An open ended equity scheme following manufacturing theme

An open ended equity scheme following manufacturing theme

The scheme shall seek to generate capital appreciation by investing in a diversified portfolio of companies that follow the manufacturing theme. However, there can be no assurance that the investment objective of the Scheme will be realized.

The scheme shall seek to generate capital appreciation by investing in a diversified portfolio of companies that follow the manufacturing theme. However, there can be no assurance that the investment objective of the Scheme will be realized.

| Issuer/Instrument | % to Net Assets |

|

|---|---|---|

| Equity & Equity related |

||

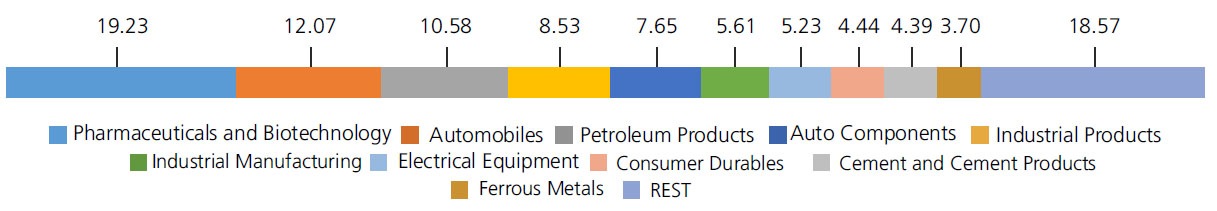

| Pharmaceuticals and Biotechnology | 19.23 | |

| Sun Pharmaceuticals Industries Ltd. | 5.47 | |

| DR REDDYS LABORATORIES LTD. | 2.87 | |

| Zydus Lifesciences Limited | 2.43 | |

| Biocon Ltd. | 2.37 | |

| Cipla Ltd. | 2.21 | |

| SAI LIFE SCIENCES LIMITED | 1.29 | |

| GlaxoSmithKline Pharmaceuticals Ltd. | 1.21 | |

| EMCURE PHARMACEUTICALS LIMITED | 0.72 | |

| Ipca Laboratories Ltd. | 0.66 | |

| Automobiles | 12.07 | |

| Mahindra & Mahindra Ltd. | 3.48 | |

| Hero MotoCorp Ltd. | 2.44 | |

| Maruti Suzuki India Limited | 2.34 | |

| Tata Motors Ltd. | 2.05 | |

| Eicher Motors Ltd. | 1.76 | |

| Petroleum Products | 10.58 | |

| RELIANCE INDUSTRIES LTD. | 4.41 | |

| HINDUSTAN PETROLEUM CORPORATION LTD | 2.45 | |

| Bharat Petroleum Corporation Ltd. | 2.33 | |

| Indian Oil Corporation Ltd | 1.39 | |

| Auto Components | 8.53 | |

| Bosch Ltd. | 2.21 | |

| Bharat Forge Ltd. | 1.52 | |

| Sansera Engineering Ltd. | 1.24 | |

| Exide Industries Ltd | 1.19 | |

| Apollo Tyres Ltd. | 0.86 | |

| Schaeffler India Ltd | 0.86 | |

| KROSS LIMITED | 0.65 | |

| Industrial Products | 7.65 | |

| Graphite India Ltd. | 1.92 | |

| Cummins India Ltd. | 1.83 | |

| Carborundum Universal Ltd. | 1.18 | |

| AIA Engineering Limited. | 1.11 | |

| QUADRANT FUTURE TEK LIMITED | 1.02 | |

| KEI INDUSTRIES LTD. | 0.59 | |

| Industrial Manufacturing | 5.61 | |

| KAYNES TECHNOLOGY INDIA LTD. | 2.14 | |

| DEE DEVELOPMENT ENGINEEERS LTD | 1.42 | |

| JYOTI CNC AUTOMATION LTD | 0.99 | |

| JNK INDIA LIMITED | 0.53 | |

| STANDARD GLASS LINING TECHNOLOGY LIMITED | 0.53 | |

| Electrical Equipment | 5.23 | |

| ABB India Ltd | 1.88 | |

| WAAREE ENERGIES LIMITED | 1.18 | |

| PREMIER ENERGIES LIMITED | 1.13 | |

| Thermax Ltd. | 1.04 | |

| Consumer Durables | 4.44 | |

| Voltas Ltd. | 1.26 | |

| PG ELECTROPLAST LTD | 1.13 | |

| Amber Enterprises India Ltd. | 1.10 | |

| V-Guard Industries Ltd. | 0.95 | |

| Cement and Cement Products | 4.39 | |

| Ambuja Cements Ltd. | 2.28 | |

| Ultratech Cement Ltd. | 2.11 | |

| Ferrous Metals | 3.70 | |

| Tata Steel Ltd. | 3.70 | |

| Aerospace and Defense | 3.61 | |

| Bharat Electronics Ltd. | 2.44 | |

| MTAR Technologies Ltd. | 1.17 | |

| Non - Ferrous Metals | 3.11 | |

| Hindalco Industries Ltd | 3.11 | |

| Fertilizers and Agrochemicals | 2.86 | |

| Coromandel International Ltd. | 2.86 | |

| Construction | 2.60 | |

| Larsen And Toubro Ltd. | 2.60 | |

| Personal Products | 1.45 | |

| Dabur India Ltd. | 1.45 | |

| Textiles and Apparels | 1.42 | |

| SANATHAN TEXTILES LIMITED | 0.75 | |

| Garware Technical Fibres Ltd. | 0.67 | |

| Chemicals and Petrochemicals | 1.13 | |

| SOLAR INDUSTRIES INDIA LIMITED | 1.13 | |

| Diversified | 0.71 | |

| 3M India Ltd. | 0.71 | |

| Equity & Equity related - Total | 98.32 | |

| Mutual Fund Units | ||

| Kotak Liquid Direct Growth | 0.42 | |

| Mutual Fund Units - Total | 0.42 | |

| Triparty Repo | 1.87 | |

| Net Current Assets/(Liabilities) | -0.61 | |

| Grand Total | 100.00 | |

| | ||

| Monthly SIP of (₹) 10000 | Since Inception | 3 years | 1 year |

| Total amount invested (₹) | 3,70,000 | 3,60,000 | 1,20,000 |

| Total Value as on Feb 28, 2025 (₹) | 4,31,307 | 4,16,427 | 1,08,554 |

| Scheme Returns (%) | 9.97 | 9.71 | -17.37 |

| Nifty India Manufacturing (TRI) (%) (%) | 14.61 | 14.44 | -22.39 |

| Alpha* | -4.64 | -4.73 | 5.02 |

| Nifty India Manufacturing (TRI) (%) (₹)# | 4,62,099 | 4,45,937 | 1,05,105 |

| Nifty 50 (₹)^ | 4,23,935 | 4,10,521 | 1,12,215 |

| Nifty 50 (%) | 8.82 | 8.74 | -11.93 |

| Regular | Direct | |

| Growth | Rs15.3260 | Rs16.0920 |

| IDCW | Rs15.3260 | Rs16.0920 |

A) Regular Plan B) Direct Plan

Options: Growth and Income Distribution cum

capital withdrawal (IDCW) (Payout and

Reinvestment)

| Fund Manager* | Mr. Harsha Upadhyaya & Mr. Abhishek Bisen |

| Benchmark | Nifty India Manufacturing TRI |

| Allotment date | February 22, 2022 |

| AAUM | Rs2,232.08 crs |

| AUM | Rs2,039.96 crs |

| Folio count | 97,119 |

Trustee's Discretion

| Portfolio Turnover | 17.69% |

| $Beta | 0.87 |

| $Sharpe ## | 0.55 |

| $Standard Deviation | 14.97% |

| ^^(P/E) | 20.78 |

| ^^P/BV | 3.50 |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load:

Nil. (applicable for all plans)

Exit Load:

• For redemption / switch out within 90

days from the date of allotment: 0.5%

• If units are redeemed or switched out on

or after 90 days from the date of allotment -

Nil

| Regular Plan: | 2.01% |

| Direct Plan: | 0.56% |

Folio Count data as on 31st January 2025.

Benchmark: Nifty India Manufacturing TRI

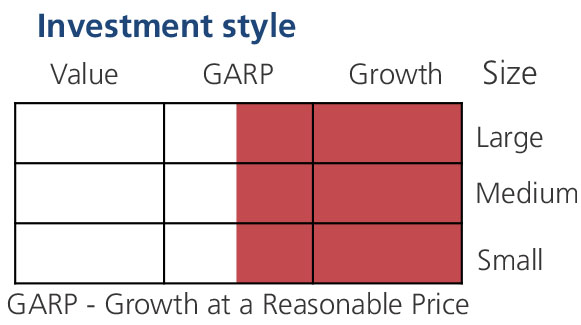

This product is suitable for investors who are seeking*:

- Long-term capital growth

- Investment equity and equity related securities across market capitalisation.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st January, 2025. An addendum may be issued or updated on the website for new riskometer.

## Risk rate assumed to be 6.40% (FBIL Overnight MIBOR rate as on 28th Feb 2025). **Total Expense Ratio includes applicable B30 fee and GST

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'