However, there is no assurance that the objective of the scheme will be realized.

However, there is no assurance that the objective of the scheme will be realized.

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity Related | ||

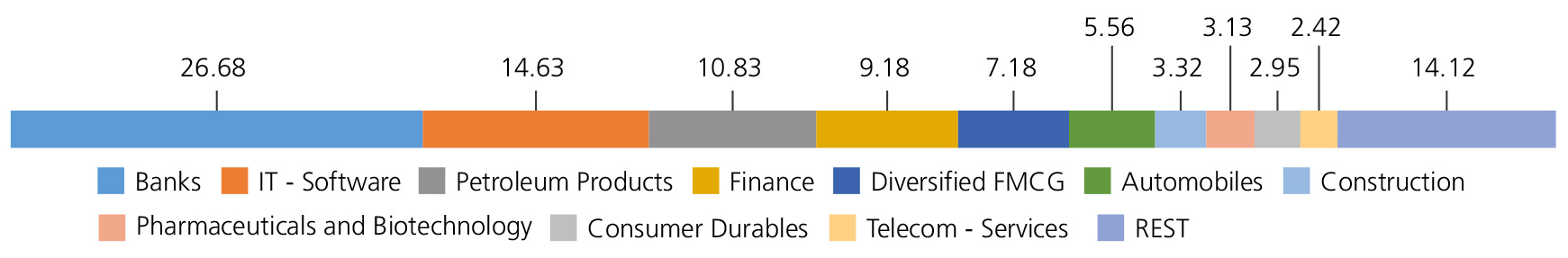

| Banks | 26.68 | |

| HDFC Bank Ltd. | 9.17 | |

| ICICI Bank Ltd. | 7.76 | |

| Kotak Mahindra Bank Ltd. | 3.26 | |

| Axis Bank Ltd. | 2.97 | |

| State Bank Of India | 2.61 | |

| IndusInd Bank Ltd. | 0.91 | |

| IT - Software | 14.63 | |

| Infosys Ltd. | 7.09 | |

| Tata Consultancy Services Ltd. | 4.42 | |

| HCL Technologies Ltd. | 1.48 | |

| Tech Mahindra Ltd. | 0.89 | |

| Wipro Ltd. | 0.75 | |

| Petroleum Products | 10.83 | |

| RELIANCE INDUSTRIES LTD. | 10.43 | |

| Bharat Petroleum Corporation Ltd. | 0.40 | |

| Finance | 9.18 | |

| HDFC Ltd. | 6.12 | |

| Bajaj Finance Ltd. | 2.12 | |

| Bajaj Finserv Ltd. | 0.94 | |

| Diversified FMCG | 7.18 | |

| ITC Ltd. | 4.32 | |

| Hindustan Unilever Ltd. | 2.86 | |

| Automobiles | 5.56 | |

| Mahindra & Mahindra Ltd. | 1.58 | |

| Maruti Suzuki India Limited | 1.49 | |

| Tata Motors Ltd. | 0.98 | |

| Eicher Motors Ltd. | 0.56 | |

| Bajaj Auto Ltd. | 0.54 | |

| Hero MotoCorp Ltd. | 0.41 | |

| Construction | 3.32 | |

| Larsen And Toubro Ltd. | 3.32 | |

| Pharmaceuticals and Biotechnology | 3.13 | |

| Sun Pharmaceuticals Industries Ltd. | 1.34 | |

| Dr Reddys Laboratories Ltd. | 0.68 | |

| Cipla Ltd. | 0.64 | |

| Divi s Laboratories Ltd. | 0.47 | |

| Consumer Durables | 2.95 | |

| Asian Paints Ltd. | 1.66 | |

| Titan Company Ltd. | 1.29 | |

| Telecom - Services | 2.42 | |

| Bharti Airtel Ltd | 2.42 | |

| Power | 2.04 | |

| National Thermal Power Corporation Limited | 1.05 | |

| Power Grid Corporation Of India Ltd. | 0.99 | |

| Ferrous Metals | 1.91 | |

| Tata Steel Ltd. | 1.09 | |

| JSW Steel Ltd. | 0.82 | |

| Cement and Cement Products | 1.86 | |

| Ultratech Cement Ltd. | 1.09 | |

| Grasim Industries Ltd. | 0.77 | |

| Food Products | 1.56 | |

| Nestle India Ltd. | 0.87 | |

| Britannia Industries Ltd. | 0.69 | |

| Insurance | 1.29 | |

| SBI Life Insurance Company Ltd | 0.66 | |

| HDFC Life Insurance Company Ltd. | 0.63 | |

| Oil | 0.77 | |

| Oil & Natural Gas Corporation Ltd. | 0.77 | |

| Non - Ferrous Metals | 0.76 | |

| Hindalco Industries Ltd | 0.76 | |

| Consumable Fuels | 0.59 | |

| Coal India Ltd. | 0.59 | |

| Healthcare Services | 0.58 | |

| Apollo Hospitals Enterprises Ltd. | 0.58 | |

| Transport Infrastructure | 0.58 | |

| Adani Port and Special Economic Zone Ltd. | 0.58 | |

| Agricultural Food and other Product | 0.56 | |

| Tata Consumer Products Ltd | 0.56 | |

| Metals and Minerals Trading | 0.49 | |

| Adani Enterprises Ltd. | 0.49 | |

| Fertilizers and Agrochemicals | 0.48 | |

| UPL Ltd | 0.48 | |

| Equity & Equity Related - Total | 99.35 | |

| Triparty Repo | 0.69 | |

| Net Current Assets/(Liabilities) | -0.04 | |

| Grand Total | 100.00 | |

For detailed portfolio log on to:

https://www.kotakmf.com/Products/funds/index-funds/Kotak-Nifty-50-Index-Fund/Reg-G

| Reg-Plan-IDCW | Rs11.078 |

| Dir-Plan-IDCW | Rs11.14 |

| Growth Option | Rs11.078 |

| Direct Growth Option | Rs11.141 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Devender Singhal Mr. Satish Dondapati & Mr. Abhishek Bisen |

| Benchmark | Nifty 50 Index TRI (Total Return Index) |

| Allotment date | June 21, 2021 |

| AAUM | Rs262.63 crs |

| AUM | Rs260.25 crs |

| Folio count | 47,625 |

| Portfolio Turnover : | 16.20% |

| Tracking Error: | 0.18% |

Initial Purchase: Rs100 and in multiple of

Rs1 for purchase and of Rs0.01 for switches

Additional Investment: Rs100 & in

multiples of Rs1 for purchase and Rs0.01 for switches

Ideal Investments Horizon: 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

Nil. (applicable for all plans)

Regular: 0.51%; Direct: 0.18%

Fund

Benchmark

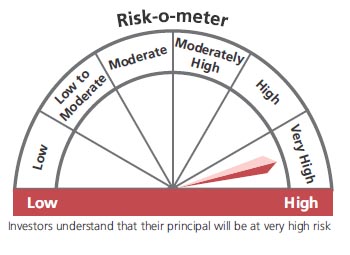

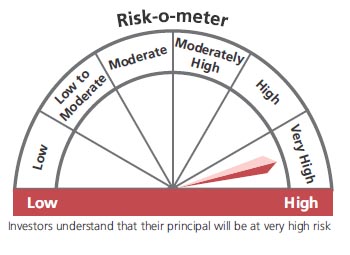

This product is suitable for investors who are seeking*:

- Long term capital growth

- Returns that are commensurate with the performance of NIFTY 50 Index, subject to tracking error.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 28th February, 2023. An addendum may be issued or updated on the website for new riskometer

* For Fund Manager experience, please refer 'Our Fund Managers'

Total Expense Ratio includes applicable B30 fee and GST.

For scheme performance, please refer 'Scheme Performances'