An open ended equity scheme following manufacturing theme

An open ended equity scheme following manufacturing theme

The scheme shall seek to generate capital appreciation by investing in a diversified portfolio of companies that follow the manufacturing theme. However, there is no assurance that the objective of the Scheme will be realized.

The scheme shall seek to generate capital appreciation by investing in a diversified portfolio of companies that follow the manufacturing theme. However, there is no assurance that the objective of the Scheme will be realized.

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

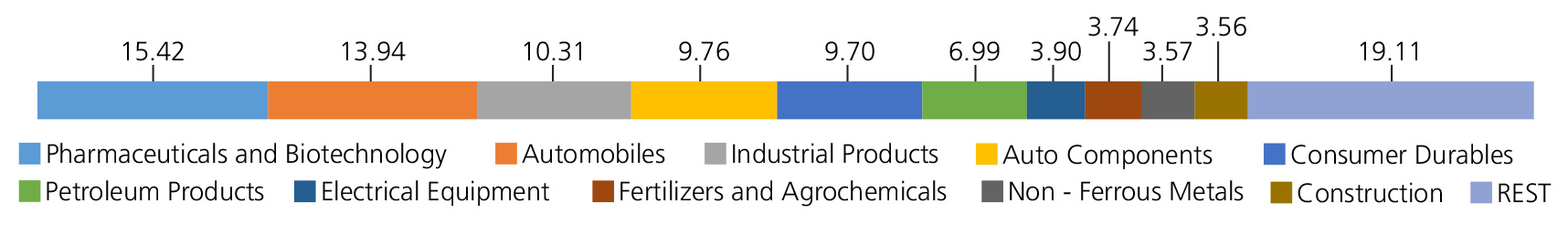

| Pharmaceuticals and Biotechnology | 15.42 | |

| Sun Pharmaceuticals Industries Ltd. | 5.08 | |

| Dr Reddys Laboratories Ltd. | 4.04 | |

| Zydus Lifesciences Limited | 2.67 | |

| Cipla Ltd. | 2.55 | |

| GLAND PHARMA LIMITED | 1.08 | |

| Automobiles | 13.94 | |

| Maruti Suzuki India Limited | 5.29 | |

| Mahindra & Mahindra Ltd. | 5.06 | |

| Eicher Motors Ltd. | 2.17 | |

| Tata Motors Ltd. | 1.42 | |

| Industrial Products | 10.31 | |

| Carborundum Universal Ltd. | 2.60 | |

| Bharat Forge Ltd. | 2.34 | |

| Cummins India Ltd. | 1.97 | |

| AIA Engineering Limited. | 1.92 | |

| Supreme Industries Limited | 1.48 | |

| Auto Components | 9.76 | |

| Bosch Ltd. | 2.34 | |

| Samvardhana Motherson International Limited | 1.47 | |

| Apollo Tyres Ltd. | 1.41 | |

| Balkrishna Industries Ltd. | 1.24 | |

| Schaeffler India Ltd | 1.22 | |

| Exide Industries Ltd | 1.21 | |

| Sona BLW Precision Forgings Ltd | 0.87 | |

| Consumer Durables | 9.70 | |

| V-Guard Industries Ltd. | 1.97 | |

| Whirlpool of India Ltd. | 1.53 | |

| Kajaria Ceramics Ltd. | 1.51 | |

| Bata India Ltd. | 1.41 | |

| Voltas Ltd. | 1.37 | |

| Dixon Technologies India Ltd. | 0.75 | |

| Amber Enterprises India Ltd. | 0.63 | |

| Elin Electronics Ltd. | 0.53 | |

| Petroleum Products | 6.99 | |

| RELIANCE INDUSTRIES LTD. | 5.34 | |

| Bharat Petroleum Corporation Ltd. | 1.65 | |

| Electrical Equipment | 3.90 | |

| ABB India Ltd | 2.47 | |

| Thermax Ltd. | 1.43 | |

| Fertilizers and Agrochemicals | 3.74 | |

| P I Industries Ltd | 1.90 | |

| Coromandel International Ltd. | 1.84 | |

| Non - Ferrous Metals | 3.57 | |

| Hindalco Industries Ltd | 3.57 | |

| Construction | 3.56 | |

| Larsen And Toubro Ltd. | 3.56 | |

| Chemicals and Petrochemicals | 3.38 | |

| SRF Ltd. | 1.33 | |

| Tata Chemicals Ltd | 1.05 | |

| Solar Industries India Limited | 1.00 | |

| Cement and Cement Products | 2.97 | |

| Ultratech Cement Ltd. | 2.97 | |

| Ferrous Metals | 2.66 | |

| Tata Steel Ltd. | 2.66 | |

| Aerospace and Defense | 1.79 | |

| Bharat Electronics Ltd. | 1.79 | |

| Personal Products | 1.70 | |

| Godrej Consumer Products Ltd. | 1.70 | |

| Beverages | 1.63 | |

| United Breweries Ltd. | 1.63 | |

| Agricultural, Commercial and Constr | 1.56 | |

| Ashok Leyland Ltd. | 1.56 | |

| Diversified | 1.29 | |

| 3M India Ltd. | 1.29 | |

| Textiles and Apparels | 0.99 | |

| Garware Technical Fibres Ltd. | 0.99 | |

| Equity & Equity related - Total | 98.86 | |

| Triparty Repo | 1.37 | |

| Net Current Assets/(Liabilities) | -0.23 | |

| Grand Total | 100.00 | |

| | ||

| Reg-Plan-IDCW | Rs10.81 |

| Dir-Plan-IDCW | Rs10.81 |

| Growth option | Rs11.004 |

| Direct Growth option | Rs11.004 |

A) Regular Plan B) Direct Plan

Options: Growth and Income Distribution cum

capital withdrawal (IDCW) (Payout and

Reinvestment)

| Fund Manager* | Mr.Harish Krishnan Mr. Abhishek Bisen |

| Benchmark | Nifty India Manufacturing Index TRI |

| Allotment date | February 22, 2022 |

| AAUM | Rs982.06 crs |

| AUM | Rs978.49 crs |

| Folio count | 46,028 |

Trustee's Discretion

| Portfolio Turnover | 2.21% |

Initial Investment: Rs5000 and in multiple ofRs1 for purchase and of Rs0.01 for switches

Additional Investment: Rs1000 & in multiples of Rs1 for purchase and for Rs0.01

for switches

Ideal Investments Horizon: 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

a)For redemption / switch out of upto 10%

of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

b)If units redeemed or switched out are

excess of the limit within 1 year from the

date of allotment: 1%

c)If units are redeemed or switched out

or after 1 year from the date of allotment:

NIL

Units issued on reinvestment of IDCW shall

not be subject to entry and exit load.

Regular: 2.28%; Direct: 0.57%

Benchmark

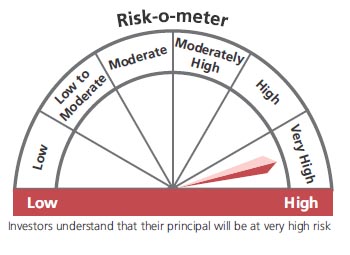

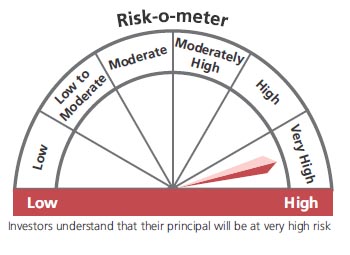

This product is suitable for investors who are seeking*:

- Long-term capital growth

- Investment equity and equity related securities across market capitalisation.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 28th February, 2023. An addendum may be issued or updated on the website for new riskometer

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'Our Fund Managers'

For scheme performance, please refer 'Scheme Performances'