Key Events for the Month of February 2025

• India’s Services Purchasing Managers' Index (PMI) expanded at the slowest pace in over two years in January, amid

softer increases in sales and output, declining from 59.3 in December to 56.5 in January its lowest level since November

2022.

• The Manufacturing Purchasing Managers’ Index (PMI) rose from 56.4 in December to 57.7 in January, indicating

an expansion in the sector’s activity. The pace of growth was the highest since July and surpassed the long-term average.

• India’s retail inflation, based on the Consumer Price Index (CPI), stood at 4.31% in January, dropping significantly from

5.22% in December.

• India’s Wholesale Price Index (WPI)-based inflation declined to 2.31% in January 2025, primarily due to an increase in

the prices of food products, food articles, other manufactured goods, non-food articles, and textiles, according to data

released by the Ministry of Commerce and Industry on Friday. This is marginally lower than the December 2024 WPI

rate of 2.37%.

• The Indian economy continued to perform well in the fourth and final quarter of the year, with GST collections rising

9.1% to ₹1.84 lakh crore in February, compared with ₹1.96 lakh crore in the previous month

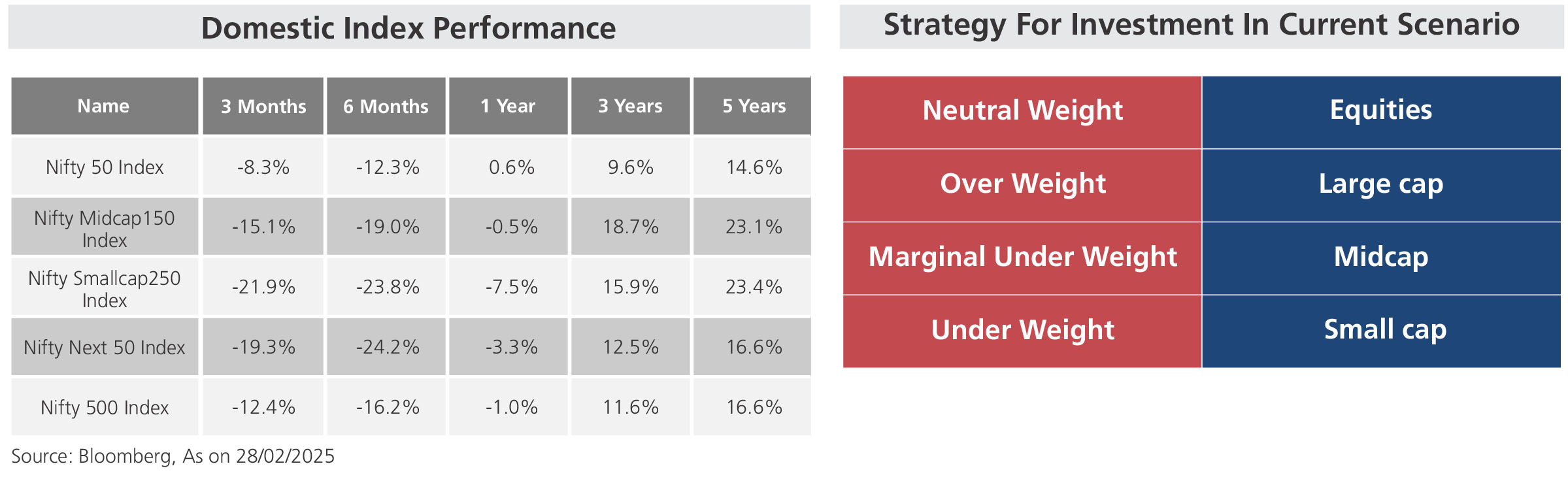

• Indian equity indices saw a significant decline amid global events, with the Nifty and Sensex closing 5.89% and 5.55%

lower month-on-month, respectively.

| |

Sectoral Index Performance |

| Name | 3 Months | 6 Months | 1 Year | 3 Years | 5 Years |

| Nifty Auto Index | -12.3% | -21.7% | 0.4% | 23.7% | 24.3% |

| Nifty Bank Index | -7.1% | -5.9% | 4.8% | 10.1% | 10.6% |

| Nifty Energy Index | -19.9% | -31.4% | -22.7% | 7.4% | 17.0% |

| Nifty Financial Services Index | -4.1% | -2.6% | 12.8% | 10.8% | 11.2% |

| Nifty FMCG Index | -12.5% | -19.6% | -6.2% | 12.6% | 11.6% |

| Nifty Healthcare Index | -10.2% | -12.6% | 6.1% | 16.1% | 21.4% |

| Nifty Infrastructure Index | -12.2% | -18.7% | -5.2% | 16.9% | 20.5% |

| Nifty IT Index | -13.5% | -12.8% | -1.1% | 3.3% | 19.6% |

| Nifty Media Index | -30.5% | -34.1% | -32.3% | -11.6% | -3.7% |

| Nifty Metal Index | -9.0% | -12.6% | 3.8% | 11.7% | 29.6% |

| Nifty Pharma Index | -10.9% | -14.7% | 4.3% | 15.3% | 21.2% |

| Nifty Psu Bank Index | -17.0% | -19.1% | -18.4% | 28.4% | 23.7% |

| Nifty Realty Index | -21.8% | -24.3% | -12.4% | 22.3% | 23.2% |

| BSE Consumer Durables Index | -15.2% | -16.7% | 3.4% | 7.1% | 15.1% |

| BSE Industrial Index | -23.9% | -26.8% | -5.1% | 28.8% | 34.0% |

| |

Global Index Performance |

| Name | 3 Months | 6 Months | 1 Year | 3 Years | 5 Years |

| MSCI World Index | -0.1% | 3.9% | 14.0% | 8.5% | 12.2% |

| MSCI Emerging Index | 1.7% | -0.2% | 7.5% | -2.2% | 1.8% |

| MSCI India index | -10.9% | -15.9% | -1.2% | 9.7% | 15.1% |

| Dow Jones Industrial Average Index | -2.4% | 5.5% | 12.4% | 8.9% | 11.5% |

| Nasdaq Composite Index | -1.9% | 6.4% | 17.1% | 11.1% | 17.1% |

| Nikkei 225 Index | -2.8% | -3.9% | -5.1% | 11.9% | 11.9% |

| Shanghai Composite Index | -0.2% | 16.8% | 10.1% | -1.4% | 2.9% |

| Deutsche Boerse AG german Stock Index DAX | 14.9% | 19.3% | 27.6% | 15.9% | 13.6% |