An open-ended fund of fund scheme predominantly investing in debt oriented mutual fund schemes and equity arbitrage mutual fund scheme of Kotak Mahindra Mutual Fund.

An open-ended fund of fund scheme predominantly investing in debt oriented mutual fund schemes and equity arbitrage mutual fund scheme of Kotak Mahindra Mutual Fund.

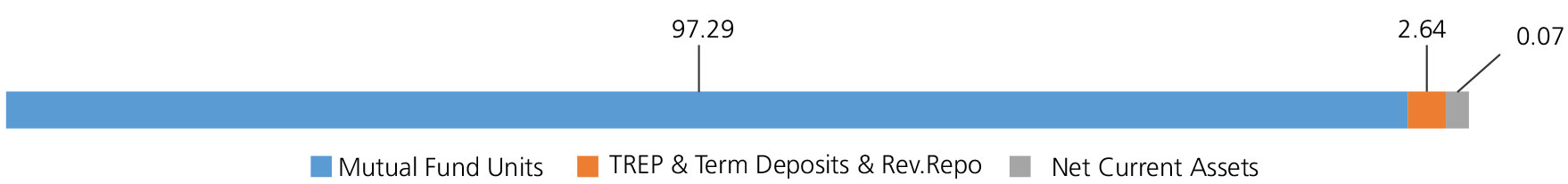

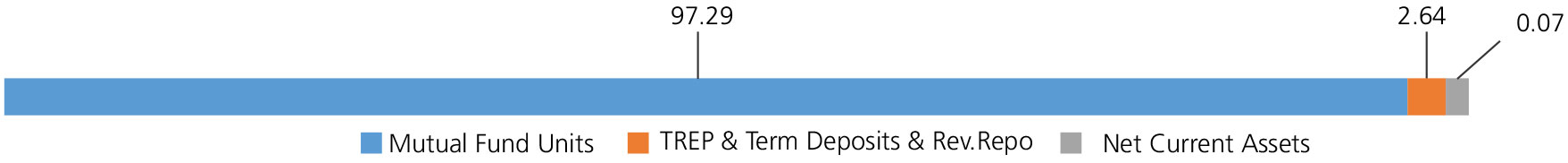

| Issuer/Instrument | Rating | % to Net Assets |

|---|---|---|

| Mutual Fund Units | ||

| Kotak Corporate Bond Fund Direct Growth | Mutual Fund | 56.83 |

| Kotak Equity Arbitrage Fund Direct Plan Growth | Mutual Fund | 40.27 |

| Kotak Gilt Fund Direct Growth | Mutual Fund | 0.19 |

| Mutual Fund Units - Total | 97.29 | |

| Triparty Repo | 2.64 | |

| Net Current Assets/(Liabilities) | 0.07 | |

| Grand Total | 100.00 | |

| Regular | Direct | |

| Growth | Rs11.9500 | Rs11.9751 |

| IDCW | Rs11.9498 | Rs11.9752 |

A) Regular B) Direct Plan

Options: Growth and Income Distribution

cum capital withdrawal (IDCW) (Payout and

Reinvestment)

| Fund Manager* | Mr. Abhishek Bisen |

| Benchmark | Nifty Composite Debt Index (60%) + Nifty 50 Arbitrage Index (TRI) (40%) |

| Allotment date | November 17, 2022 |

| AAUM | Rs238.70 crs |

| AUM | Rs287.92 crs |

| Folio count | 1,496 |

Trustee’s Discretion

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 2 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load: Nil

| Regular Plan: | 0.28% |

| Direct Plan: | 0.10% |

Folio Count data as on 31st January 2025.

Fund

Benchmark : Nifty Composite Debt Index (60%) + Nifty 50 Arbitrage Index (TRI) (40%)

This product is suitable for investors who are seeking*:

- Long-term capital appreciation

- An open ended fund of fund scheme predominantly investing in debt oriented mutual fund schemes and equity arbitrage mutual fund scheme of Kotak Mahindra Mutual Fund.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st January, 2025. An addendum may be issued or updated on the website for new riskometer.

**Total Expense Ratio includes applicable B30 fee and GST

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'