Multicap fund - A 36 months close ended equity scheme investing across large cap, midcap and small cap stocks

Multicap fund - A 36 months close ended equity scheme investing across large cap, midcap and small cap stocks

The investment objective of the scheme is

to generate capital appreciation from a

diversified portfolio of equity & equity

related instruments across market

capitalisation and sectors.

There is no assurance or guarantee that

the investment objective of the scheme

will be achieved.

The investment objective of the scheme is

to generate capital appreciation from a

diversified portfolio of equity & equity

related instruments across market

capitalisation and sectors.

There is no assurance or guarantee that

the investment objective of the scheme

will be achieved.

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

| Banks | 27.45 | |

| HDFC Bank Ltd. | 7.78 | |

| Bank Of Baroda | 4.93 | |

| Axis Bank Ltd. | 4.69 | |

| ICICI Bank Ltd. | 4.45 | |

| State Bank Of India | 3.66 | |

| IndusInd Bank Ltd. | 1.94 | |

| Automobiles | 8.37 | |

| Maruti Suzuki India Limited | 5.75 | |

| Hero MotoCorp Ltd. | 2.62 | |

| Petroleum Products | 7.54 | |

| Reliance Industries Ltd. | 7.54 | |

| Construction | 7.03 | |

| Larsen And Toubro Ltd. | 2.66 | |

| Kalpataru Power Transmission Ltd. | 2.51 | |

| JMC Projects (India) Ltd. | 1.16 | |

| PNC Infratech Ltd | 0.70 | |

| Diversified FMCG | 5.90 | |

| ITC Ltd. | 5.90 | |

| Consumer Durables | 5.69 | |

| Pokarna Ltd. | 2.54 | |

| Century Plyboards (India) Ltd. | 2.22 | |

| Bata India Ltd. | 0.93 | |

| IT - Software | 4.24 | |

| Persistent Systems Limited | 1.96 | |

| Infosys Ltd. | 1.52 | |

| Tech Mahindra Ltd. | 0.76 | |

| Power | 3.53 | |

| National Thermal Power Corporation Limited | 3.53 | |

| Entertainment | 3.19 | |

| Zee Entertainment Enterprises Ltd | 2.55 | |

| Inox Leisure Ltd. | 0.64 | |

| Personal Products | 2.82 | |

| Emami Ltd. | 1.71 | |

| Godrej Consumer Products Ltd. | 1.11 | |

| Telecom - Services | 2.80 | |

| Bharti Airtel Ltd | 2.65 | |

| Bharti Airtel Ltd - Partly Paid Shares | 0.15 | |

| Finance | 2.57 | |

| Power Finance Corporation Ltd. | 1.95 | |

| Mahindra & Mahindra Financial Services Ltd. | 0.62 | |

| Leisure Services | 2.35 | |

| Barbeque Nation Hospitality Ltd. | 1.54 | |

| Jubilant Foodworks Limited | 0.81 | |

| Gas | 2.04 | |

| GAIL (India) Ltd. | 2.04 | |

| Industrial Products | 1.87 | |

| Bharat Forge Ltd. | 1.87 | |

| Healthcare Services | 1.82 | |

| Fortis Healthcare India Ltd | 1.82 | |

| Auto Components | 1.67 | |

| Subros Ltd. | 1.67 | |

| Beverages | 1.58 | |

| United Spirits Ltd. | 1.58 | |

| Aerospace & Defense | 1.32 | |

| Bharat Electronics Ltd. | 1.32 | |

| Cement & Cement Products | 1.27 | |

| JK Cement Ltd. | 1.27 | |

| IT - Services | 1.05 | |

| Firstsource Solutions Ltd. | 1.05 | |

| Pharmaceuticals & Biotechnology | 0.61 | |

| Zydus Lifesciences Limited | 0.61 | |

| Equity & Equity related - Total | 96.71 | |

| Options | ||

| CNX NIFTY - 14500.000 - Put Option - December 2023 | 0.58 | |

| Options - Total | 0.58 | |

| Triparty Repo | 1.91 | |

| Net Current Assets/(Liabilities) | 0.80 | |

| Grand Total | 100.00 | |

| | ||

| Reg-Plan-IDCW | Rs20.149 |

| Dir-Plan-IDCW | Rs21.068 |

| Growth option | Rs20.148 |

| Direct Growth option | Rs21.214 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW & Growth.

(applicable for all plans)

| Fund Manager* | Mr. Devender Singhal |

| Benchmark | Nifty 200 TRI |

| Allotment date | February 20, 2018 |

| AAUM | Rs95.37 crs |

| AUM | Rs94.18 crs |

| Folio count | 1,737 |

Trustee's Discretion

| Portfolio Turnover | 50.71% |

The scheme is a close ended scheme. The units of the scheme can be traded on the stock exchange.

Entry Load: Nil. (applicable for all plans)

Exit Load: Nil. (applicable for all plans)

Regular:1.28%; Direct: 0.34%

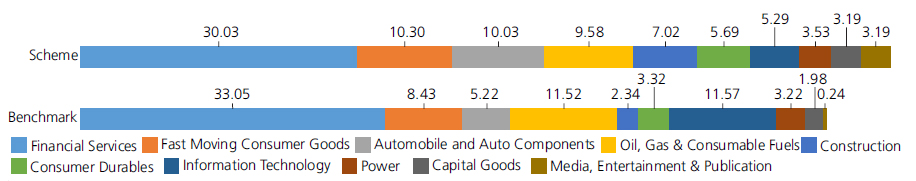

Benchmark

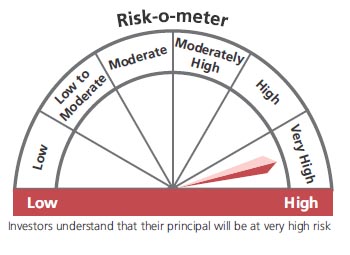

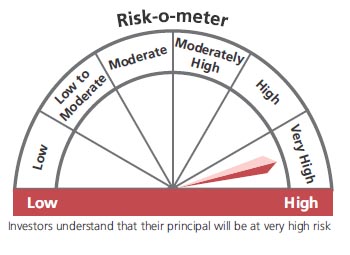

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in equity and equity related securities without any market capitalisation and sector bias.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

* For Fund Manager experience, please refer 'Our Fund Managers'

For scheme performance, please refer 'Scheme Performances'