Investment Objective

The investment objective of the scheme is

to replicate the composition of the NIFTY

100 Low Volatility 30 Index and to generate

returns that are commensurate with the

performance of the NIFTY 100 Low

Volatility 30 Index, subject to tracking

errors. However, there is no assurance that

the objective of the scheme will be realized.

The investment objective of the scheme is

to replicate the composition of the NIFTY

100 Low Volatility 30 Index and to generate

returns that are commensurate with the

performance of the NIFTY 100 Low

Volatility 30 Index, subject to tracking

errors. However, there is no assurance that

the objective of the scheme will be realized.

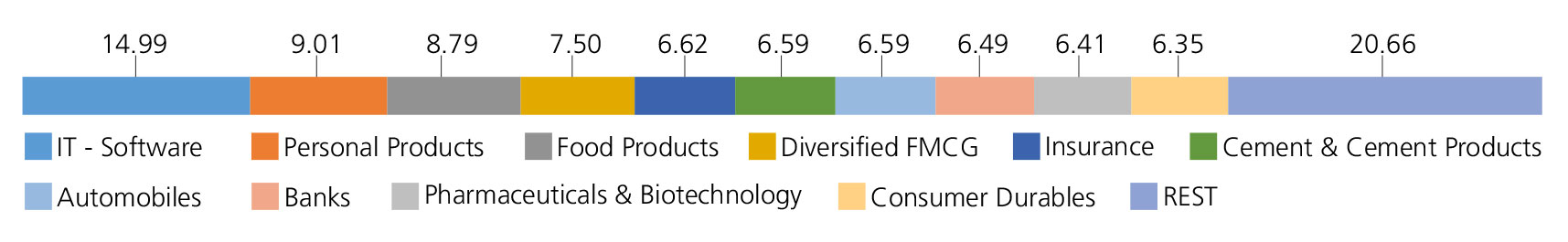

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity Related | ||

| IT - Software | 14.99 | |

| Tata Consultancy Services Ltd. | 3.53 | |

| Infosys Ltd. | 3.30 | |

| Wipro Ltd. | 2.82 | |

| HCL Technologies Ltd. | 2.79 | |

| Tech Mahindra Ltd. | 2.55 | |

| Personal Products | 9.01 | |

| Dabur India Ltd. | 3.14 | |

| Marico Ltd. | 2.97 | |

| Colgate Palmolive (India ) Ltd. | 2.90 | |

| Food Products | 8.79 | |

| Nestle India Ltd. | 4.58 | |

| Britannia Industries Ltd. | 4.21 | |

| Diversified FMCG | 7.50 | |

| Hindustan Unilever Ltd. | 4.00 | |

| ITC Ltd. | 3.50 | |

| Insurance | 6.62 | |

| SBI Life Insurance Company Ltd | 3.71 | |

| HDFC Life Insurance Company Ltd. | 2.91 | |

| Automobiles | 6.59 | |

| Bajaj Auto Ltd. | 3.52 | |

| Hero MotoCorp Ltd. | 3.07 | |

| Cement & Cement Products | 6.59 | |

| Ultratech Cement Ltd. | 3.59 | |

| ACC Ltd. | 3.00 | |

| Banks | 6.49 | |

| HDFC Bank Ltd. | 3.35 | |

| Kotak Mahindra Bank Ltd. | 3.14 | |

| Pharmaceuticals & Biotechnology | 6.41 | |

| Cipla Ltd. | 3.43 | |

| Dr Reddys Laboratories Ltd. | 2.98 | |

| Consumer Durables | 6.35 | |

| Asian Paints Ltd. | 3.47 | |

| Berger Paints (I) Ltd. | 2.88 | |

| Power | 6.00 | |

| National Thermal Power Corporation Limited | 3.10 | |

| Power Grid Corporation Of India Ltd. | 2.90 | |

| Petroleum Products | 5.96 | |

| Reliance Industries Ltd. | 3.02 | |

| Indian Oil Corporation Ltd | 2.94 | |

| Construction | 3.70 | |

| Larsen And Toubro Ltd. | 3.70 | |

| Chemicals & Petrochemicals | 3.64 | |

| Pidilite Industries Ltd. | 3.64 | |

| Equity & Equity Related - Total | 98.64 | |

| Net Current Assets/(Liabilities) | 1.36 | |

| Grand Total | 100.00 | |

NAV

| Reg-Plan-IDCW | Rs13.0589 |

Available Plans/Options

A) Regular Plan

| Fund Manager | Mr. Devender Singhal Mr. Satish Dondapati* |

| Benchmark | NIFTY 100 Low

Volatility 30 Index (Total Return Index) |

| Allotment date | March 23, 2022 |

| AAUM | Rs1.31 crs |

| AUM | Rs1.06 crs |

| Folio count | 1,393 |

IDCW Frequency

Trustee's Discretion

Ratios

| Portfolio Turnover : | 636.62% |

Minimum Investment Amount

Through Exchange:1 Unit,

Through AMC: 2,00,000 Units

Ideal Investment Horizon: 5 years and above

Load Structure

Entry Load: Nil. (applicable for all plans)

Exit Load:

Nil. (applicable for all plans)

Total Expense Ratio**

Regular: 0.30%

Data as on July 31, 2022

Fund

Benchmark

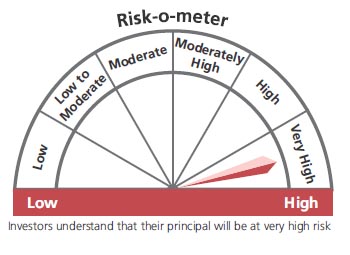

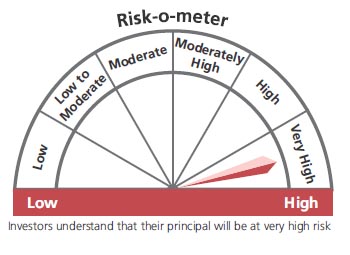

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in stocks Comprising the underlying index and endeavours to track the benchmark index

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

* For Fund Manager experience, please refer 'Our Fund Managers'

Total Expense Ratio includes applicable B30 fee and GST

Scheme has not completed 6 months since inception