An open ended equity scheme following Quant based investing theme

An open ended equity scheme following Quant based investing theme

The scheme shall seek to generate long term capital appreciation by investing predominantly in equity and equity related securities selected based on quant model theme. However, there is no assurance that the objective of the scheme will be achieved.

The scheme shall seek to generate long term capital appreciation by investing predominantly in equity and equity related securities selected based on quant model theme. However, there is no assurance that the objective of the scheme will be achieved.

| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

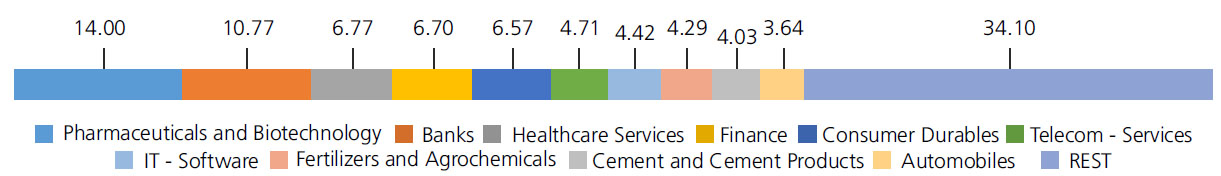

| Pharmaceuticals and Biotechnology | 14.00 | |

| Sun Pharmaceuticals Industries Ltd. | 2.84 | |

| Divi s Laboratories Ltd. | 2.79 | |

| Alkem Laboratories Ltd. | 2.08 | |

| Lupin Ltd. | 1.93 | |

| Ajanta Pharma Ltd. | 1.66 | |

| Laurus Labs Ltd. | 1.58 | |

| PIRAMAL PHARMA LTD. | 1.12 | |

| Banks | 10.77 | |

| ICICI Bank Ltd. | 3.58 | |

| HDFC Bank Ltd. | 2.86 | |

| Kotak Mahindra Bank Ltd. | 2.34 | |

| FEDERAL BANK LTD. | 1.99 | |

| Healthcare Services | 6.77 | |

| Apollo Hospitals Enterprises Ltd. | 3.06 | |

| KRISHNA INSTITUTE OF MEDICAL | 1.93 | |

| DR.Lal Pathlabs Ltd. | 1.78 | |

| Finance | 6.70 | |

| Bajaj Finserv Ltd. | 2.59 | |

| Bajaj Finance Ltd. | 2.27 | |

| SHRIRAM FINANCE LTD. | 1.84 | |

| Consumer Durables | 6.57 | |

| Havells India Ltd. | 2.03 | |

| Voltas Ltd. | 1.66 | |

| Metro Brands Ltd. | 1.47 | |

| BLUE STAR LTD. | 1.41 | |

| Telecom - Services | 4.71 | |

| Bharti Airtel Ltd | 3.07 | |

| Bharti Airtel Ltd - Partly Paid Shares | 1.64 | |

| IT - Software | 4.42 | |

| HCL Technologies Ltd. | 3.14 | |

| Oracle Financial Services Software Ltd | 1.28 | |

| Fertilizers and Agrochemicals | 4.29 | |

| Coromandel International Ltd. | 2.46 | |

| UPL Ltd | 1.83 | |

| Cement and Cement Products | 4.03 | |

| Ultratech Cement Ltd. | 2.18 | |

| Dalmia Bharat Limited | 1.85 | |

| Automobiles | 3.64 | |

| TVS Motors Company Ltd | 1.86 | |

| Bajaj Auto Ltd. | 1.78 | |

| Capital Markets | 2.65 | |

| HDFC Asset Management Company Ltd. | 1.71 | |

| MOTILAL OSWAL FINANCIAL SERVICES LTD | 0.94 | |

| Food Products | 2.54 | |

| Britannia Industries Ltd. | 2.54 | |

| Textiles and Apparels | 2.22 | |

| Page Industries Ltd | 2.22 | |

| Personal Products | 2.14 | |

| Colgate Palmolive (India ) Ltd. | 2.14 | |

| Auto Components | 2.13 | |

| Bosch Ltd. | 2.13 | |

| Beverages | 2.13 | |

| UNITED SPIRITS LTD. | 2.13 | |

| Insurance | 2.08 | |

| ICICI Prudential Life Insurance Company Ltd | 2.08 | |

| Chemicals and Petrochemicals | 1.96 | |

| SRF Ltd. | 1.96 | |

| Non - Ferrous Metals | 1.94 | |

| Hindalco Industries Ltd | 1.94 | |

| Transport Services | 1.94 | |

| Inter Globe Aviation Ltd | 1.94 | |

| IT - Services | 1.81 | |

| L&T Technology Services Ltd | 1.81 | |

| Gas | 1.56 | |

| Petronet LNG Ltd. | 1.56 | |

| Retailing | 1.41 | |

| ZOMATO LTD. | 1.41 | |

| Diversified Metals | 1.40 | |

| Vedanta Ltd. | 1.40 | |

| Transport Infrastructure | 1.39 | |

| JSW INFRASTRUCTURE LIMITED | 1.39 | |

| Realty | 1.36 | |

| Oberoi Realty Ltd | 1.36 | |

| Power | 1.14 | |

| TORRENT POWER LTD | 1.14 | |

| Construction | 1.13 | |

| Kec International Ltd. | 1.13 | |

| Equity & Equity related - Total | 98.83 | |

| Mutual Fund Units | ||

| Kotak Liquid Direct Growth | 0.08 | |

| Mutual Fund Units - Total | 0.08 | |

| Triparty Repo | 1.23 | |

| Net Current Assets/(Liabilities) | -0.14 | |

| Grand Total | 100.00 | |

| | ||

| Monthly SIP of (₹) 10000 | Since Inception | 1 Year |

| Total amount invested (₹) | 1,90,000 | 1,20,000 |

| Total Value as on Feb 28, 2025 (₹) | 1,86,165 | 1,03,655 |

| Scheme Returns (%) | -2.45 | -24.47 |

| Nifty 200 (TRI) Returns (%) | -0.95 | -16.50 |

| Alpha* | -1.50 | -7.97 |

| Nifty 200 (TRI) (₹)# | 1,88,516 | 1,09,141 |

| Nifty 50 (TRI) (₹)^ | 1,90,377 | 1,12,215 |

| Nifty 50 (TRI) Returns (%) | 0.24 | -11.93 |

| Regular | Direct | |

| Growth | Rs12.9150 | Rs12.9630 |

| IDCW | Rs12.9150 | Rs12.9630 |

A) Regular Plan B) Direct Plan

Options: Growth and Income Distribution

cum capital withdrawal (IDCW) (Payout and

Reinvestment)

| Fund Manager* | Mr. Harsha Upadhyaya, Mr. Rohit Tandon & Mr. Abhishek Bisen |

| Benchmark | Nifty 200 TRI |

| Allotment date | August 02, 2023 |

| AAUM | Rs749.97 crs |

| AUM | Rs707.12 crs |

| Folio count | 17,453 |

Trustee's Discretion

| Portfolio Turnover | 188.32% |

| $Beta | 1.22 |

| $Sharpe ## | 0.64 |

| $Standard Deviation | 19.03% |

| ^^(P/E) | 31.90 |

| ^^P/BV | 4.82 |

Initial & Additional Investment

• Rs5000 and in multiples of Rs1 for

purchases and of Rs0.01 for switches

Additional Investment

• Rs1000 and in multiples of Rs1 for

purchases and of Rs0.01 for switches

Systematic Investment Plan (SIP)

• Rs500 (Subject to a minimum of 10 SIP

installments of Rs500/- each)

• 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

• For redemption / switch out within 90

days from the date of allotment: 0.5%

• If units are redeemed or switched out on

or after 90 days from the date of allotment -

Nil.

| Regular Plan: | 1.46% |

| Direct Plan: | 1.16% |

Folio Count data as on 31st January 2025.

Benchmark : Nifty 200 TRI

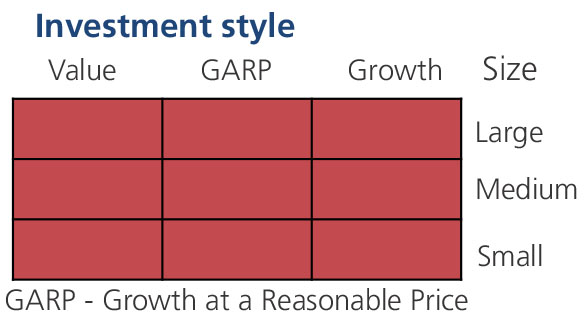

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment predominantly in equity & equity related instruments selected based on quant model

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st January, 2025. An addendum may be issued or updated on the website for new riskometer.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'