| KOTAK NIFTY SDL JUL 2026 INDEX FUND

An open-ended Target Maturity Index Fund investing in constituents of Nifty SDL Jul 2026 Index.

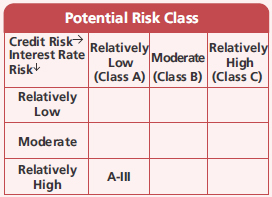

A relatively high interest rate risk and relatively low credit risk.

An open-ended Target Maturity Index Fund investing in constituents of Nifty SDL Jul 2026 Index.

A relatively high interest rate risk and relatively low credit risk.

| KOTAK NIFTY SDL JUL 2026 INDEX FUND

An open-ended Target Maturity Index Fund investing in constituents of Nifty SDL Jul 2026 Index.

A relatively high interest rate risk and relatively low credit risk.

An open-ended Target Maturity Index Fund investing in constituents of Nifty SDL Jul 2026 Index.

A relatively high interest rate risk and relatively low credit risk.

Investment Objective

The investment objective of the scheme is to

track the Nifty SDL Jul 2026 Index by

investing in SDLs, maturing on or before July

2026, subject to tracking difference.

There is no assurance or guarantee that the investment objective of the scheme would be achieved

There is no assurance or guarantee that the investment objective of the scheme would be achieved

The investment objective of the scheme is to

track the Nifty SDL Jul 2026 Index by

investing in SDLs, maturing on or before July

2026, subject to tracking difference.

There is no assurance or guarantee that the investment objective of the scheme would be achieved

There is no assurance or guarantee that the investment objective of the scheme would be achieved

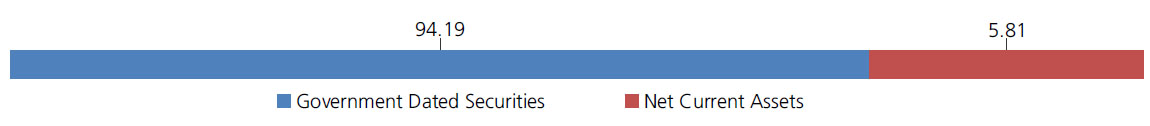

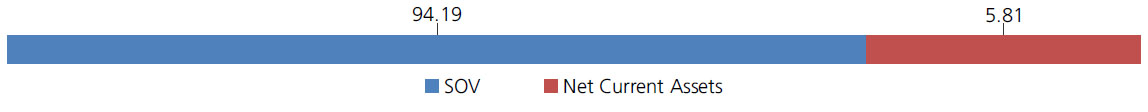

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Government Dated Securities | ||

| 8.01 Tamil Nadu State Govt-Tamil Nadu | SOV | 46.26 |

| 7.84 Maharashtra State Govt-Maharashtra | SOV | 31.32 |

| 7.96 Punjab State Govt-Punjab | SOV | 12.93 |

| 7.85 Andhra Pradesh State Govt-Andhra Pradesh | SOV | 3.68 |

| Government Dated Securities - Total | 94.19 | |

| Net Current Assets/(Liabilities) | 5.81 | |

| Grand Total | 100.00 | |

NAV

| Regular-Plan-Growth | Rs10.069 |

| Direct-Plan-Growth | Rs10.071 |

| Regular-Plan-IDCW | Rs10.069 |

Available Plans/Options

Regular & Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Abhishek Bisen |

| Benchmark | Nifty SDL Jul 2026 Index |

| Allotment date | December 22, 2022 |

| AAUM | Rs53.29 crs |

| AUM | Rs55.05 crs |

| Folio count | 343 |

Ratios

| Portfolio Average Maturity | 3.14 yrs |

| IRS Average Maturity* | - |

| Net Average Maturity | 3.14 yrs |

| Portfolio Modified Duration | 2.69 yrs |

| IRS Modified Duration* | - |

| Net Modified Duration | 2.69 yrs |

| Portfolio Macaulay Duration | 2.79 yrs |

| IRS Macaulay Duration* | - |

| Net Macaulay Duration | 2.79 yrs |

| Annualised YTM* | 7.43% |

*in case of semi annual YTM, it will be annualized.

Minimum Investment Amount

Initial Investment: Rs5000 and in multiple

of Rs1 for purchase and for Rs0.01 for

switches

Additional Investment: Rs1000 & in multiples

of Rs1 for purchase and for Rs0.01 for

switches

Ideal Investments Horizon: 1 year and Above

Load Structure

Entry Load: Nil. (applicable for all plans)

Exit Load: Nil

Total Expense Ratio**

Regular: 0.40%; Direct: 0.20%

Data as on January 31, 2023

Fund

Benchmark

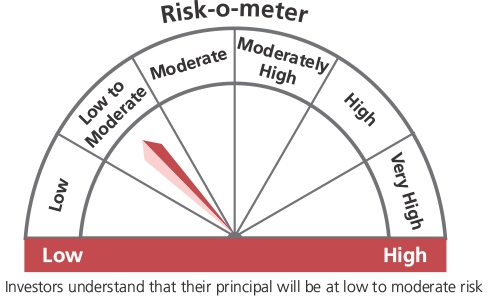

This product is suitable for investors who are seeking*:

- Income over Target Maturity Period

- Target Maturity Index Fund tracking Nifty SDL Jul 2026 Index

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

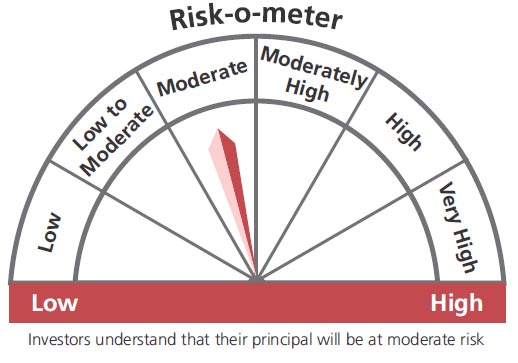

The above risk-o—meter is based on the scheme portfolio as on 31st January 2023. An addendum may be issued or updated on the website for new riskometer

**Total Expense Ratio includes applicable B30 fee and GST

* For Fund Manager experience, please refer 'Our Fund Managers'

For scheme performance, please refer 'Scheme Performances'