Investment Objective

The investment objective of the scheme is

to replicate the composition of the Nifty

Next 50 and to generate returns that are

commensurate with the performance of

the NIFTY Next 50 Index, subject to tracking

errors.

However, there is no assurance that the objective of the scheme will be realized.

However, there is no assurance that the objective of the scheme will be realized.

The investment objective of the scheme is

to replicate the composition of the Nifty

Next 50 and to generate returns that are

commensurate with the performance of

the NIFTY Next 50 Index, subject to tracking

errors.

However, there is no assurance that the objective of the scheme will be realized.

However, there is no assurance that the objective of the scheme will be realized.

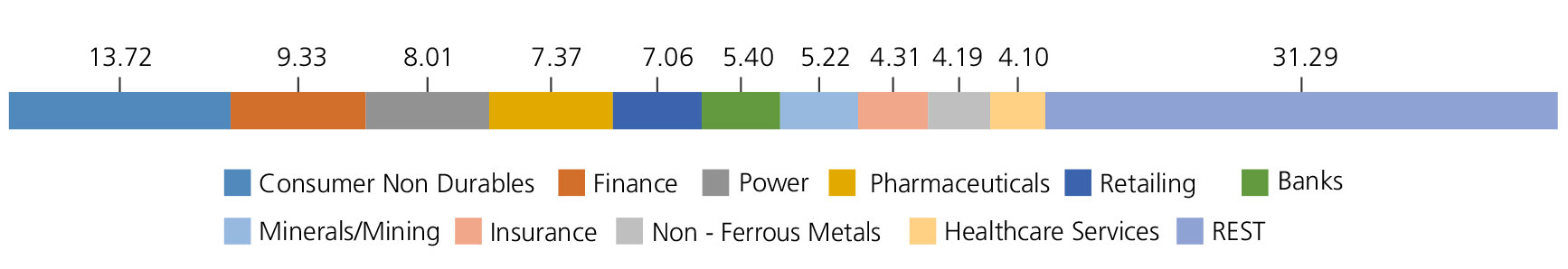

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity Related | ||

| Consumer Non Durables | 13.72 | |

| Dabur India Ltd. | 2.79 | |

| Godrej Consumer Products Ltd. | 2.46 | |

| Marico Ltd. | 2.25 | |

| United Spirits Ltd. | 2.23 | |

| Colgate Palmolive (India ) Ltd. | 1.64 | |

| Berger Paints (I) Ltd. | 1.42 | |

| Procter & Gamble Hygiene and Health Care Ltd. | 0.93 | |

| Finance | 9.33 | |

| Piramal Enterprises Limited | 2.34 | |

| Cholamandalam Investment and Finance Company Ltd. | 2.31 | |

| SBI Cards & Payment Services Pvt. Ltd. | 1.76 | |

| Bajaj Holdings and Investment Ltd. | 1.67 | |

| Muthoot Finance Ltd | 1.25 | |

| Power | 8.01 | |

| Adani Green Energy Ltd. | 4.25 | |

| Adani Transmission Ltd | 3.76 | |

| Pharmaceuticals | 7.37 | |

| Lupin Ltd. | 1.52 | |

| Aurobindo Pharma Ltd. | 1.49 | |

| Biocon Ltd. | 1.38 | |

| Torrent Pharmaceuticals Ltd. | 1.14 | |

| Gland Pharma Limited | 1.06 | |

| Cadila Healthcare Ltd | 0.78 | |

| Retailing | 7.06 | |

| Avenue Supermarts Ltd. | 4.14 | |

| Info Edge (India) Ltd. | 2.92 | |

| Banks | 5.40 | |

| Bandhan Bank Ltd. | 1.76 | |

| Bank Of Baroda | 1.68 | |

| Yes Bank Ltd | 1.08 | |

| Punjab National Bank | 0.88 | |

| Minerals/Mining | 5.22 | |

| Adani Enterprises Ltd. | 3.83 | |

| NMDC Ltd. | 1.39 | |

| Insurance | 4.31 | |

| ICICI Lombard General Insurance Company Ltd | 2.73 | |

| ICICI Prudential Life Insurance Company Ltd | 1.58 | |

| Non - Ferrous Metals | 4.19 | |

| Vedanta Ltd. | 4.19 | |

| Healthcare Services | 4.10 | |

| Apollo Hospitals Enterprises Ltd. | 4.10 | |

| Cement & Cement Products | 3.46 | |

| Ambuja Cements Ltd. | 1.96 | |

| ACC Ltd. | 1.50 | |

| Gas | 3.26 | |

| GAIL (India) Ltd. | 2.23 | |

| Indraprastha Gas Ltd. | 1.03 | |

| Chemicals | 3.10 | |

| Pidilite Industries Ltd. | 3.10 | |

| Ferrous Metals | 2.65 | |

| Jindal Steel & Power Ltd. | 1.47 | |

| Steel Authority of India Ltd. | 1.18 | |

| Consumer Durables | 2.52 | |

| Havells India Ltd. | 2.52 | |

| Software | 2.26 | |

| Larsen & Toubro Infotech Ltd | 2.26 | |

| Leisure Services | 1.89 | |

| Jubilant Foodworks Limited | 1.89 | |

| Construction | 1.84 | |

| DLF Ltd. | 1.84 | |

| Industrial Capital Goods | 1.77 | |

| Siemens Ltd. | 1.77 | |

| Pesticides | 1.68 | |

| P I Industries Ltd | 1.68 | |

| Transportation | 1.53 | |

| Inter Globe Aviation Ltd | 1.53 | |

| Petroleum Products | 1.48 | |

| Hindustan Petroleum Corporation Ltd | 1.48 | |

| Telecom - Services | 1.47 | |

| Indus Towers Ltd. | 1.47 | |

| Capital Markets | 1.17 | |

| HDFC Asset Management Company Ltd. | 1.17 | |

| Auto Ancillaries | 1.14 | |

| Bosch Ltd. | 1.14 | |

| Equity & Equity Related - Total | 99.93 | |

| Triparty Repo | 1.56 | |

| Net Current Assets/(Liabilities) | -1.49 | |

| Grand Total | 100.00 | |

NAV

| Reg-Plan-IDCW | Rs11.3532 |

| Dir-Plan-IDCW | Rs11.4123 |

| Growth Option | Rs11.3529 |

| Direct Growth Option | Rs11.4125 |

Available Plans/Options

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of IDCW & Growth (applicable for all plans)

| Fund Manager | Mr. Devender Singhal & Mr. Satish Dondapati* |

| Benchmark | Nifty Next 50 Index TRI |

| Allotment date | March 10, 2021 |

| AAUM | Rs89.89 crs |

| AUM | Rs89.63 crs |

| Folio count | 9,230 |

Ratios

| Portfolio Turnover : | 69.34% |

Minimum Investment Amount

Initial Investment: Rs5000 and in multiple of

Rs1 for purchase and of Rs0.01 for switches

Additional Investment: Rs1000 & in

multiples of Rs1 for purchase and of Rs0.01 for switches

Ideal Investments Horizon: 5 years & above

Load Structure

Entry Load: Nil. (applicable for all plans)

Exit Load:

Nil. (applicable for all plans)

Total Expense Ratio**

Regular: 0.83%; Direct: 0.32%

Data as on February 28, 2022

Fund

Benchmark

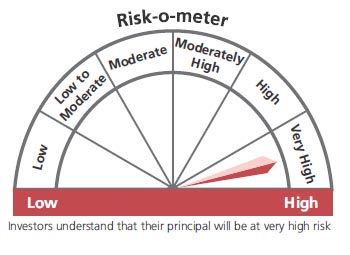

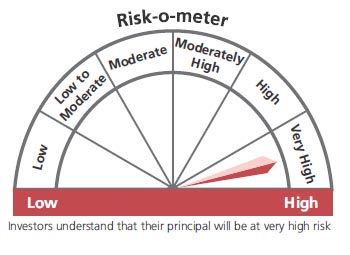

This product is suitable for investors who are seeking*:

- Long term capital growth

- Returns that are commensurate with the performance of NIFTY Next 50 Index, subject to tracking error.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

* For Fund Manager experience, please refer 'Our Fund Managers'

Total Expense Ratio includes applicable B30 fee and GST

For scheme performance, please refer 'Scheme Performances'