Investment Objective

The investment objective of the scheme is

to replicate the composition of the NIFTY IT

Index and to generate returns that are

commensurate with the performance of

the NIFTY IT Index, subject to tracking

errors.

However, there is no assurance or guarantee that the investment objective of the scheme will be achieved.

However, there is no assurance or guarantee that the investment objective of the scheme will be achieved.

The investment objective of the scheme is

to replicate the composition of the NIFTY IT

Index and to generate returns that are

commensurate with the performance of

the NIFTY IT Index, subject to tracking

errors.

However, there is no assurance or guarantee that the investment objective of the scheme will be achieved.

However, there is no assurance or guarantee that the investment objective of the scheme will be achieved.

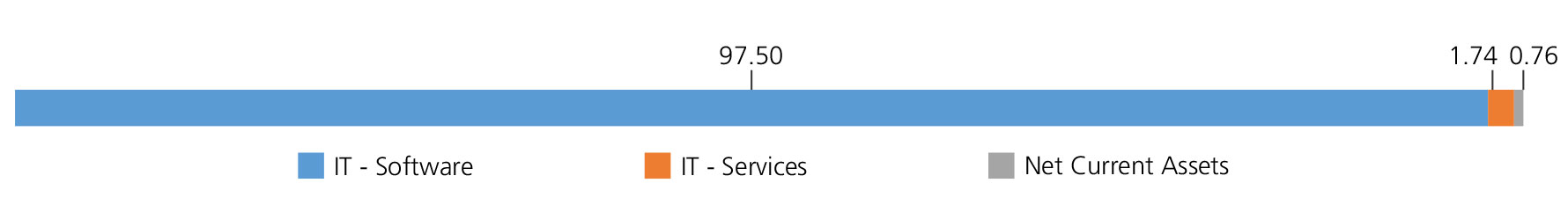

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity Related |

||

| IT - Software | 97.50 | |

| Tata Consultancy Services Ltd. | 26.21 | |

| Infosys Ltd. | 25.75 | |

| HCL Technologies Ltd. | 9.42 | |

| Wipro Ltd. | 8.97 | |

| Tech Mahindra Ltd. | 8.74 | |

| LTIMindtree Limited | 7.61 | |

| Persistent Systems Limited | 4.49 | |

| Mphasis Ltd | 3.26 | |

| Coforge Limited | 3.05 | |

| IT - Services | 1.74 | |

| L&T Technology Services Ltd | 1.74 | |

| Equity & Equity Related - Total | 99.24 | |

| Net Current Assets/(Liabilities) | 0.76 | |

| Grand Total | 100.00 | |

NAV

Rs30.789

Available Plans/Options

Regular Plan

| Fund Manager* | Mr. Devender Singhal & Mr. Satish Dondapati |

| Benchmark | NIFTY IT Index TRI |

| Allotment date | March 2, 2021 |

| AAUM | Rs146.47 crs |

| AUM | Rs149.83 crs |

| Folio count | 10,864 |

Ratios

| Portfolio Turnover | 289.82% |

| Tracking Error: | 0.20% |

Minimum Investment Amount

Through Exchange:1 Unit,

Through AMC: 100000 Units,

Ideal Investment Horizon: 5 years and

above

Load Structure

Entry Load: Nil. (applicable for all plans)

Exit Load:

Nil (applicable for all plans)

Total Expense Ratio**

Regular: 0.22%

Data as on January 31, 2023

Fund

Benchmark

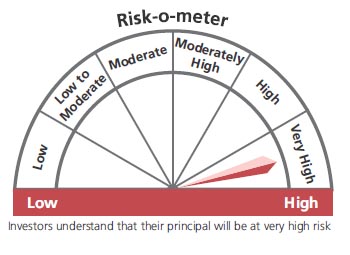

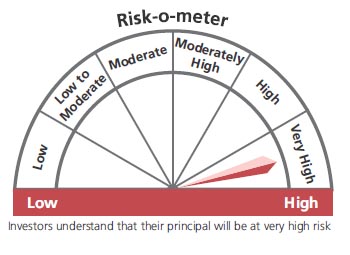

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in stocks comprising the underlying index and endeavours to track the benchmark index.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st January 2023. An addendum may be issued or updated on the website for new riskometer

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'Our Fund Managers'

For scheme performance, please refer 'Scheme Performances'