An open-ended equity scheme following Transportation & Logistics theme

An open-ended equity scheme following Transportation & Logistics theme

The investment objective of the scheme is to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in transportation & logistics and related activities. However, there is no assurance that the objective of the scheme will be achieved.

The investment objective of the scheme is to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity related securities of companies engaged in transportation & logistics and related activities. However, there is no assurance that the objective of the scheme will be achieved.

| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

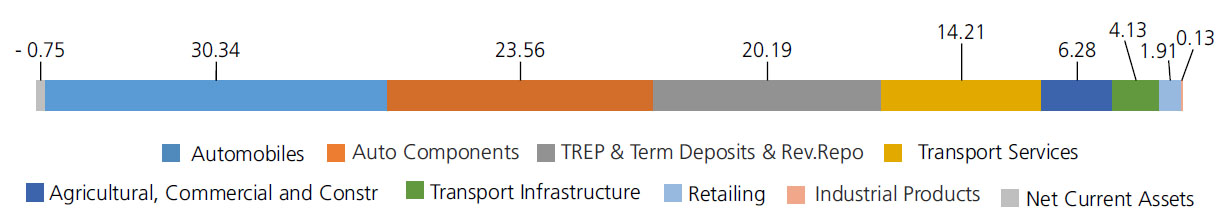

| Automobiles | 30.34 | |

| Maruti Suzuki India Limited | 9.22 | |

| Mahindra & Mahindra Ltd. | 5.98 | |

| Hero MotoCorp Ltd. | 4.26 | |

| Tata Motors Ltd. | 4.15 | |

| Bajaj Auto Ltd. | 4.06 | |

| HYUNDAI MOTORS INDIA LTD | 2.67 | |

| Auto Components | 23.56 | |

| ZF Commercial Vehicle Control Systems India Limited | 5.63 | |

| Subros Ltd. | 5.10 | |

| Igarashi Motors India Ltd. | 3.10 | |

| Sundaram Fasteners Ltd. | 2.40 | |

| Bosch Ltd. | 2.05 | |

| Sansera Engineering Ltd. | 2.01 | |

| AMARA RAJA ENERGY MOB LTD. | 1.40 | |

| Apollo Tyres Ltd. | 1.28 | |

| KROSS LIMITED | 0.59 | |

| Transport Services | 14.21 | |

| Inter Globe Aviation Ltd | 5.76 | |

| Blue Dart Express Ltd. | 2.57 | |

| Great Eastern Shipping Company Ltd | 1.67 | |

| Container Corporation of India Ltd. | 1.60 | |

| WESTERN CARRIERS (INDIA) LTD | 1.33 | |

| DELHIVERY LTD | 0.64 | |

| MAHINDRA LOGISTICS LTD | 0.64 | |

| Agricultural, Commercial and Constr | 6.28 | |

| Ashok Leyland Ltd. | 3.89 | |

| V.S.T Tillers Tractors Ltd | 2.39 | |

| Transport Infrastructure | 4.13 | |

| Adani Port and Special Economic Zone Ltd. | 4.13 | |

| Retailing | 1.91 | |

| SWIGGY LTD | 1.91 | |

| Industrial Products | 0.13 | |

| QUADRANT FUTURE TEK LIMITED | 0.13 | |

| Equity & Equity related - Total | 80.56 | |

| Triparty Repo | 20.19 | |

| Net Current Assets/(Liabilities) | -0.75 | |

| Grand Total | 100.00 | |

| | ||

| Regular | Direct | |

| Growth | Rs8.8680 | Rs8.8970 |

| IDCW | Rs8.8680 | Rs8.8970 |

A) Regular Plan B) Direct Plan

Options: Growth and Income Distribution

cum capital withdrawal (IDCW) (Payout and

Reinvestment)

| Fund Manager* |

Mr. Nalin Rasik Bhatt & Mr. Abhishek Bisen |

| Benchmark | Nifty Transportation & Logistics Index TRI |

| Allotment date | December 16, 2024 |

| AAUM | Rs 343.09 crs |

| AUM | Rs 349.98 crs |

| Folio count | 27,660 |

Trustee's Discretion

| ^^(P/E) | 23.98 |

| ^^P/BV | 4.45 |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

• For redemption / switch out within 90

days from the date of allotment: 0.5%

• If units are redeemed or switched out on

or after 90 days from the date of allotment -

Nil

| Regular Plan: | 2.41% |

| Direct Plan: | 0.82% |

Benchmark : Nifty Transportation & Logistics Index TRI

This product is suitable for investors who are seeking*:

- Long-term capital growth

- Investment in portfolio of predominantly equity and equity related securities of companies engaged in Transportation & Logistics and related activities

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'