 |

| SMALL INDUSTRIES DEVELOPMENT BANK OF INDIA | ICRA AAA | 1.32 |

| Public Sector Undertakings - Total | 44.20 | |

| Corporate Debt/Financial Institutions | ||

| TITAN COMPANY LTD. | CRISIL AAA | 13.72 |

| HDB Financial Services Ltd. | CRISIL AAA | 8.71 |

| Mahindra & Mahindra Financial Services Ltd. | CRISIL AAA | 5.66 |

| Kotak Mahindra Prime Ltd. | CRISIL AAA | 2.75 |

| HDFC BANK LTD. | CRISIL AAA | 2.74 |

| LIC HOUSING FINANCE LTD. | CRISIL AAA | 1.10 |

| BAJAJ FINANCE LTD. | CRISIL AAA | 1.10 |

| Corporate Debt/Financial Institutions - Total | 35.78 | |

| Treasury Bills | ||

| 182 DAYS TREASURY BILL 27/06/2025 | SOV | 13.59 |

| Treasury Bills - Total | 13.59 | |

| Triparty Repo | 2.80 | |

| Net Current Assets/(Liabilities) | 3.63 | |

| Grand Total | 100.00 | |

Net Asset Value (NAV)

| Regular | Direct | |

| Growth | Rs10.8253 | Rs10.8429 |

| IDCW | Rs10.8234 | Rs10.8445 |

Available Plans/Options

A) Regular B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Abhishek Bisen |

| Benchmark | Nifty AAA Bond Jun 2025 HTM Index |

| Allotment date | March 28, 2024 |

| AAUM | Rs321.29 crs |

| AUM | Rs182.26 crs |

| Folio count | 5,297 |

Debt Quant

| Average Maturity | 0.10 yrs |

| Modified Duration | 0.10 yrs |

| Macaulay Duration | 0.10 yrs |

| Annualised YTM* | 6.52% |

| Tracking Error | 0.22% |

Minimum Investment Amount

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

Ideal Investments Horizon

• 1 year

Load Structure

Entry Load:

Nil. (applicable for all plans)

Exit Load: Nil.

Total Expense Ratio**

| Regular Plan: | 0.23% |

| Direct Plan: | 0.08% |

Data as on 30th April, 2025 unless

otherwise specified.

Folio Count data as on 31st March 2025.

Folio Count data as on 31st March 2025.

Fund

Benchmark : Nifty AAA Bond Jun 2025 HTM Index

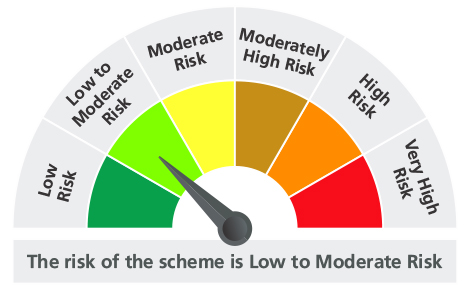

This product is suitable for investors who are seeking*:

- Income over Target Maturity Period

- An open-ended Target Maturity Index Fund tracking Nifty AAA Bond Jun 2025 HTM Index subject to tracking errors.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'