An open-ended equity scheme following contrarian investment strategy

An open-ended equity scheme following contrarian investment strategy

is not yet recognised by the market. At times, the broad market takes time to appreciate the long-term potential of some fundamentally sound companies.

Stocks of such companies are traded at prices below their intrinsic value and are regarded as undervalued stocks.

We believe that, over a period of time, the price of a stock reflects the intrinsic value of the underlying company. Thus, the moving up of the price of the undervalued stock towards its intrinsic value will help us generate capital appreciation for investors. However, there can be no assurance that the investment objective of the Scheme will be achieved.

is not yet recognised by the market. At times, the broad market takes time to appreciate the long-term potential of some fundamentally sound companies.

Stocks of such companies are traded at prices below their intrinsic value and are regarded as undervalued stocks.

We believe that, over a period of time, the price of a stock reflects the intrinsic value of the underlying company. Thus, the moving up of the price of the undervalued stock towards its intrinsic value will help us generate capital appreciation for investors. However, there can be no assurance that the investment objective of the Scheme will be achieved.

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity related | ||

| Banks | 22.38 | |

| ICICI Bank Ltd. | 4.69 | |

| HDFC Bank Ltd. | 4.47 | |

| State Bank Of India | 3.53 | |

| Axis Bank Ltd. | 3.31 | |

| Federal Bank Ltd. | 1.93 | |

| Bank Of Baroda | 1.85 | |

| AU Small Finance Bank Ltd. | 1.52 | |

| IndusInd Bank Ltd. | 1.08 | |

| IT - Software | 10.35 | |

| Infosys Ltd. | 5.28 | |

| HCL Technologies Ltd. | 1.71 | |

| Persistent Systems Limited | 1.70 | |

| Tata Consultancy Services Ltd. | 1.66 | |

| Pharmaceuticals and Biotechnology | 6.40 | |

| Sun Pharmaceuticals Industries Ltd. | 2.38 | |

| Torrent Pharmaceuticals Ltd. | 1.31 | |

| Alkem Laboratories Ltd. | 0.92 | |

| Dr Reddys Laboratories Ltd. | 0.67 | |

| Cipla Ltd. | 0.61 | |

| Zydus Lifesciences Limited | 0.51 | |

| Industrial Products | 5.96 | |

| Cummins India Ltd. | 2.47 | |

| Bharat Forge Ltd. | 1.86 | |

| Supreme Industries Limited | 1.63 | |

| Automobiles | 5.93 | |

| Maruti Suzuki India Limited | 2.25 | |

| Hero MotoCorp Ltd. | 2.08 | |

| Mahindra & Mahindra Ltd. | 1.60 | |

| Finance | 4.96 | |

| HDFC Ltd. | 1.58 | |

| Power Finance Corporation Ltd. | 1.44 | |

| LIC Housing Finance Ltd. | 1.23 | |

| Aavas Financiers Ltd. | 0.51 | |

| Mahindra & Mahindra Financial Services Ltd. | 0.20 | |

| Construction | 4.59 | |

| Larsen And Toubro Ltd. | 3.40 | |

| Kalpataru Power Transmission Ltd. | 1.19 | |

| Diversified FMCG | 4.29 | |

| ITC Ltd. | 2.43 | |

| Hindustan Unilever Ltd. | 1.86 | |

| Cement and Cement Products | 3.80 | |

| Ultratech Cement Ltd. | 2.54 | |

| Shree Cement Ltd. | 1.00 | |

| The Ramco Cements Ltd | 0.26 | |

| Petroleum Products | 3.78 | |

| RELIANCE INDUSTRIES LTD. | 3.56 | |

| Hindustan Petroleum Corporation Ltd | 0.22 | |

| Telecom - Services | 2.77 | |

| Bharti Airtel Ltd | 2.67 | |

| Bharti Airtel Ltd - Partly Paid Shares | 0.10 | |

| Consumer Durables | 2.71 | |

| Whirlpool of India Ltd. | 1.05 | |

| Kajaria Ceramics Ltd. | 0.87 | |

| Bata India Ltd. | 0.43 | |

| Elin Electronics Ltd. | 0.36 | |

| Personal Products | 2.63 | |

| Godrej Consumer Products Ltd. | 1.93 | |

| Emami Ltd. | 0.70 | |

| Auto Components | 2.42 | |

| Bosch Ltd. | 1.41 | |

| Exide Industries Ltd | 1.01 | |

| Power | 2.26 | |

| National Thermal Power Corporation Limited | 2.26 | |

| Ferrous Metals | 1.73 | |

| Jindal Steel & Power Ltd. | 1.73 | |

| Transport Services | 1.70 | |

| Inter Globe Aviation Ltd | 1.47 | |

| Container Corporation of India Ltd. | 0.23 | |

| Aerospace and Defense | 1.64 | |

| Bharat Electronics Ltd. | 1.64 | |

| Insurance | 1.59 | |

| SBI Life Insurance Company Ltd | 1.59 | |

| Chemicals and Petrochemicals | 1.41 | |

| SRF Ltd. | 1.41 | |

| Beverages | 1.35 | |

| United Breweries Ltd. | 1.35 | |

| Realty | 1.15 | |

| Oberoi Realty Ltd | 1.15 | |

| Non - Ferrous Metals | 1.02 | |

| Hindalco Industries Ltd | 1.02 | |

| Gas | 0.87 | |

| Gujarat State Petronet Ltd. | 0.87 | |

| Leisure Services | 0.36 | |

| Jubilant Foodworks Limited | 0.36 | |

| Entertainment | 0.20 | |

| Zee Entertainment Enterprises Ltd | 0.20 | |

| Equity & Equity related - Total | 98.25 | |

| Triparty Repo | 2.00 | |

| Net Current Assets/(Liabilities) | -0.25 | |

| Grand Total | 100.00 | |

| | ||

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 21,10,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on Jan 31, 2023(₹) | 75,22,201 | 25,20,682 | 14,24,613 | 8,85,137 | 4,73,904 | 1,26,253 |

| Scheme Returns (%) | 13.05 | 14.20 | 14.82 | 15.54 | 18.68 | 9.76 |

| Nifty 500 (TRI) Returns (%) | 12.47 | 13.47 | 13.67 | 14.45 | 16.78 | 2.24 |

| Alpha | 0.58 | 0.73 | 1.15 | 1.09 | 1.89 | 7.52 |

| Nifty 500 (TRI) (₹)# | 70,79,329 | 24,23,595 | 13,67,403 | 8,61,799 | 4,61,396 | 1,21,449 |

| Nifty 100 (TRI) Returns (%) | 12.42 | 12.88 | 13.14 | 13.42 | 15.16 | 1.58 |

| Alpha | 0.63 | 1.32 | 1.68 | 2.11 | 3.52 | 8.18 |

| Nifty 100 (TRI) (₹)# | 70,43,789 | 23,49,269 | 13,41,599 | 8,40,169 | 4,50,826 | 1,21,026 |

| Nifty 50 (TRI) (₹)^ | 69,28,724 | 23,77,776 | 13,75,036 | 8,57,687 | 4,58,693 | 1,23,148 |

| Nifty 50 (TRI) Returns (%) | 12.26 | 13.11 | 13.83 | 14.26 | 16.37 | 4.88 |

TRI - Total Return Index, In terms of SEBI circular dated January 4, 2018, the performance of the scheme is benchmarked to the Total Return variant (TRI) of the Benchmark Index instead of Price Return Variant (PRI). Alpha is difference of scheme return with benchmark return.

*All payouts during the period have been reinvested in the units of the scheme at the then prevailing NAV. Source: ICRA MFI Explorer.

| Reg-Plan-IDCW | Rs30.146 |

| Dir-Plan-IDCW | Rs35.522 |

| Growth option | Rs87.458 |

| Direct Growth option | Rs99.824 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager* | Ms. Shibani Kurian |

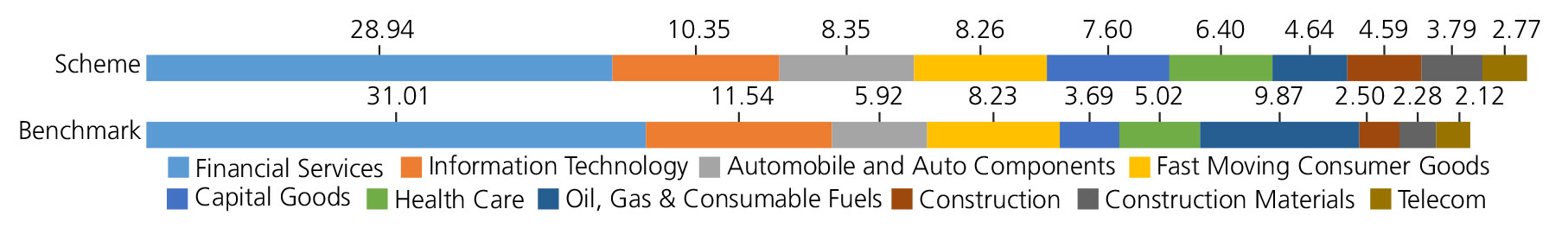

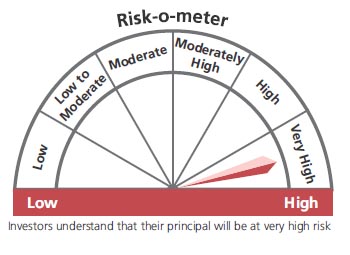

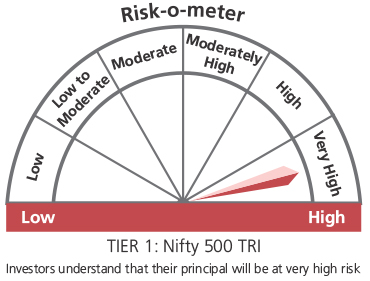

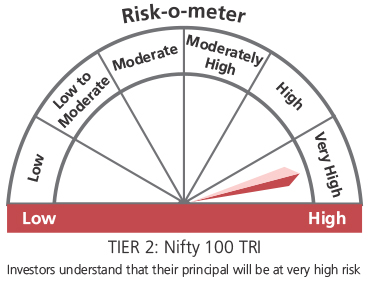

| Benchmark | Nifty 500 TRI (Tier 1) Nifty 100 TRI (Tier 2) |

| Allotment date | July 27, 2005 |

| AAUM | Rs1,454.62 crs |

| AUM | Rs1,446.85 crs |

| Folio count | 58,181 |

Trustee's Discretion

| Portfolio Turnover | 23.67% |

| $Beta | 0.98 |

| $Sharpe ## | 0.49 |

| $Standard Deviation | 22.83% |

| (P/E) | 20.39 |

| P/BV | 2.87 |

| IDCW Yield | 1.31 |

Initial Investment: Rs5000 and in multiple of

Rs1 for purchase and for Rs0.01 for switches

Additional Investment: Rs1000 & in multiples

of Rs1

Ideal Investments Horizon: 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

a) For redemption / switch out within 90

days from the date of allotment:1%

b) If units are redeemed or switched out on

or after 90 days from the date of allotment -

Nil.

Regular:2.22%; Direct: 0.81%

Benchmark

Benchmark

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in portfolio of predominantly equity & equity related securities.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st January 2023. An addendum may be issued or updated on the website for new riskometer

***As per SEBI Circular dated 27th October 2021 The first tier benchmark is reflective of the category of the scheme and the second tier benchmark is demonstrative of the investment style / strategy of the Fund Manager within the category.

## Risk rate assumed to be 6.50% (FBIL Overnight MIBOR rate as on 31st January 2023).**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'