| KOTAK NIFTY 1D RATE LIQUID ETF

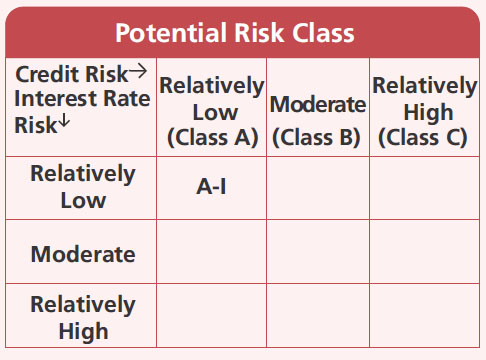

An open-ended Exchange Traded Fund replicating/tracking NIFTY 1D Rate Index. A Relatively Low Interest Rate Risk and Relatively Low Credit Risk.

NSE Symbol - LIQUID1

An open-ended Exchange Traded Fund replicating/tracking NIFTY 1D Rate Index. A Relatively Low Interest Rate Risk and Relatively Low Credit Risk.

NSE Symbol - LIQUID1

| KOTAK NIFTY 1D RATE LIQUID ETF

An open-ended Exchange Traded Fund replicating/tracking NIFTY 1D Rate Index. A Relatively Low Interest Rate Risk and Relatively Low Credit Risk.

NSE Symbol - LIQUID1

An open-ended Exchange Traded Fund replicating/tracking NIFTY 1D Rate Index. A Relatively Low Interest Rate Risk and Relatively Low Credit Risk.

NSE Symbol - LIQUID1

Investment Objective

The investment objective of the Scheme is to invest in Triparty repo on Government securities or treasury bills (TREPS).

The Scheme aims to provide investment returns that, before expenses, closely correspond to the returns of the NIFTY 1D Rate Index, subject to

tracking difference. There is no assurance or guarantee that the investment objective of the scheme would be achieved

The investment objective of the Scheme is to invest in Triparty repo on Government securities or treasury bills (TREPS).

The Scheme aims to provide investment returns that, before expenses, closely correspond to the returns of the NIFTY 1D Rate Index, subject to

tracking difference. There is no assurance or guarantee that the investment objective of the scheme would be achieved

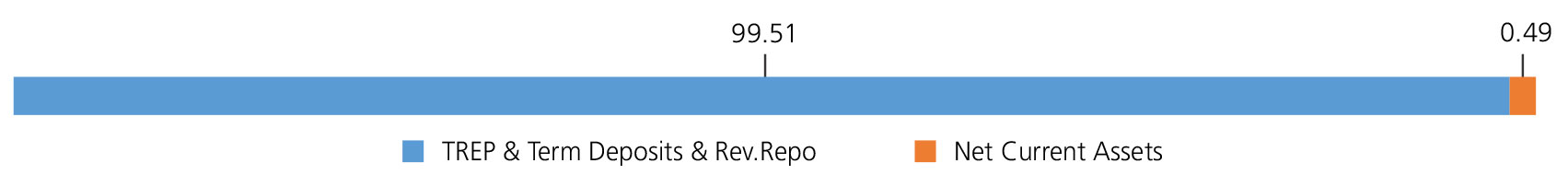

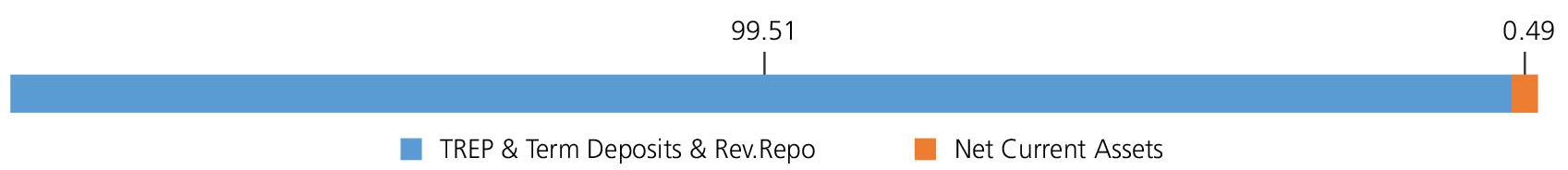

| Issuer/Instrument | % to Net Assets |

|

|---|---|---|

| Triparty Repo | 99.51 | |

| Net Current Assets/(Liabilities) | 0.49 | |

| Grand Total | 100.00 | |

Net Asset Value (NAV)

| Rs1037.4680 |

Available Plans/Options

Growth Option

Debt Quant

| Average Maturity | 2.99 days |

| Modified Duration | 2.99 days |

| Macaulay Duration | 2.99 days |

| Annualised YTM* | 6.25% |

| Tracking Error | 0.02% |

| Fund Manager* | Mr. Abhishek Bisen & Mr. Satish Dondapati |

| Benchmark | NIFTY 1D Rate Index |

| Allotment date | January 24, 2023 |

| AAUM | Rs923.07 crs |

| AUM | Rs1,090.28 crs |

| Folio count | 5,799 |

Minimum Investment Amount

Through Exchange: 1 Unit,

Through AMC: 100 Units and in multiple thereof

Greater than Rs. 25 Crore- For Large

Investors***

Ideal Investments Horizon

• 1-15 days

IDCW Frequency

Not Applicable

Load Structure

Entry Load:

Nil.

Exit Load:

Nil.

Total Expense Ratio**

| 0.19% |

Data as on 28th February, 2025 unless otherwise specified.

Folio Count data as on 31st January 2025.

Folio Count data as on 31st January 2025.

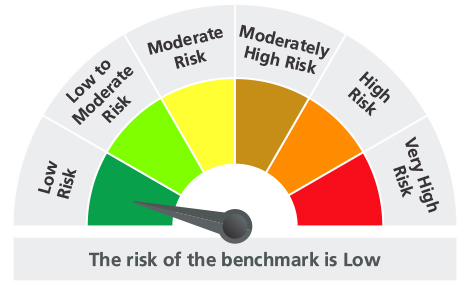

Fund

Benchmark : NIFTY 1D Rate Index

This product is suitable for investors who are seeking*:

- Income over a short term investment horizon.

- Investment in Tri-party repo on Government securities or treasury bills (TREPS).

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st January, 2025. An addendum may be issued or updated on the website for new riskometer.

***Not applicable to Recognised Provident Funds, approved gratuity funds and approved superannuation funds under Income Tax Act, 1961, Schemes managed by Employee Provident Fund Organisation of India and Market Makers as per para 3.6.2.1 and 3.6.2.2 of SEBI Master Circular no. SEBI/HO/IMD/IMD-PoD-1/P/CIR/2024/90 dated June 27, 2024 as amended from time to time along with SEBI letter no. SEBI/HO/IMD- POD- 2/P/OW/2024/15311/1 dated April 26, 2024, SEBI letter no. SEBI/HO/IMD- POD-2/P/OW/2024/34080/1 dated October 29, 2024 and SEBI/HO/IMD- POD-2/P/OW/2024/6441/1 dated February 28, 2025.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

Total Expense Ratio includes applicable B30 fee and GST

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'