Investment Objective

The investment objective of the scheme is

to replicate the composition of the NIFTY

India Consumption Index and to generate

returns that are commensurate with the

performance of the NIFTY India

Consumption Index, subject to tracking

errors. However, there is no assurance or

guarantee that the investment objective of

the scheme will be achieved.

The investment objective of the scheme is

to replicate the composition of the NIFTY

India Consumption Index and to generate

returns that are commensurate with the performance of the NIFTY India Consumption Index, subject to tracking

errors. However, there is no assurance or

guarantee that the investment objective of

the scheme will be achieved.

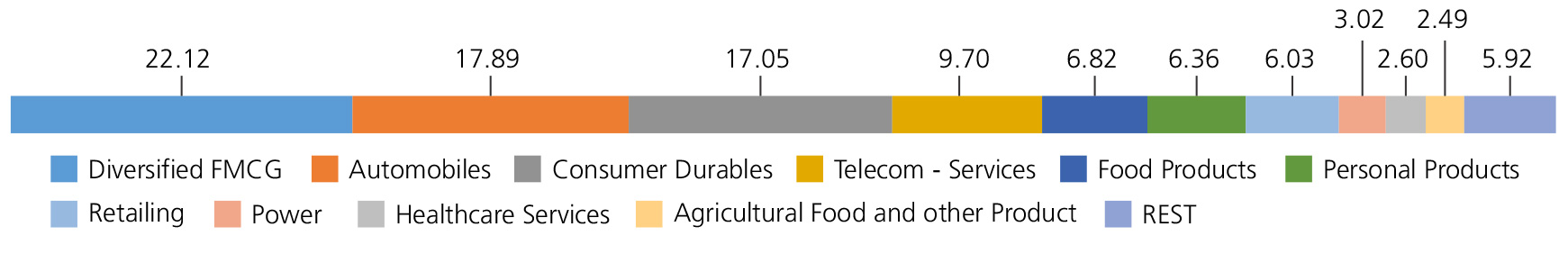

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity Related | ||

| Diversified FMCG | 22.12 | |

| ITC Ltd. | 12.03 | |

| Hindustan Unilever Ltd. | 10.09 | |

| Automobiles | 17.89 | |

| Mahindra & Mahindra Ltd. | 7.02 | |

| Maruti Suzuki India Limited | 6.56 | |

| Eicher Motors Ltd. | 2.51 | |

| Hero MotoCorp Ltd. | 1.80 | |

| Consumer Durables | 17.05 | |

| Asian Paints Ltd. | 7.34 | |

| Titan Company Ltd. | 5.71 | |

| Havells India Ltd. | 1.73 | |

| Voltas Ltd. | 1.19 | |

| Crompton Greaves Consumer Electricals Ltd | 1.08 | |

| Telecom - Services | 9.70 | |

| Bharti Airtel Ltd | 9.70 | |

| Food Products | 6.82 | |

| Nestle India Ltd. | 3.77 | |

| Britannia Industries Ltd. | 3.05 | |

| Personal Products | 6.36 | |

| Godrej Consumer Products Ltd. | 2.02 | |

| Dabur India Ltd. | 1.75 | |

| Marico Ltd. | 1.47 | |

| Colgate Palmolive (India ) Ltd. | 1.12 | |

| Retailing | 6.03 | |

| Avenue Supermarts Ltd. | 2.81 | |

| Trent Ltd | 1.65 | |

| Info Edge (India) Ltd. | 1.57 | |

| Power | 3.02 | |

| Tata Power Co. Ltd. | 1.98 | |

| Adani Transmission Ltd | 1.04 | |

| Healthcare Services | 2.60 | |

| Apollo Hospitals Enterprises Ltd. | 2.60 | |

| Agricultural Food and other Product | 2.49 | |

| Tata Consumer Products Ltd | 2.49 | |

| Beverages | 1.28 | |

| United Spirits Ltd. | 1.28 | |

| Realty | 1.26 | |

| DLF Ltd. | 1.26 | |

| Textiles and Apparels | 1.18 | |

| Page Industries Ltd | 1.18 | |

| Entertainment | 1.04 | |

| Zee Entertainment Enterprises Ltd | 1.04 | |

| Leisure Services | 0.97 | |

| Jubilant Foodworks Limited | 0.97 | |

| Equity & Equity Related - Total | 99.81 | |

| Net Current Assets/(Liabilities) | 0.19 | |

| Grand Total | 100.00 | |

NAV

Rs71.3136

Available Plans/Options

Regular Plan

| Fund Manager* | Mr. Devender Singhal Mr. Satish Dondapati & Mr. Abhishek Bisen |

| Benchmark | NIFTY India Consumption Index TRI |

| Allotment date | July 28, 2022 |

| AAUM | Rs0.66 crs |

| AUM | Rs0.64 crs |

| Folio count | 209 |

Ratios

| Portfolio Turnover : | 545.21% |

Minimum Investment Amount

Through Exchange: 1 Unit,

Through AMC: 50000 Units

Ideal Investments Horizon: 5 years & above

Load Structure

Entry Load: Nil. (applicable for all plans)

Exit Load:

Nil. (applicable for all plans)

Total Expense Ratio**

Regular: 0.30%

Data as on February 28, 2023

Fund

Benchmark

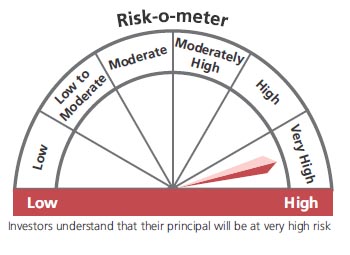

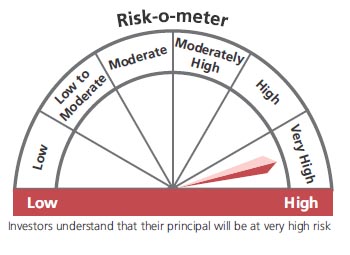

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in stocks comprising the underlying index and endeavours to track the benchmark index

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 28th February, 2023. An addendum may be issued or updated on the website for new riskometer

Total Expense Ratio includes applicable B30 fee and GST

Scheme has not completed 6 months since inception