| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity Related | ||

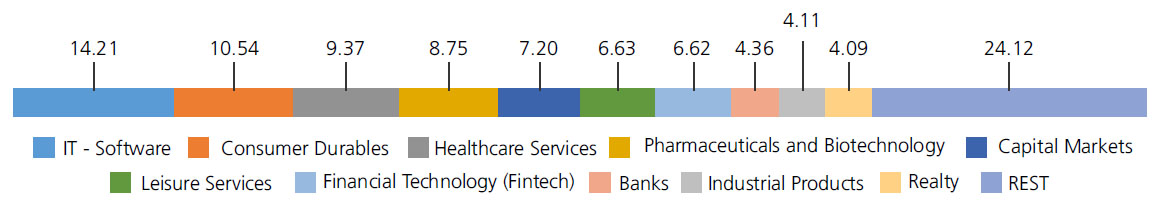

| IT - Software | 14.21 | |

| PERSISTENT SYSTEMS LIMITED | 5.20 | |

| Coforge Limited | 4.86 | |

| Oracle Financial Services Software Ltd | 2.53 | |

| Mphasis Ltd | 1.62 | |

| Consumer Durables | 10.54 | |

| Dixon Technologies India Ltd. | 4.84 | |

| Voltas Ltd. | 3.00 | |

| KALYAN JEWELLERS INDIA LTD. | 2.70 | |

| Healthcare Services | 9.37 | |

| MAX HEALTHCARE INSTITUTE LTD. | 5.00 | |

| Fortis Healthcare India Ltd | 3.33 | |

| Syngene International Limited | 1.04 | |

| Pharmaceuticals and Biotechnology | 8.75 | |

| Lupin Ltd. | 4.44 | |

| Ipca Laboratories Ltd. | 1.49 | |

| Aurobindo Pharma Ltd. | 1.17 | |

| Biocon Ltd. | 0.83 | |

| Ajanta Pharma Ltd. | 0.82 | |

| Capital Markets | 7.20 | |

| BSE LTD. | 5.34 | |

| HDFC Asset Management Company Ltd. | 1.86 | |

| Leisure Services | 6.63 | |

| INDIAN HOTELS COMPANY LTD. | 5.17 | |

| Jubilant Foodworks Limited | 1.46 | |

| Financial Technology (Fintech) | 6.62 | |

| PB FINTECH LTD. | 4.50 | |

| ONE 97 COMMUNICATIONS LTD. | 2.12 | |

| Banks | 4.36 | |

| FEDERAL BANK LTD. | 3.63 | |

| INDIAN BANK | 0.73 | |

| Industrial Products | 4.11 | |

| Cummins India Ltd. | 2.23 | |

| Polycab India Ltd. | 1.01 | |

| KEI INDUSTRIES LTD. | 0.87 | |

| Realty | 4.09 | |

| PHOENIX MILLS LTD. | 1.18 | |

| GODREJ PROPERTIES LIMITED | 1.17 | |

| Oberoi Realty Ltd | 0.90 | |

| PRESTIGE ESTATES PROJECTS LIMITED | 0.84 | |

| Electrical Equipment | 3.93 | |

| CG POWER AND INDUSTRIAL SOLUTIONS LIMITED | 2.35 | |

| HITACHI ENERGY INDIA LIMITED | 0.99 | |

| Thermax Ltd. | 0.59 | |

| Telecom - Services | 2.35 | |

| Indus Towers Ltd. | 2.35 | |

| Finance | 2.18 | |

| INDIAN RENEWABLE ENERGY DEVELOPMENT AGENCY LTD. | 0.92 | |

| CRISIL Ltd. | 0.72 | |

| HOUSING & URBAN DEVELOPMENT CORPORATION LTD. | 0.54 | |

| Fertilizers and Agrochemicals | 1.88 | |

| Coromandel International Ltd. | 1.88 | |

| Textiles and Apparels | 1.62 | |

| Page Industries Ltd | 1.62 | |

| Oil | 1.56 | |

| OIL INDIA LIMITED | 1.56 | |

| Construction | 1.44 | |

| Rail Vikas Nigam Limited. | 1.44 | |

| Gas | 1.43 | |

| Petronet LNG Ltd. | 1.43 | |

| Petroleum Products | 1.43 | |

| HINDUSTAN PETROLEUM CORPORATION LTD | 1.43 | |

| Ferrous Metals | 1.36 | |

| LLOYDS METALS AND ENERGY LTD. | 1.36 | |

| Chemicals and Petrochemicals | 1.28 | |

| SOLAR INDUSTRIES INDIA LIMITED | 1.28 | |

| Industrial Manufacturing | 1.06 | |

| MAZAGOAN DOCK SHIPBUILDERS LTD | 1.06 | |

| Power | 1.03 | |

| TORRENT POWER LTD | 1.03 | |

| Auto Components | 0.98 | |

| UNO MINDA LIMITED | 0.98 | |

| Diversified | 0.61 | |

| Godrej Industries Ltd. | 0.61 | |

| Aerospace and Defense | 0.35 | |

| BHARAT DYNAMICS LTD | 0.35 | |

| Equity & Equity Related - Total | 100.37 | |

| Triparty Repo | 0.66 | |

| Net Current Assets/(Liabilities) | -1.03 | |

| Grand Total | 100.00 | |

| Regular | Direct | |

| Growth | Rs7.6830 | Rs7.7030 |

| IDCW | Rs7.6830 | Rs7.7030 |

A) Regular Plan B) Direct Plan

OOptions: a) Growth and Income

Distribution cum capital withdrawal

(IDCW) (Payout and Reinvestment)

| Fund Manager* | Mr. Devender Singhal, Mr. Satish Dondapati & Mr. Abhishek Bisen |

| Benchmark | Nifty Midcap 150 Momentum 50 Index (TRI) |

| Allotment date | October 8, 2024 |

| AAUM | Rs75.50 crs |

| AUM | Rs75.23 crs |

| Folio count | 26,826 |

| Portfolio Turnover | 50.31% |

| Tracking Error | 0.55% |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

IDCW is declared subject to availability and adequacy of distributable surplus

Entry Load:

NIL. (applicable for all plans)

Exit Load:

NIL

| Regular Plan: | 0.93% |

| Direct Plan: | 0.28% |

Folio Count data as on 31st January 2025.

Fund

Benchmark : Nifty Midcap 150 Momentum 50 Index (TRI)

This product is suitable for investors who are seeking*:

- Long term capital growth

- Return that corresponds to the performance of Nifty Midcap 150 Momentum 50 Index subject to tracking error.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st January, 2025. An addendum may be issued or updated on the website for new riskometer.

**Total Expense Ratio includes applicable B30 fee and GST.

The scheme has not completed 6 month since inception

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'