An open ended fund of fund scheme investing in units of Kotak Mahindra Mutual Fund schemes & ETFs / Index schemes (Domestic & Offshore Funds including Gold ETFs schemes).

An open ended fund of fund scheme investing in units of Kotak Mahindra Mutual Fund schemes & ETFs / Index schemes (Domestic & Offshore Funds including Gold ETFs schemes).

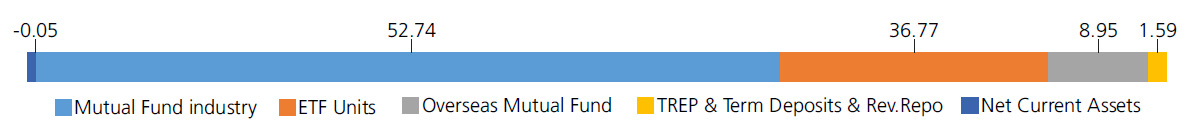

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity related | ||

| Mutual Fund Units | ||

| Kotak Bond Direct Plan Growth | Mutual Fund industry | 14.63 |

| Kotak Bluechip Fund | Mutual Fund industry | 12.19 |

| Kotak Flexicap Fund Direct Growth | Mutual Fund industry | 10.75 |

| Kotak Nifty MNC ETF | ETF Units | 9.85 |

| Kotak Mutual Fund - Kotak Gold ETF | ETF Units | 9.64 |

| Kotak PSU Bank ETF | ETF Units | 9.26 |

| Ishares Nasdaq 100 UCITS ETF USD | Overseas Mutual Fund | 8.95 |

| Kotak Mutual Fund - Kotak NIFTY ETF | ETF Units | 8.02 |

| Kotak Infrastructure & Economic Reform Fund Direct Growth | Mutual Fund industry | 7.81 |

| Kotak Corporate Bond Fund Direct Growth | Mutual Fund industry | 6.74 |

| Kotak Equity Opportunities Fund Direct Growth | Mutual Fund industry | 0.62 |

| Mutual Fund Units - Total | 98.46 | |

| Triparty Repo | 1.59 | |

| Net Current Assets/(Liabilities) | -0.05 | |

| Grand Total | 100.00 | |

| Reg-Plan-IDCW | Rs143.399 |

| Dir-Plan-IDCW | Rs153.083 |

| Growth Option | Rs147.318 |

| Direct Growth Option | Rs155.888 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Devender Singhal, Mr. Abhishek Bisen & Mr. Arjun Khanna ( Dedicated fund manager for investments in foreign securities) |

| Benchmark | 90% Nifty 50 Hybrid Composite Debt 50:50 Index + 5% price of Physical Gold +5 % MSCI World Index |

| Allotment date | August 9, 2004 |

| AAUM | Rs784.99 crs |

| AUM | Rs783.79 crs |

| Folio count | 26,237 |

Trustee's Discretion

| Portfolio Turnover | 27.21% |

| $Beta | 1.27 |

| $Sharpe ## | 0.77 |

| $Standard Deviation | 14.78% |

Initial Investment: Rs5000 and in multiple of

Rs1 for purchase and for Rs0.01 for switches

Additional Investment: Rs1000 & in multiples

of Rs1

Ideal Investment Horizon: 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load: 8% of the units allotted shall be redeemed

without any Exit Load on or before

completion of 1 Year from the date of

allotment of units.

Any redemption in excess of such limit

within 1 Year from the date of allotment

shall be subject to the following Exit Load:

a) If redeemed or switched out on or before

completion of 1 Year from the date of

allotment of units-1.00%

b) If redeemed or switched out after

completion of 1 Year from the date of

allotment of units-NIL

Regular: 1.02%; Direct: 0.13%

Fund

Benchmark

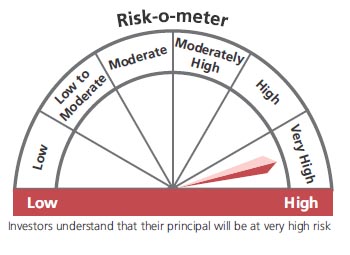

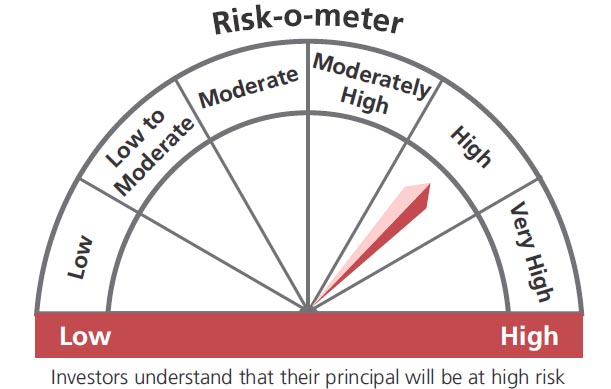

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in Kotak Mahindra Mutual Fund schemes & ETFs/Index schemes (Domestic & Offshore Funds including Gold ETFs)

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 28th February, 2023. An addendum may be issued or updated on the website for new riskometer

## Risk rate assumed to be 6.70% (FBIL Overnight MIBOR rate as on 28th February 2023). **Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'