Investment Objective

The investment objective of the scheme is

to replicate the composition of the NIFTY

Alpha 50 Index and to generate returns that

are commensurate with the performance of

the NIFTY Alpha 50 Index, subject to

tracking errors. However, there is no

assurance or guarantee that the investment

objective of the scheme will be achieved.

The investment objective of the scheme is

to replicate the composition of the NIFTY

Alpha 50 Index and to generate returns that

are commensurate with the performance of

the NIFTY Alpha 50 Index, subject to

tracking errors. However, there is no

assurance or guarantee that the investment

objective of the scheme will be achieved.

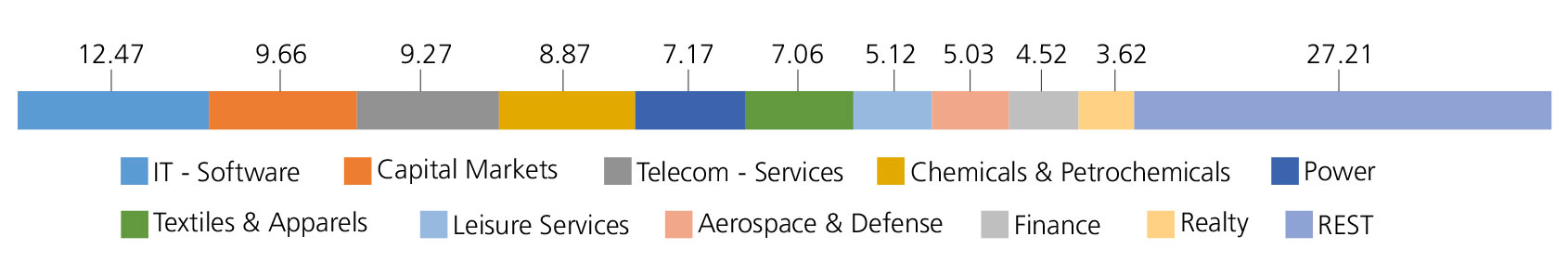

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity Related | ||

| IT - Software | 12.47 | |

| Tata Elxsi Ltd. | 3.92 | |

| KPIT Technologies Ltd. | 3.60 | |

| Persistent Systems Limited | 1.59 | |

| Mphasis Ltd | 1.01 | |

| Tanla Solutions Limited | 0.96 | |

| MindTree Ltd. | 0.87 | |

| Birlasoft Ltd. | 0.35 | |

| Coforge Limited | 0.17 | |

| Capital Markets | 9.66 | |

| BSE Ltd. | 4.07 | |

| Angel One Limited | 2.99 | |

| Indian Energy Exchange Ltd | 1.78 | |

| Central Depository Services (India) Ltd. | 0.82 | |

| Telecom - Services | 9.27 | |

| Tata Teleservices Ltd | 7.91 | |

| Himachal Futuristic Comm Ltd | 1.36 | |

| Chemicals & Petrochemicals | 8.87 | |

| Linde India Ltd. | 3.16 | |

| Gujarat Narmada Valley Fertilisers Co Ltd. | 2.77 | |

| SRF Ltd. | 2.77 | |

| Deepak Nitrite Ltd. | 0.17 | |

| Power | 7.17 | |

| Tata Power Co. Ltd. | 3.55 | |

| Adani Transmission Ltd | 1.82 | |

| Adani Green Energy Ltd. | 1.80 | |

| Textiles & Apparels | 7.06 | |

| Trident Ltd | 5.02 | |

| Page Industries Ltd | 1.86 | |

| Vardhman Textiles Ltd. | 0.18 | |

| Leisure Services | 5.12 | |

| The Indian Hotels Company Ltd. | 2.60 | |

| Indian Railway Catering And Tourism Corporation Ltd. | 2.52 | |

| Aerospace & Defense | 5.03 | |

| Hindustan Aeronautics Ltd. | 2.77 | |

| Bharat Electronics Ltd. | 2.26 | |

| Finance | 4.52 | |

| Poonawalla Fincorp Ltd. | 2.95 | |

| Bajaj Holdings and Investment Ltd. | 1.57 | |

| Realty | 3.62 | |

| Prestige Estates Projects Limited | 1.85 | |

| Macrotech Developers Ltd | 1.77 | |

| Electrical Equipment | 3.31 | |

| ABB India Ltd | 1.84 | |

| Suzlon Energy Ltd. | 1.47 | |

| Beverages | 3.25 | |

| Varun Beverages Ltd | 2.11 | |

| Radico Khaitan Ltd. | 1.14 | |

| Gas | 3.25 | |

| Adani Total Gas Ltd. | 3.25 | |

| Industrial Products | 3.13 | |

| APL Apollo Tubes Ltd. | 1.60 | |

| Polycab India Ltd. | 1.53 | |

| Healthcare Services | 3.09 | |

| Max Healthcare Institute Ltd. | 2.23 | |

| Apollo Hospitals Enterprises Ltd. | 0.86 | |

| Metals & Minerals Trading | 2.29 | |

| Adani Enterprises Ltd. | 2.29 | |

| Oil | 2.08 | |

| Oil India Limited | 2.08 | |

| Auto Components | 1.81 | |

| Minda Industries Ltd. | 1.81 | |

| Consumer Durables | 1.40 | |

| Titan Company Ltd. | 1.40 | |

| Non - Ferrous Metals | 0.97 | |

| National Aluminium Company Ltd | 0.97 | |

| IT - Services | 0.96 | |

| L&T Technology Services Ltd | 0.96 | |

| Fertilizers & Agrochemicals | 0.89 | |

| Chambal Fertilisers & Chemicals Ltd. | 0.89 | |

| Diversified Metals | 0.45 | |

| Vedanta Ltd. | 0.45 | |

| Pharmaceuticals & Biotechnology | 0.12 | |

| Laurus Labs Ltd. | 0.12 | |

| Equity & Equity Related - Total | 99.79 | |

| Triparty Repo | 0.13 | |

| Net Current Assets/(Liabilities) | 0.08 | |

| Grand Total | 100.00 | |

NAV

| Reg-Plan-IDCW | Rs27.6357 |

Available Plans/Options

A) Regular Plan

| Fund Manager | Mr. Devender Singhal Mr. Satish Dondapati Mr. Abhishek Bisen* |

| Benchmark | NIFTY Alpha 50 Index (Total Return Index) |

| Allotment date | December 22, 2021 |

| AAUM | Rs69.77 crs |

| AUM | Rs76.07 crs |

| Folio count | 9,594 |

Ratios

| Portfolio Turnover : | 121.50% |

Minimum Investment Amount

Through Exchange:1 Unit,

Through AMC: 100000 Units,

Ideal Investment Horizon: 5 years and above

Load Structure

Entry Load: Nil. (applicable for all plans)

Exit Load:

Nil. (applicable for all plans)

Total Expense Ratio**

Regular: 0.40%

Data as on July 31, 2022

Fund

Benchmark

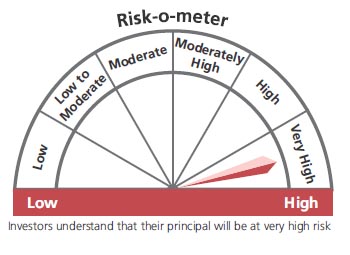

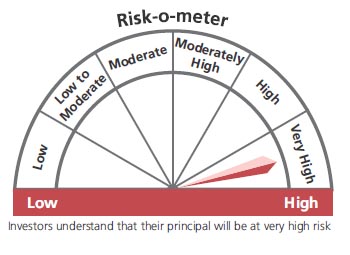

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in stocks Comprising the underlying index and endeavours to track the benchmark index

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

* For Fund Manager experience, please refer 'Our Fund Managers'

Total Expense Ratio includes applicable B30 fee and GST

Scheme has not completed 6 months since inception