| Issuer/Instrument | Rating | % to Net Assets |

|---|---|---|

| Mutual Fund Units | ||

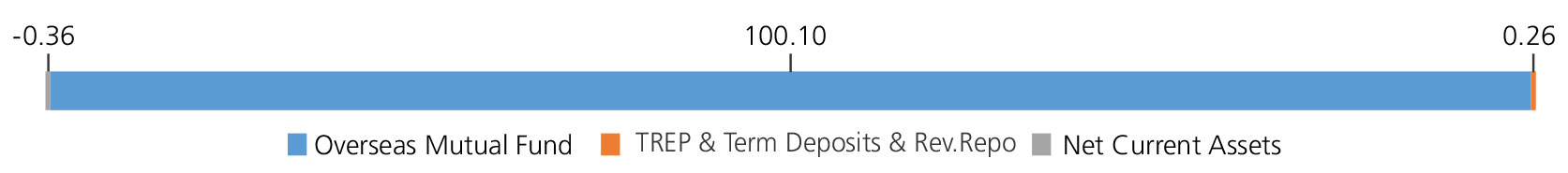

| Ishares Nasdaq 100 UCITS ETF USD | Overseas Mutual Fund | 100.10 |

| Mutual Fund Units - Total | 100.10 | |

| Triparty Repo | 0.26 | |

| Net Current Assets/(Liabilities) | -0.36 | |

| Grand Total | 100.00 | |

For viewing detailed portfolio of Ishares NASDAQ 100 UCITS ETF USD on desktop please visit: https://www.ishares.com/uk/individual/en/products/253741/ishares-nasdaq-100-ucits-etf

| Regular | Direct | |

| Growth | Rs18.0442 | Rs18.3338 |

A) Regular Plan B) Direct Plan

Options: Growth

| Fund Manager* | Mr. Arjun Khanna & Mr. Abhishek Bisen |

| Benchmark | NASDAQ 100 Index TRI |

| Allotment date | February 2, 2021 |

| AAUM | Rs3,511.15 crs |

| AUM | Rs3,342.08 crs |

| Folio count | 51,007 |

| Portfolio Turnover | 1.12% |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:Nil

| Regular Plan: | 0.62% |

| Direct Plan: | 0.25% |

Folio Count data as on 31st January 2025.

Fund

Benchmark : NASDAQ 100 Index TRI

This product is suitable for investors who are seeking*:

- Long term capital growth

- Return that corresponds generally to the performance of the NASDAQ-100 Index, subject to tracking error.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st January, 2025. An addendum may be issued or updated on the website for new riskometer.

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'