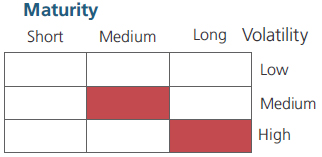

An open ended medium term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 4 years and 7 years.

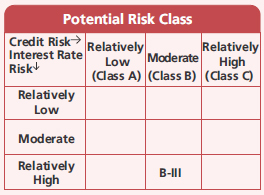

A relatively high interest rate risk and moderate credit risk.

An open ended medium term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 4 years and 7 years.

A relatively high interest rate risk and moderate credit risk.

| Issuer/Instrument | Rating | % to Net Assets |

|---|---|---|

| Debt Instruments | ||

| Debentures and Bonds | ||

| Government Dated Securities | ||

| 6.79% Central Government | SOV | 16.24 |

| 7.02% Central Government | SOV | 15.76 |

| 7.32% Central Government | SOV | 10.34 |

| 7.09% Central Government | SOV | 9.67 |

| 7.30% Central Government | SOV | 7.62 |

| 7.34% Central Government | SOV | 7.58 |

| 7.37% Central Government | SOV | 4.80 |

| GS CG 25/11/2032 - (STRIPS) | SOV | 1.30 |

| GS CG 25/05/2033 - (STRIPS) | SOV | 1.25 |

| 7.63% Maharashtra State Govt-Maharashtra | SOV | 0.97 |

| 7.10% Central Government | SOV | 0.96 |

| GS CG 22/04/2038 - (STRIPS) | SOV | 0.58 |

| 6.80% Central Government | SOV | 0.45 |

| 8.31% Telangana State Govt-Telangana | SOV | 0.24 |

| GS CG 25/11/2035 - (STRIPS) | SOV | 0.13 |

| GS CG 25/11/2036 - (STRIPS) | SOV | 0.12 |

| 6.58% Gujarat State Govt-Gujarat | SOV | 0.11 |

| GS CG 25/11/2037 - (STRIPS) | SOV | 0.11 |

| GS CG 25/05/2039 - (STRIPS) | SOV | 0.10 |

| 7.78% West Bengal State Govt-West Bengal | SOV | 0.10 |

| GS CG 22 Aug 2026 - (STRIPS) | SOV | 0.07 |

| Government Dated Securities - Total | 78.50 | |

| Public Sector Undertakings | ||

| Power Finance Corporation Ltd. | CRISIL AAA | 2.85 |

| NATIONAL BANK FOR AGRICULTURE & RURAL DEVELOPMENT | CRISIL AAA | 2.34 |

| SMALL INDUSTRIES DEVELOPMENT BANK OF INDIA | CRISIL AAA | 2.11 |

| REC LTD | CRISIL AAA | 1.55 |

| NATIONAL BANK FOR AGRICULTURE & RURAL DEVELOPMENT | ICRA AAA | 1.17 |

| National Housing Bank | CRISIL AAA | 0.23 |

| INDIAN RAILWAY FINANCE CORPORATION LTD. | CRISIL AAA | 0.23 |

| Export-Import Bank of India | CRISIL AAA | 0.07 |

| Public Sector Undertakings - Total | 10.55 | |

| Corporate Debt/Financial Institutions | ||

| HDFC BANK LTD. | CRISIL AAA | 1.18 |

| Mahindra & Mahindra Financial Services Ltd. | CRISIL AAA | 1.17 |

| Kotak Mahindra Investments Ltd. | CRISIL AAA | 0.24 |

| BAJAJ HOUSING FINANCE LTD. | CRISIL AAA | 0.23 |

| Sundaram Finance Ltd. | ICRA AAA | 0.23 |

| LIC HOUSING FINANCE LTD. | CRISIL AAA | 0.23 |

| HDB Financial Services Ltd. | CRISIL AAA | 0.11 |

| Corporate Debt/Financial Institutions - Total | 3.39 | |

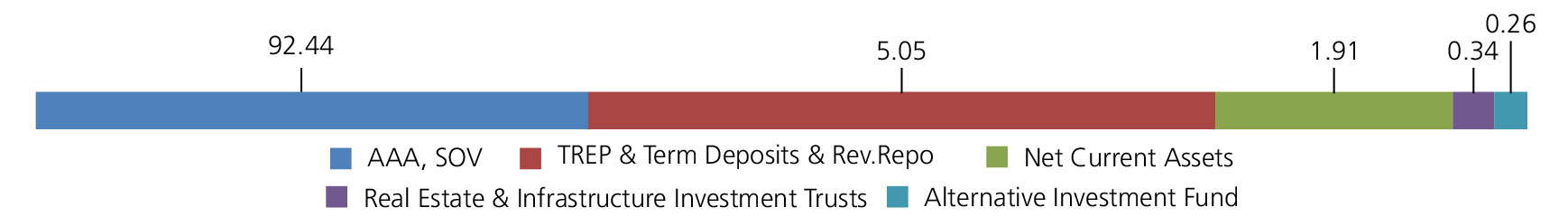

| Triparty Repo | 5.05 | |

| Alternative Investment Fund | ||

| CORPORATE DEBT MARKET DEVELOPMENT FUND - CLASS A2 | Alternative Investment Fund | 0.26 |

| Alternative Investment Fund - Total | 0.26 | |

| Real Estate & Infrastructure Investment Trusts | ||

| INDUS INFRA TRUST | Transport Infrastructure | 0.34 |

| Real Estate & Infrastructure Investment Trusts - Total | 0.34 | |

| Net Current Assets/(Liabilities) | 1.91 | |

| Grand Total | 100.00 | |

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (Rs) | 30,40,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on February 28, 2025 (Rs) | 87,17,056 | 16,58,180 | 10,49,003 | 6,94,926 | 3,99,347 | 1,23,892 |

| Scheme Returns (%) | 7.49 | 6.30 | 6.26 | 5.82 | 6.87 | 6.14 |

| CRISIL Medium to Long Duration Debt A-III Index Returns (%) | 7.96 | 7.21 | 6.99 | 6.44 | 7.60 | 7.50 |

| Alpha* | -0.48 | -0.90 | -0.74 | -0.62 | -0.73 | -1.36 |

| CRISIL Medium to Long Duration Debt A-III Index (Rs)# | 93,76,290 | 17,38,445 | 10,76,950 | 7,05,809 | 4,03,683 | 1,24,747 |

| CRISIL 10 Year Gilt Index (Rs)^ | NA | 16,58,624 | 10,54,917 | 7,03,862 | 4,08,633 | 1,25,600 |

| CRISIL 10 Year Gilt Index Returns (%) | NA | 6.31 | 6.41 | 6.33 | 8.43 | 8.86 |

| Regular | Direct | |

| Growth | Rs74.1788 | Rs83.0243 |

| IDCW | Rs45.4470 | Rs27.6332 |

| Fund Manager* | Mr. Abhishek Bisen |

| Benchmark*** | CRISIL Medium to Long Duration Debt A-III Index |

| Allotment date | November 25, 1999 |

| AAUM | Rs2,117.23 crs |

| AUM | Rs2,133.99 crs |

| Folio count | 5,437 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

At discretion of trustees

| Average Maturity | 12.65 yrs |

| Modified Duration | 6.51 yrs |

| Macaulay Duration | 6.75 yrs |

| Annualised YTM* | 7.00% |

| $Standard Deviation | 1.82% |

Source: $ICRA MFI Explorer

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 2-3 years

Entry Load:

Nil. (applicable for all plans)

Exit Load: Nil.(applicable for all plans)

| Regular Plan: | 1.65% |

| Direct Plan: | 0.70% |

Folio Count data as on 31st January 2025.

Fund

Benchmark: CRISIL Medium to Long Duration Debt A-III Index

This product is suitable for investors who are seeking*:

- Income over a long investment horizon

- Investment in debt & money market securities with a portfolio Macaulay duration between 4 years & 7 years.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st January, 2025. An addendum may be issued or updated on the website for new riskometer.

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'