An Open Ended Scheme investing in Equity, Debt & Money Market Instruments, Commodity ETFs and Exchange Traded Commodity Derivatives.

An Open Ended Scheme investing in Equity, Debt & Money Market Instruments, Commodity ETFs and Exchange Traded Commodity Derivatives.

| Issuer/Instrument | Rating | % to Net Assets |

|

|---|---|---|---|

| Equity & Equity related | |||

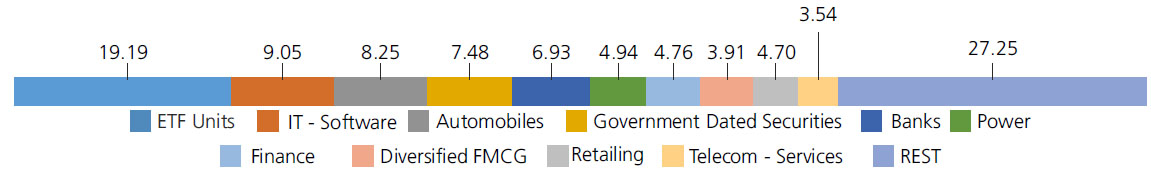

| IT - Software | 9.05 | ||

| Infosys Ltd. | 3.30 | ||

| Tech Mahindra Ltd. | 2.23 | ||

| Oracle Financial Services Software Ltd | 1.19 | ||

| Mphasis Ltd | 0.79 | ||

| Wipro Ltd. | 0.77 | ||

| PERSISTENT SYSTEMS LIMITED | 0.70 | ||

| Tata Consultancy Services Ltd. | 0.07 | ||

| Automobiles | 8.25 | ||

| Maruti Suzuki India Limited | 4.65 | ||

| Hero MotoCorp Ltd. | 2.43 | ||

| Mahindra & Mahindra Ltd. | 1.17 | ||

| Banks | 6.93 | ||

| State Bank Of India | 2.87 | ||

| Bank Of Baroda | 1.84 | ||

| HDFC Bank Ltd. | 1.53 | ||

| JAMMU AND KASHMIR BANK LTD. | 0.59 | ||

| IndusInd Bank Ltd. | 0.09 | ||

| FEDERAL BANK LTD. | 0.01 | ||

| Power | 4.95 | ||

| NTPC LTD | 2.90 | ||

| NLC India Ltd. | 1.18 | ||

| NTPC GREEN ENERGY LIMITED | 0.87 | ||

| Finance | 4.76 | ||

| Power Finance Corporation Ltd. | 1.98 | ||

| POONAWALLA FINCORP LTD. | 1.36 | ||

| Mahindra & Mahindra Financial Services Ltd. | 0.67 | ||

| Bajaj Finserv Ltd. | 0.59 | ||

| Bajaj Finance Ltd. | 0.07 | ||

| LIC Housing Finance Ltd. | 0.06 | ||

| REC LTD | 0.03 | ||

| Diversified FMCG | 4.70 | ||

| ITC Ltd. | 2.51 | ||

| Hindustan Unilever Ltd. | 2.19 | ||

| Retailing | 3.91 | ||

| SWIGGY LTD | 1.74 | ||

| ZOMATO LTD. | 1.29 | ||

| FSN E-COMMERCE VENTURES LTD. | 0.88 | ||

| Telecom - Services | 3.54 | ||

| Bharti Airtel Ltd | 1.54 | ||

| Indus Towers Ltd. | 1.03 | ||

| Vodafone Idea Ltd | 0.97 | ||

| Leisure Services | 1.72 | ||

| SAPPHIRE FOODS INDIA LTD. | 1.49 | ||

| Barbeque Nation Hospitality Ltd. | 0.14 | ||

| ITC HOTELS LIMITED | 0.09 | ||

| Industrial Manufacturing | 1.64 | ||

| JYOTI CNC AUTOMATION LTD | 1.14 | ||

| DEE DEVELOPMENT ENGINEEERS LTD | 0.50 | ||

| Auto Components | 1.53 | ||

| SAMVARDHANA MOTHERSON INTERNATIONAL LIMITED | 1.11 | ||

| Subros Ltd. | 0.42 | ||

| Entertainment | 1.36 | ||

| PVR INOX LIMITED | 0.85 | ||

| Sun TV Network Ltd. | 0.51 | ||

| Cement and Cement Products | 1.18 | ||

| Ambuja Cements Ltd. | 1.18 | ||

| Beverages | 1.16 | ||

| Radico Khaitan Ltd. | 1.16 | ||

| Gas | 1.15 | ||

| GAIL (India) Ltd. | 1.15 | ||

| Personal Products | 1.15 | ||

| Emami Ltd. | 0.81 | ||

| Dabur India Ltd. | 0.34 | ||

| Transport Services | 1.14 | ||

| Inter Globe Aviation Ltd | 1.14 | ||

| Pharmaceuticals and Biotechnology | 1.04 | ||

| ORCHID PHARMA LTD. | 0.93 | ||

| Sun Pharmaceuticals Industries Ltd. | 0.09 | ||

| Aurobindo Pharma Ltd. | 0.01 | ||

| Cipla Ltd. | 0.01 | ||

| Healthcare Services | 0.88 | ||

| Fortis Healthcare India Ltd | 0.66 | ||

| GPT HEALTHCARE LIMITED | 0.22 | ||

| Transport Infrastructure | 0.83 | ||

| Adani Port and Special Economic Zone Ltd. | 0.83 | ||

| Insurance | 0.78 | ||

| LIFE INSURANCE CORPORATION OF INDIA LTD. | 0.77 | ||

| SBI Life Insurance Company Ltd | 0.01 | ||

| Capital Markets | 0.75 | ||

| ICICI Securities Ltd | 0.75 | ||

| Chemicals and Petrochemicals | 0.64 | ||

| Tata Chemicals Ltd | 0.64 | ||

| Other Utilities | 0.61 | ||

| CONCORD ENVIRO SYSTEMS LIMITED | 0.61 | ||

| Diversified Metals | 0.58 | ||

| Vedanta Ltd. | 0.58 | ||

| Construction | 0.57 | ||

| Ashoka Buildcon Limited | 0.57 | ||

| Consumer Durables | 0.45 | ||

| Titan Company Ltd. | 0.45 | ||

| Agricultural Food and other Product | 0.30 | ||

| Marico Ltd. | 0.30 | ||

| Printing and Publication | 0.29 | ||

| Navneet Education Ltd. | 0.29 | ||

| Minerals and Mining | 0.26 | ||

| NMDC Ltd. | 0.26 | ||

| Petroleum Products | 0.21 | ||

| RELIANCE INDUSTRIES LTD. | 0.21 | ||

| Realty | 0.20 | ||

| DLF Ltd. | 0.20 | ||

| Agricultural, Commercial and Construction Vehicles | 0.19 | ||

| V.S.T Tillers Tractors Ltd | 0.19 | ||

| Industrial Products | 0.11 | ||

| QUADRANT FUTURE TEK LIMITED | 0.11 | ||

| Metals and Minerals Trading | 0.11 | ||

| Adani Enterprises Ltd. | 0.11 | ||

| Consumable Fuels | 0.09 | ||

| Coal India Ltd. | 0.09 | ||

| Non - Ferrous Metals | 0.02 | ||

| HINDUSTAN COPPER LTD. | 0.02 | ||

| Equity & Equity related - Total | 67.03 | ||

| Future | |||

| POONAWALLA FINCORP LTD. | Finance | 0.07 | |

| NTPC LTD | Power | -1.42 | |

| Vodafone Idea Ltd | Telecom - Services | -0.98 | |

| Adani Port and Special Economic Zone Ltd. | Transport Infrastructure | -0.84 | |

| Bajaj Finserv Ltd. | Finance | -0.59 | |

| Vedanta Ltd. | Diversified Metals | -0.58 | |

| Inter Globe Aviation Ltd | Transport Services | -0.53 | |

| NMDC Ltd. | Minerals and Mining | -0.26 | |

| Ambuja Cements Ltd. | Cement and Cement Products | -0.21 | |

| RELIANCE INDUSTRIES LTD. | Petroleum Products | -0.21 | |

| DLF Ltd. | Realty | -0.20 | |

| Adani Enterprises Ltd. | Metals and Minerals Trading | -0.11 | |

| Bharti Airtel Ltd | Telecom - Services | -0.11 | |

| Coal India Ltd. | Consumable Fuels | -0.09 | |

| IndusInd Bank Ltd. | Banks | -0.09 | |

| Sun Pharmaceuticals Industries Ltd. | Pharmaceuticals and Biotechnology | -0.09 | |

| HDFC Bank Ltd. | Banks | -0.08 | |

| Bajaj Finance Ltd. | Finance | -0.07 | |

| Tata Consultancy Services Ltd. | IT - Software | -0.07 | |

| LIC Housing Finance Ltd. | Finance | -0.06 | |

| Bank Of Baroda | Banks | -0.03 | |

| REC LTD | Finance | -0.03 | |

| HINDUSTAN COPPER LTD. | Non - Ferrous Metals | -0.02 | |

| Aurobindo Pharma Ltd. | Pharmaceuticals and Biotechnology | -0.01 | |

| Cipla Ltd. | Pharmaceuticals and Biotechnology | -0.01 | |

| FEDERAL BANK LTD. | Banks | -0.01 | |

| SBI Life Insurance Company Ltd | Insurance | -0.01 | |

| Mutual Fund Units | |||

| Kotak Mutual Fund - Kotak Gold ETF | Exchange Traded Funds | 10.44 | |

| Kotak Mutual Fund - Kotak Silver Etf | Exchange Traded Funds | 8.75 | |

| Kotak Liquid Direct Growth | Mutual Fund industry | 0.34 | |

| Mutual Fund Units - Total | 19.53 | ||

| Debt Instruments | |||

| Debentures and Bonds | |||

| Corporate Debt/Financial Institutions | |||

| INDIA GRID TRUST | CRISIL AAA | 0.66 | |

| BAJAJ FINANCE LTD. | CRISIL AAA | 0.33 | |

| HDFC BANK LTD. | CRISIL AAA | 0.06 | |

| Corporate Debt/Financial Institutions - Total | 1.05 | ||

| Public Sector Undertakings | |||

| REC LTD | CRISIL AAA | 0.35 | |

| SMALL INDUSTRIES DEVELOPMENT BANK OF INDIA | CRISIL AAA | 0.13 | |

| Public Sector Undertakings - Total | 0.48 | ||

| Government Dated Securities | |||

| 7.18% Central Government | SOV | 3.16 | |

| 7.06% Central Government | SOV | 1.65 | |

| 7.32% Central Government | SOV | 1.01 | |

| 7.93% Central Government | SOV | 1.00 | |

| 7.02% Central Government | SOV | 0.33 | |

| 7.53% Central Government | SOV | 0.33 | |

| Government Dated Securities - Total | 7.48 | ||

| Money Market Instruments | |||

| Commercial Paper(CP)/Certificate of Deposits(CD) | |||

| Public Sector Undertakings | |||

| BANK OF BARODA | FITCH A1+ | 1.30 | |

| Public Sector Undertakings - Total | 1.30 | ||

| Triparty Repo | 3.17 | ||

| Real Estate & Infrastructure Investment Trusts | |||

| INDUS INFRA TRUST | Transport Infrastructure | 0.05 | |

| Real Estate & Infrastructure Investment Trusts - Total | 2.63 | ||

| Net Current Assets/(Liabilities) | -2.67 | ||

| Grand Total | 100.00 | ||

| Monthly SIP of (Rs) 10000 | Since Inception | 1 Year | |

| Total amount invested (₹) | 1,70,000 | 1,20,000 | |

| Total Value as on Jan 31, 2025 (₹) | 1,82,310 | 1,21,493 | |

| Scheme Returns (%) | 9.71 | 2.31 | |

| NIFTY 500 TRI 65% + NIFTY Short Duration Debt Index 25% + Domestic Price of Gold 5% + Domestic Price of Silver 5% Returns (%) | 9.97 | 3.09 | |

| Alpha* | -0.25 | -0.78 | |

| NIFTY 500 TRI 65% + NIFTY Short Duration Debt Index 25% + Domestic Price of Gold 5% + Domestic Price of Silver 5% (₹)# | 1,82,629 | 1,21,995 | |

| Nifty 50 (TRI) (₹)^ | 1,79,613 | 1,20,014 | |

| Nifty 50 (TRI) Returns (%) | 7.58 | 0.02 |

| Regular | Direct | |

| Growth | Rs 12.4911 | Rs12.7421 |

| IDCW | Rs 12.4909 | Rs12.7415 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Devender Singhal, Mr. Abhishek Bisen, Mr. Hiten Shah & Mr. Jeetu Valechha Sonar |

| Benchmark | Nifty 500 TRI (65%) + Nifty Short Duration Debt Index (25%) + Domestic Price of Gold (5%) + Domestic Price of Silver (5%) |

| Allotment date | September 22, 2023 |

| AAUM | Rs7,651.68 crs |

| AUM | Rs7,680.06 crs |

| Folio count | 1,68,586 |

Trustee's Discretion

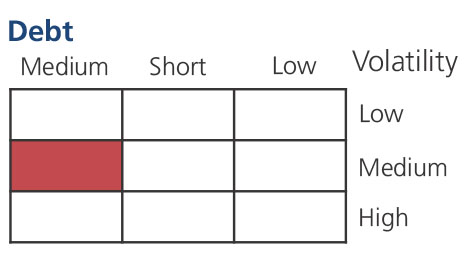

| Average Maturity | 4.68 yrs |

| Modified Duration | 2.89 yrs |

| Macaulay Duration | 2.99 yrs |

| Annualised YTM* | 6.97% |

| $Standard Deviation | 8.14% |

| $Beta | 0.95 |

| $ Sharpe## | 1.29 |

| ^^P/E$$ | 26.15 |

| ^^P/BV$$ | 3.47 |

| Portfolio Turnover | 167.53% |

$$Equity Component of the Portfolio.

Source: $ICRA MFI Explorer, ^^Bloomberg

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

• For redemption / switch out of upto 30%

of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

• If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%

• If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL

| Regular Plan: | 1.73% |

| Direct Plan: | 0.41% |

Folio Count data as on 31st December 2024.

Fund

Benchmark: Nifty 500 TRI (65%) + Nifty Short Duration Debt Index (25%) + Domestic Price of Gold (5%) + Domestic Price of Silver (5%)

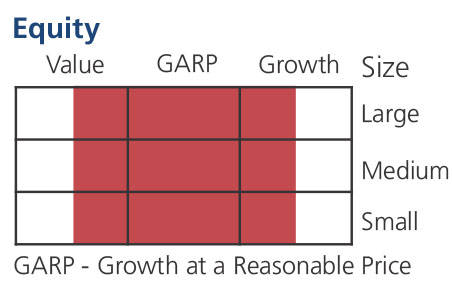

This product is suitable for investors who are seeking*:

- Long-term capital growth

- Equity & Equity related Securities, Debt & Money Market Instruments, Commodity ETFs and Exchange Traded Commodity Derivatives.

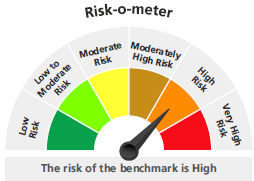

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st December, 2024. An addendum may be issued or updated on the website for new riskometer.

## Risk rate assumed to be 6.65% (FBIL Overnight MIBOR rate as on 31st Jan 2024). **Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'