An open-ended Equity Scheme following Environment, Social and Governance (ESG) theme

An open-ended Equity Scheme following Environment, Social and Governance (ESG) theme

The scheme shall seek to generate capital

appreciation by investing in a diversified

portfolio of companies that follow

Environmental, Social and Governance

parameters.

However, there can be no assurance that

the investment objective of the Scheme will

be realized.

The scheme shall seek to generate capital

appreciation by investing in a diversified

portfolio of companies that follow

Environmental, Social and Governance

parameters.

However, there can be no assurance that

the investment objective of the Scheme will

be realized.

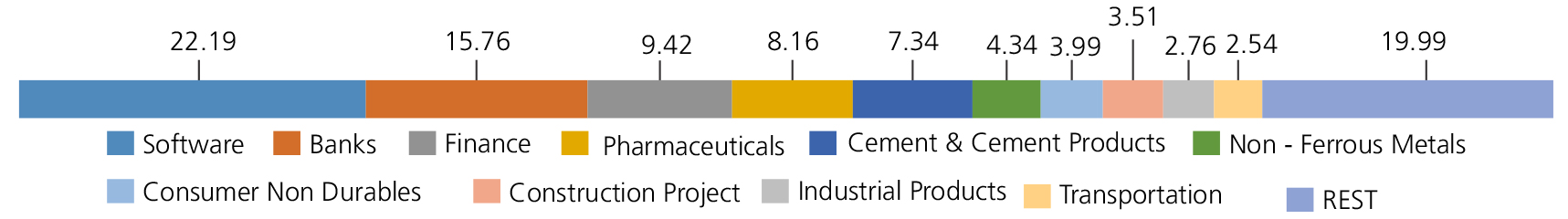

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

| Software | 22.19 | |

| Infosys Ltd. | 7.53 | |

| Tata Consultancy Services Ltd. | 5.33 | |

| Tech Mahindra Ltd. | 4.59 | |

| Wipro Ltd. | 3.26 | |

| Latent View Analytics Ltd | 1.48 | |

| Banks | 15.76 | |

| ICICI Bank Ltd. | 4.85 | |

| State Bank Of India | 4.59 | |

| HDFC Bank Ltd. | 2.95 | |

| Axis Bank Ltd. | 1.74 | |

| AU Small Finance Bank Ltd. | 1.63 | |

| Finance | 9.42 | |

| Bajaj Finance Ltd. | 4.18 | |

| HDFC Ltd. | 3.69 | |

| Muthoot Finance Ltd | 1.02 | |

| SBI Cards & Payment Services Pvt. Ltd. | 0.53 | |

| Pharmaceuticals | 8.16 | |

| Cipla Ltd. | 2.96 | |

| Divi s Laboratories Ltd. | 1.87 | |

| Cadila Healthcare Ltd | 1.38 | |

| Abbott India Ltd. | 1.11 | |

| Sun Pharmaceuticals Industries Ltd. | 0.84 | |

| Cement & Cement Products | 7.34 | |

| Ultratech Cement Ltd. | 3.03 | |

| JK Cement Ltd. | 1.74 | |

| Ambuja Cements Ltd. | 1.19 | |

| The Ramco Cements Ltd | 1.15 | |

| HeidelbergCement India Ltd. | 0.23 | |

| Non - Ferrous Metals | 4.34 | |

| Hindalco Industries Ltd | 4.34 | |

| Consumer Non Durables | 3.99 | |

| Balrampur Chini Mills Ltd. | 2.31 | |

| Hindustan Unilever Ltd. | 1.68 | |

| Construction Project | 3.51 | |

| Larsen And Toubro Ltd. | 3.51 | |

| Industrial Products | 2.76 | |

| Supreme Industries Limited | 1.57 | |

| Bharat Forge Ltd. | 1.19 | |

| Transportation | 2.54 | |

| Inter Globe Aviation Ltd | 1.15 | |

| Container Corporation of India Ltd. | 0.88 | |

| Great Eastern Shipping Company Ltd | 0.51 | |

| Healthcare Services | 2.18 | |

| DR.Lal Pathlabs Ltd. | 2.18 | |

| Fertilisers | 2.05 | |

| Coromandel International Ltd. | 2.05 | |

| Telecom - Services | 2.02 | |

| Bharti Airtel Ltd | 1.95 | |

| Bharti Airtel Ltd - Partly Paid Shares | 0.07 | |

| Chemicals | 1.77 | |

| Linde India Ltd. | 1.77 | |

| Consumer Durables | 1.75 | |

| Bata India Ltd. | 1.07 | |

| VIP Industries Ltd. | 0.68 | |

| Retailing | 1.70 | |

| Zomato Ltd. | 1.07 | |

| V-Mart Retail Ltd. | 0.39 | |

| Medplus Health Services Ltd. | 0.24 | |

| Auto | 1.51 | |

| Bajaj Auto Ltd. | 1.02 | |

| Hero MotoCorp Ltd. | 0.49 | |

| Ferrous Metals | 1.49 | |

| Jindal Steel & Power Ltd. | 1.08 | |

| Ratnamani Metals & Tubes Ltd. | 0.41 | |

| Insurance | 1.40 | |

| Bajaj Finserv Ltd. | 1.40 | |

| Pesticides | 1.12 | |

| Dhanuka Agritech Ltd. | 1.12 | |

| Auto Ancillaries | 0.90 | |

| Balkrishna Industries Ltd. | 0.90 | |

| Entertainment | 0.19 | |

| Nazara Technologies Ltd. | 0.19 | |

| Equity & Equity Related - Total | 98.09 | |

| Option | ||

| CNX NIFTY - 17500.000 - Put Option - January 2022 | 0.09 | |

| CNX NIFTY - 17600.000 - Put Option - January 2022 | 0.05 | |

| Option Total | 0.14 | |

| Mutual Fund Units | ||

| Kotak Liquid Scheme Direct Plan Growth | 0.60 | |

| Mutual Fund Units - Total | 0.60 | |

| Triparty Repo | 0.83 | |

| Net Current Assets/(Liabilities) | 0.34 | |

| Grand Total | 100.00 | |

| | ||

| Reg-Plan-IDCW | Rs12.3030 |

| Dir-Plan-IDCW | Rs12.5330 |

| Growth option | Rs12.3030 |

| Direct Growth option | Rs12.5330 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of IDCW & Growth (applicable for all plans)

| Fund Manager | Mr. Harsha Upadhyaya* |

| Benchmark | Nifty 100 ESG Index TRI |

| Allotment date | December 11, 2020 |

| AAUM | Rs1,748.41 crs |

| AUM | Rs1,753.72 crs |

| Folio count | 53,455 |

Trustee's Discretion

| Portfolio Turnover | 41.08% |

Initial Investment: Rs5000 and in multiple of

Rs1 for purchase and of Rs0.01 for switches

Additional Investment: Rs1000 & in

multiples of Rs1

Ideal Investments Horizon: 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

10% of the units allotted shall be redeemed

without any Exit Load on or before

completion of 1 Year from the date of

allotment of units.

Any redemption in excess of such limit

within 1 Year from the date of allotment

shall be subject to the following Exit Load:

a) If redeemed or switched out on or before

completion of 1 Year from the date of

allotment of units-1.00%

b) If redeemed or switched out after

completion of 1 Year from the date of

allotment of units-NIL

Regular: 2.04%; Direct: 0.37%

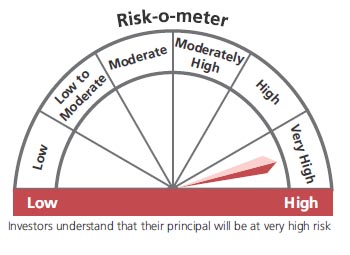

Benchmark

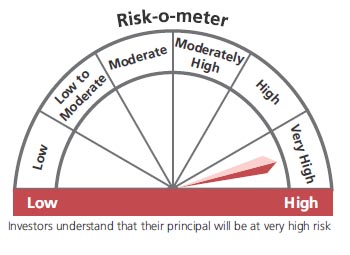

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in Portfolio of predominantly equity & equity related securities of companies following environmental, social and governance (ESG) criteria.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

* For Fund Manager experience, please refer 'Our Fund Managers'

For scheme performance, please refer 'Scheme Performances'