Mid Cap Fund - An open ended equity scheme predominantly investing in mid cap stocks

Mid Cap Fund - An open ended equity scheme predominantly investing in mid cap stocks

| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

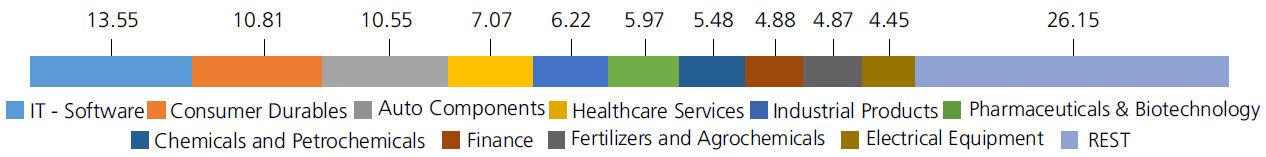

| IT - Software | 13.55 | |

| Mphasis Ltd | 2.98 | |

| Oracle Financial Services Software Ltd | 2.70 | |

| PERSISTENT SYSTEMS LIMITED | 2.59 | |

| Wipro Ltd. | 2.32 | |

| Birlasoft Ltd. | 1.74 | |

| Tech Mahindra Ltd. | 0.73 | |

| HEXAWARE TECHNOLOGIES LTD. | 0.49 | |

| Consumer Durables | 10.81 | |

| Dixon Technologies India Ltd. | 2.39 | |

| BLUE STAR LTD. | 2.18 | |

| Metro Brands Ltd. | 1.62 | |

| Voltas Ltd. | 1.44 | |

| Kajaria Ceramics Ltd. | 1.25 | |

| Amber Enterprises India Ltd. | 1.16 | |

| V-Guard Industries Ltd. | 0.77 | |

| Auto Components | 10.55 | |

| Schaeffler India Ltd | 2.02 | |

| Exide Industries Ltd | 1.77 | |

| Bharat Forge Ltd. | 1.35 | |

| UNO MINDA LIMITED | 1.28 | |

| MRF Limited | 1.02 | |

| ZF Commercial Vehicle Control Systems India Limited | 0.89 | |

| Apollo Tyres Ltd. | 0.88 | |

| Balkrishna Industries Ltd. | 0.75 | |

| Sundaram Fasteners Ltd. | 0.59 | |

| Healthcare Services | 7.07 | |

| Fortis Healthcare India Ltd | 3.45 | |

| Global Health Ltd. | 1.96 | |

| MAX HEALTHCARE INSTITUTE LTD. | 1.66 | |

| Industrial Products | 6.22 | |

| SUPREME INDUSTRIES LIMITED | 1.84 | |

| KEI INDUSTRIES LTD. | 1.26 | |

| Polycab India Ltd. | 1.06 | |

| Ratnamani Metals & Tubes Ltd. | 1.06 | |

| APL APOLLO TUBES LTD. | 1.00 | |

| Pharmaceuticals and Biotechnology | 5.97 | |

| Ipca Laboratories Ltd. | 3.39 | |

| JB CHEMICALS & PHARMACEUTICALS LTD. | 1.46 | |

| Torrent Pharmaceuticals Ltd. | 1.12 | |

| Chemicals and Petrochemicals | 5.48 | |

| SOLAR INDUSTRIES INDIA LIMITED | 2.19 | |

| Deepak Nitrite Ltd. | 1.68 | |

| SRF Ltd. | 1.61 | |

| Finance | 4.88 | |

| Power Finance Corporation Ltd. | 1.96 | |

| LIC Housing Finance Ltd. | 1.43 | |

| Mahindra & Mahindra Financial Services Ltd. | 0.90 | |

| REC LTD | 0.59 | |

| Fertilizers and Agrochemicals | 4.87 | |

| Coromandel International Ltd. | 2.93 | |

| P I Industries Ltd | 1.94 | |

| Electrical Equipment | 4.45 | |

| GE VERNOVA T&D INDIA LIMITED | 1.99 | |

| Apar Industries Limited | 1.24 | |

| Thermax Ltd. | 1.22 | |

| Cement and Cement Products | 3.85 | |

| JK Cement Ltd. | 2.55 | |

| The Ramco Cements Ltd | 1.30 | |

| Insurance | 2.77 | |

| ICICI Lombard General Insurance Company Ltd | 1.64 | |

| Max Financial Services Ltd. | 1.13 | |

| Realty | 2.71 | |

| Oberoi Realty Ltd | 2.71 | |

| Capital Markets | 2.67 | |

| NUVAMA WEALTH MANAGEMENT LIMITED | 1.01 | |

| BSE LTD. | 0.95 | |

| Prudent Corporate Advisory Services Ltd. | 0.71 | |

| Telecom - Services | 2.16 | |

| BHARTI HEXACOM LTD. | 2.16 | |

| Aerospace and Defense | 1.88 | |

| Bharat Electronics Ltd. | 1.88 | |

| Petroleum Products | 1.62 | |

| HINDUSTAN PETROLEUM CORPORATION LTD | 1.62 | |

| Banks | 1.42 | |

| FEDERAL BANK LTD. | 1.42 | |

| Personal Products | 1.40 | |

| Emami Ltd. | 1.40 | |

| Oil | 1.19 | |

| OIL INDIA LIMITED | 1.19 | |

| Retailing | 1.04 | |

| ZOMATO LTD. | 0.85 | |

| VISHAL MEGA MART LIMITED | 0.19 | |

| Power | 0.66 | |

| NTPC GREEN ENERGY LIMITED | 0.66 | |

| Construction | 0.56 | |

| TECHNO ELECTRIC & ENGINEERING COMPANY LIMITED | 0.56 | |

| Equity & Equity related - Total | 97.78 | |

| Mutual Fund Units | ||

| Kotak Liquid Direct Growth | 0.24 | |

| Mutual Fund Units - Total | 0.24 | |

| Triparty Repo | 2.26 | |

| Net Current Assets/(Liabilities) | -0.28 | |

| Grand Total | 100.00 | |

Note: Large Cap, Midcap, Small cap and Debt and Money Market stocks as a % age of Net Assets: 11.17, 69.38, 17.23 & 2.22.

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 21,60,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on Feb 28, 2025 (₹) | 1,25,82,058 | 29,52,955 | 16,52,453 | 9,69,843 | 4,35,684 | 1,06,219 |

| Scheme Returns (%) | 17.27 | 17.16 | 19.00 | 19.31 | 12.82 | -20.78 |

| Nifty Midcap 150 (TRI) Returns (%) | 17.13 | 18.11 | 20.29 | 21.53 | 15.17 | -22.22 |

| Alpha* | 0.14 | -0.95 | -1.29 | -2.22 | -2.35 | 1.45 |

| Nifty Midcap 150 (TRI) (₹)# | 1,23,90,222 | 31,08,295 | 17,29,938 | 10,23,336 | 4,50,601 | 1,05,218 |

| Nifty Midcap 100 (TRI) Returns (%) | 16.30 | 17.30 | 20.26 | 22.30 | 15.99 | -22.12 |

| Alpha* | 0.96 | -0.14 | -1.26 | -2.99 | -3.17 | 1.35 |

| Nifty Midcap 100 (TRI) (₹)# | 1,13,21,874 | 29,74,725 | 17,28,216 | 10,42,735 | 4,55,881 | 1,05,289 |

| Nifty 50 (TRI) (₹)^ | 73,30,548 | 23,61,941 | 13,44,619 | 8,34,267 | 4,10,521 | 1,12,215 |

| Nifty 50 (TRI) Returns (%) | 12.28 | 13.00 | 13.22 | 13.16 | 8.74 | -11.93 |

| Regular | Direct | |

| Growth | Rs108.7740 | Rs125.4160 |

| IDCW | Rs59.7420 | Rs74.7210 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager* |

Mr. Atul Bhole |

| Benchmark*** | NIFTY Midcap 150 TRI (Tier 1), Nifty Midcap 100 TRI (Tier 2) |

| Allotment date | March 30, 2007 |

| AAUM | Rs47,148.49 crs |

| AUM | Rs43,941.48 crs |

| Folio count | 18,77,553 |

Trustee's Discretion

| Portfolio Turnover | 44.19% |

| $Beta | 0.89 |

| $Sharpe ## | 0.64 |

| $Standard Deviation | 15.96% |

| ^^(P/E) | 27.92 |

| ^^P/BV | 4.51 |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

• For redemption / switch out of upto 10%

of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

• If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%

• If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL.

| Regular Plan: | 1.47% |

| Direct Plan: | 0.45% |

Folio Count data as on 31st January 2025.

Benchmark - Tier 1: Nifty Midcap 150 TRI

Benchmark - Tier 2: Nifty Midcap 100 TRI

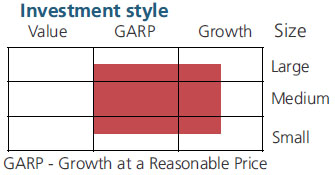

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in equity & equity related securities predominantly in mid cap companies.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st January, 2025. An addendum may be issued or updated on the website for new riskometer.

## Risk rate assumed to be 6.40% (FBIL Overnight MIBOR rate as on 28th Feb 2025).**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'