An open ended debt scheme predominantly investing in AA and below rated corporate bonds (Excluding AA+ rated corporate bonds).

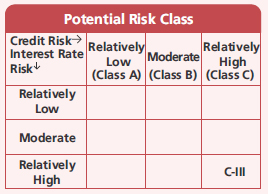

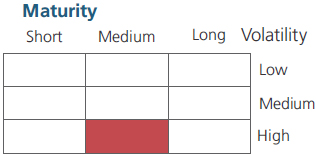

A relatively high interest rate risk and relatively high credit risk.

An open ended debt scheme predominantly investing in AA and below rated corporate bonds (Excluding AA+ rated corporate bonds).

A relatively high interest rate risk and relatively high credit risk.

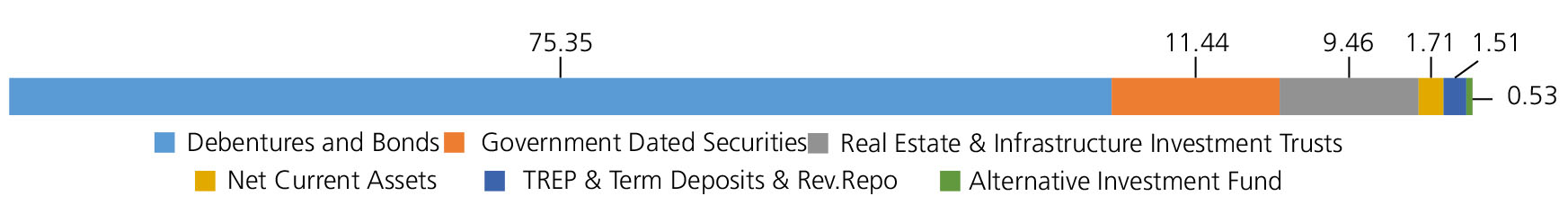

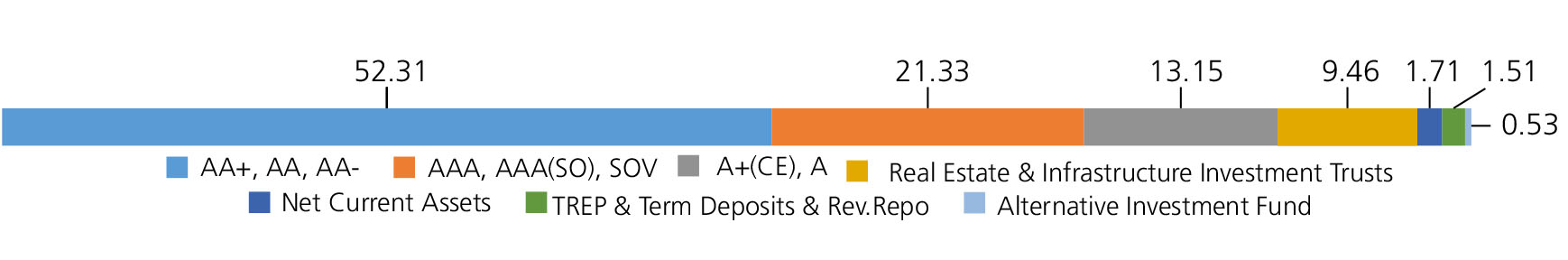

| Issuer/Instrument | Rating | % to Net Assets |

|---|---|---|

| Debt Instruments | ||

| Debentures and Bonds | ||

| Government Dated Securities | ||

| 7.18% Central Government | SOV | 9.66 |

| 7.10% Central Government | SOV | 1.78 |

| Government Dated Securities - Total | 11.44 | |

| Public Sector Undertakings | ||

| U P Power Corporation Ltd ( Guaranteed By UP State Government ) | CRISIL A+(CE) | 3.55 |

| NATIONAL BANK FOR AGRICULTURE & RURAL DEVELOPMENT | CRISIL AAA | 3.43 |

| THDC India Ltd. (THDCIL) | CARE AA | 1.37 |

| Public Sector Undertakings - Total | 8.35 | |

| Corporate Debt/Financial Institutions | ||

| GODREJ INDUSTRIES LTD | ICRA AA+ | 6.90 |

| TATA PROJECTS LTD. | CRISIL AA | 6.85 |

| BAMBOO HOTEL AND GLOBAL CENTRE (DELHI) PRIVATE LTD | ICRA A+(CE) | 6.84 |

| VEDANTA LTD. | ICRA AA | 6.83 |

| ADITYA BIRLA REAL ESTATE LTD (^) | CRISIL AA | 6.42 |

| AADHAR HOUSING FINANCE LIMITED | ICRA AA | 5.51 |

| INDOSTAR CAPITAL FINANCE LIMITED | CRISIL AA- | 5.50 |

| ADITYA BIRLA RENEWABLES LIMITED | CRISIL AA | 5.50 |

| AU SMALL FINANCE BANK LTD. | CRISIL AA | 4.14 |

| PTC VAJRA TRUST (SERIES A1) 20/02/2029 (MAT 20/02/2027)(VAJRA TRUST) | ICRA AAA(SO) | 4.05 |

| PRESTIGE PROJECTS PVT. LTD | ICRA A | 2.76 |

| TATA PROJECTS LTD. | FITCH AA | 2.60 |

| PTC SANSAR TRUST (SERIES A1) 25/06/2030 ( MAT 31/08/2027)(SANSAR TRUST) | CRISIL AAA(SO) | 1.80 |

| Nirma Ltd. | CRISIL AA | 0.69 |

| PTC DHRUVA TRUST (SERIES A1) 24/03/2030 (MAT 24/10/2029)(DHRUVA TRUST) | ICRA AAA(SO) | 0.61 |

| Corporate Debt/Financial Institutions - Total | 67.00 | |

| Triparty Repo | 1.51 | |

| Alternative Investment Fund | ||

| CORPORATE DEBT MARKET DEVELOPMENT FUND - CLASS A2 | Alternative Investment Fund | 0.53 |

| Alternative Investment Fund - Total | 0.53 | |

| Real Estate & Infrastructure Investment Trusts | ||

| Embassy Office Parks REIT | Realty | 3.84 |

| INDUS INFRA TRUST | Transport Infrastructure | 3.36 |

| BROOKFIELD INDIA REAL ESTATE TRUST | Realty | 2.26 |

| Real Estate & Infrastructure Investment Trusts - Total | 9.46 | |

| Net Current Assets/(Liabilities) | 1.71 | |

| Grand Total | 100.00 | |

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 17,80,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on February 28, 2025 (₹) | 30,31,172 | 16,37,769 | 10,30,199 | 6,92,221 | 3,97,529 | 1,23,875 |

| Scheme Returns (%) | 6.83 | 6.06 | 5.75 | 5.67 | 6.56 | 6.11 |

| CRISIL Credit Risk Debt B-II Index Returns (%) | 8.36 | 7.84 | 7.70 | 7.40 | 7.95 | 8.06 |

| Alpha* | -1.54 | -1.77 | -1.96 | -1.74 | -1.38 | -1.95 |

| CRISIL Credit Risk Debt B-II Index (₹)# | 34,35,419 | 17,97,019 | 11,04,551 | 7,23,011 | 4,05,759 | 1,25,099 |

| CRISIL 10 Year Gilt Index (₹)^ | 29,76,811 | 16,58,624 | 10,54,917 | 7,03,862 | 4,08,633 | 1,25,600 |

| CRISIL 10 Year Gilt Index (%) | 6.61 | 6.31 | 6.41 | 6.33 | 8.43 | 8.86 |

| Regular | Direct | |

| Growth | Rs28.4382 | Rs31.8901 |

| Annual IDCW | Rs12.3674 | Rs23.9525 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Deepak Agrawal, Mr. Sunit Garg |

| Benchmark*** | CRISIL Credit Risk Debt B-II Index |

| Allotment date | May 11, 2010 |

| AAUM | Rs730.76 crs |

| AUM | Rs728.07 crs |

| Folio count | 6,602 |

At discretion of trustees

| Average Maturity | 2.97 yrs |

| Modified Duration | 2.36 yrs |

| Macaulay Duration | 2.50 yrs |

| Annualised YTM* | 8.77% |

| $Standard Deviation | 1.46% |

Source: $ICRA MFI Explorer.

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 2-3 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:a) For redemption / switch out

of upto 6% of the initial investment

amount (limit) purchased or switched in

within 1 year from the date of allotment:

Nil.

b) If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%

c) If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL

| Regular Plan: | 1.71% |

| Direct Plan: | 0.79% |

Folio Count data as on 31st January 2025.

Fund

Benchmark: CRISIL Credit Risk Debt B-II Index

This product is suitable for investors who are seeking*:

- Income over a medium term investment horizon

- Investment predominantly in in AA and below rated corporate bonds (Excluding AA+ rated corporate bonds)

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st January, 2025. An addendum may be issued or updated on the website for new riskometer.

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'