However, there is no assurance that the objective of the scheme will be realized.

However, there is no assurance that the objective of the scheme will be realized.

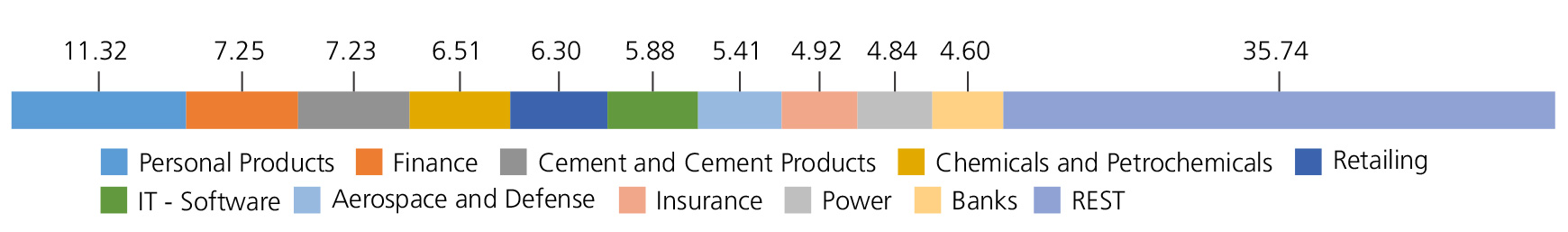

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity Related | ||

| Personal Products | 11.32 | |

| Godrej Consumer Products Ltd. | 3.41 | |

| Dabur India Ltd. | 2.95 | |

| Marico Ltd. | 2.49 | |

| Colgate Palmolive (India ) Ltd. | 1.92 | |

| Procter & Gamble Hygiene and Health Care Ltd. | 0.55 | |

| Finance | 7.25 | |

| Cholamandalam Investment and Finance Company Ltd. | 2.91 | |

| SBI Cards & Payment Services Pvt. Ltd. | 2.15 | |

| Bajaj Holdings and Investment Ltd. | 1.16 | |

| Muthoot Finance Ltd | 1.03 | |

| Cement and Cement Products | 7.23 | |

| Shree Cement Ltd. | 3.40 | |

| Ambuja Cements Ltd. | 2.46 | |

| ACC Ltd. | 1.37 | |

| Chemicals and Petrochemicals | 6.51 | |

| Pidilite Industries Ltd. | 3.43 | |

| SRF Ltd. | 3.08 | |

| Retailing | 6.30 | |

| Info Edge (India) Ltd. | 2.64 | |

| Avenue Supermarts Ltd. | 2.07 | |

| FSN E-Commerce Ventures Ltd. | 0.81 | |

| Zomato Ltd. | 0.78 | |

| IT - Software | 5.88 | |

| LTIMindtree Limited | 4.23 | |

| Mphasis Ltd | 1.65 | |

| Aerospace and Defense | 5.41 | |

| Bharat Electronics Ltd. | 3.31 | |

| Hindustan Aeronautics Ltd. | 2.10 | |

| Insurance | 4.92 | |

| ICICI Lombard General Insurance Company Ltd | 2.75 | |

| ICICI Prudential Life Insurance Company Ltd | 1.55 | |

| Life Insurance Corporation Of India Ltd. | 0.62 | |

| Power | 4.84 | |

| Tata Power Co. Ltd. | 3.35 | |

| Adani Transmission Ltd | 0.77 | |

| Adani Green Energy Ltd. | 0.72 | |

| Banks | 4.60 | |

| Bank Of Baroda | 2.89 | |

| Bandhan Bank Ltd. | 1.71 | |

| Consumer Durables | 4.30 | |

| Havells India Ltd. | 2.93 | |

| Berger Paints (I) Ltd. | 1.37 | |

| Gas | 3.50 | |

| GAIL (India) Ltd. | 2.70 | |

| Adani Total Gas Ltd. | 0.80 | |

| Auto Components | 2.98 | |

| Bosch Ltd. | 1.50 | |

| Samvardhana Motherson International Limited | 1.48 | |

| Diversified Metals | 2.92 | |

| Vedanta Ltd. | 2.92 | |

| Petroleum Products | 2.83 | |

| Indian Oil Corporation Ltd | 2.83 | |

| Electrical Equipment | 2.82 | |

| Siemens Ltd. | 2.82 | |

| Pharmaceuticals and Biotechnology | 2.63 | |

| Torrent Pharmaceuticals Ltd. | 1.30 | |

| Biocon Ltd. | 0.99 | |

| Gland Pharma Limited | 0.34 | |

| Fertilizers and Agrochemicals | 2.43 | |

| P I Industries Ltd | 2.43 | |

| Beverages | 2.16 | |

| United Spirits Ltd. | 2.16 | |

| Realty | 2.13 | |

| DLF Ltd. | 2.13 | |

| Transport Services | 1.96 | |

| Inter Globe Aviation Ltd | 1.96 | |

| Leisure Services | 1.81 | |

| Indian Railway Catering And Tourism Corporation Ltd. | 1.81 | |

| Capital Markets | 1.40 | |

| HDFC Asset Management Company Ltd. | 1.40 | |

| Telecom - Services | 1.39 | |

| Indus Towers Ltd. | 1.39 | |

| Financial Technology (Fintech) | 0.23 | |

| One 97 Communications Ltd. | 0.23 | |

| Equity & Equity Related - Total | 99.75 | |

| Triparty Repo | 0.65 | |

| Net Current Assets/(Liabilities) | -0.40 | |

| Grand Total | 100.00 | |

For detailed portfolio log on to:

https://www.kotakmf.com/Products/funds/index-funds/Kotak-Nifty-Next-50-Index-Fund/Reg-G

| Reg-Plan-IDCW | Rs10.6361 |

| Dir-Plan-IDCW | Rs10.7474 |

| Growth Option | Rs10.6358 |

| Direct Growth Option | Rs10.7475 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Devender Singhal & Mr. Satish Dondapati |

| Benchmark | Nifty Next 50 Index TRI |

| Allotment date | March 10, 2021 |

| AAUM | Rs95.52 crs |

| AUM | Rs92.58 crs |

| Folio count | 9,440 |

| Portfolio Turnover : | 67.19% |

| Tracking Error : | 0.40% |

Initial Investment: Rs5000 and in multiple of

Rs1 for purchase and of Rs0.01 for switches

Additional Investment: Rs1000 & in

multiples of Rs1 for purchase and of Rs0.01 for switches

Ideal Investments Horizon: 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

Nil. (applicable for all plans)

Regular: 0.83%; Direct: 0.31%

Fund

Benchmark

This product is suitable for investors who are seeking*:

- Long term capital growth

- Returns that are commensurate with the performance of NIFTY Next 50 Index, subject to tracking error.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 28th February, 2023. An addendum may be issued or updated on the website for new riskometer

* For Fund Manager experience, please refer 'Our Fund Managers'

Total Expense Ratio includes applicable B30 fee and GST

For scheme performance, please refer 'Scheme Performances'