(ERSTWHILE KNOWN AS KOTAK EQUITY OPPORTUNITIES FUND)

Large & Mid Cap Fund- An open ended equity scheme investing in both large cap and mid cap stocks

(ERSTWHILE KNOWN AS KOTAK EQUITY OPPORTUNITIES FUND)

Large & Mid Cap Fund- An open ended equity scheme investing in both large cap and mid cap stocks

| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

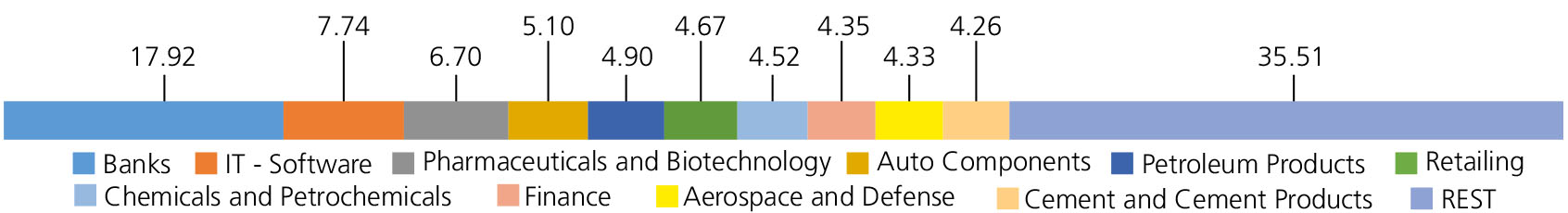

| Banks | 17.92 | |

| HDFC Bank Ltd. | 6.47 | |

| ICICI Bank Ltd. | 3.69 | |

| STATE BANK OF INDIA | 3.12 | |

| Axis Bank Ltd. | 2.36 | |

| INDIAN BANK | 1.33 | |

| Kotak Mahindra Bank Ltd. | 0.95 | |

| IT - Software | 7.74 | |

| Infosys Ltd. | 3.12 | |

| Mphasis Ltd | 2.19 | |

| Tech Mahindra Ltd. | 1.67 | |

| HCL Technologies Ltd. | 0.76 | |

| Pharmaceuticals and Biotechnology | 6.70 | |

| Sun Pharmaceuticals Industries Ltd. | 1.94 | |

| Biocon Ltd. | 1.81 | |

| Ipca Laboratories Ltd. | 1.32 | |

| GlaxoSmithKline Pharmaceuticals Ltd. | 1.24 | |

| Ajanta Pharma Ltd. | 0.39 | |

| Auto Components | 5.10 | |

| Bharat Forge Ltd. | 1.58 | |

| Apollo Tyres Ltd. | 1.31 | |

| Schaeffler India Ltd | 1.03 | |

| Exide Industries Ltd | 0.60 | |

| Bosch Ltd. | 0.58 | |

| Petroleum Products | 4.90 | |

| HINDUSTAN PETROLEUM CORPORATION LTD | 2.01 | |

| RELIANCE INDUSTRIES LTD. | 1.78 | |

| Bharat Petroleum Corporation Ltd. | 1.11 | |

| Retailing | 4.67 | |

| ETERNAL LIMITED | 3.81 | |

| SWIGGY LTD | 0.86 | |

| Chemicals and Petrochemicals | 4.52 | |

| Linde India Ltd. | 1.91 | |

| SRF Ltd. | 1.89 | |

| Tata Chemicals Ltd | 0.72 | |

| Finance | 4.35 | |

| BAJAJ FINANCE LTD. | 2.12 | |

| SHRIRAM FINANCE LTD. | 1.12 | |

| CRISIL Ltd. | 1.11 | |

| Aerospace and Defense | 4.33 | |

| Bharat Electronics Ltd. | 3.82 | |

| ASTRA MICROWAVE PRODUCTS LTD. | 0.51 | |

| Cement and Cement Products | 4.26 | |

| JK Cement Ltd. | 2.02 | |

| Ultratech Cement Ltd. | 1.44 | |

| Dalmia Bharat Limited | 0.80 | |

| Gas | 3.61 | |

| GAIL (India) Ltd. | 1.52 | |

| Petronet LNG Ltd. | 0.82 | |

| Gujarat State Petronet Ltd. | 0.76 | |

| Indraprastha Gas Ltd. | 0.51 | |

| Fertilizers and Agrochemicals | 3.11 | |

| Coromandel International Ltd. | 3.11 | |

| Construction | 3.05 | |

| Larsen And Toubro Ltd. | 2.40 | |

| KALPATARU PROJECTS INTERNATIONAL LIMITED | 0.65 | |

| Telecom - Services | 2.57 | |

| Bharti Airtel Ltd | 2.49 | |

| Bharti Airtel Ltd - Partly Paid Shares | 0.08 | |

| Power | 2.31 | |

| Power Grid Corporation Of India Ltd. | 1.24 | |

| TORRENT POWER LTD | 1.07 | |

| Agricultural, Commercial and Construction Vehicles | 2.23 | |

| Ashok Leyland Ltd. | 1.81 | |

| BEML Ltd. | 0.42 | |

| Consumer Durables | 2.19 | |

| BLUE STAR LTD. | 1.24 | |

| Voltas Ltd. | 0.95 | |

| Automobiles | 2.15 | |

| Hero MotoCorp Ltd. | 1.48 | |

| Maruti Suzuki India Limited | 0.67 | |

| Electrical Equipment | 2.11 | |

| ABB India Ltd | 1.13 | |

| Thermax Ltd. | 0.98 | |

| Ferrous Metals | 1.79 | |

| Jindal Steel & Power Ltd. | 1.79 | |

| Capital Markets | 1.74 | |

| MOTILAL OSWAL FINANCIAL SERVICES LTD | 1.49 | |

| NUVAMA WEALTH MANAGEMENT LIMITED | 0.25 | |

| Industrial Products | 1.65 | |

| Cummins India Ltd. | 1.14 | |

| AIA Engineering Limited. | 0.51 | |

| Healthcare Services | 1.01 | |

| Fortis Healthcare India Ltd | 1.01 | |

| Realty | 0.93 | |

| Oberoi Realty Ltd | 0.93 | |

| Beverages | 0.81 | |

| UNITED SPIRITS LTD. | 0.81 | |

| Diversified FMCG | 0.81 | |

| Hindustan Unilever Ltd. | 0.81 | |

| Transport Services | 0.63 | |

| Inter Globe Aviation Ltd | 0.63 | |

| Industrial Manufacturing | 0.51 | |

| Honeywell Automation India Ltd. | 0.51 | |

| Entertainment | 0.48 | |

| Sun TV Network Ltd. | 0.48 | |

| Equity & Equity related - Total | 98.18 | |

| Mutual Fund Units | ||

| Kotak Liquid Direct Growth | 0.30 | |

| Mutual Fund Units - Total | 0.30 | |

| Triparty Repo | 1.37 | |

| Net Current Assets/(Liabilities) | 0.15 | |

| Grand Total | 100.00 | |

| | ||

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 25,10,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on July 31, 2025 (₹) | 1,70,34,498 | 29,53,590 | 16,70,792 | 9,62,737 | 4,70,128 | 1,24,509 |

| Scheme Returns (%) | 15.86 | 17.16 | 19.30 | 19.00 | 18.15 | 7.08 |

| Nifty Large Midcap 250 (TRI) Returns (%) | NA | 17.58 | 19.72 | 19.11 | 17.87 | 6.15 |

| Alpha* | NA | -0.42 | -0.41 | -0.11 | 0.27 | 0.93 |

| Nifty Large Midcap 250 (TRI) (₹)# | NA | 30,21,963 | 16,95,440 | 9,65,363 | 4,68,337 | 1,23,921 |

| Nifty 200 Index (TRI) Returns (%) | 13.66 | 15.22 | 16.50 | 15.84 | 14.87 | 4.73 |

| Alpha* | 2.21 | 1.94 | 2.81 | 3.15 | 3.27 | 2.35 |

| Nifty 200 Index (TRI) (₹)# | 1,27,79,669 | 26,61,590 | 15,11,937 | 8,91,300 | 4,48,802 | 1,23,023 |

| Nifty 50 (TRI) (₹)^ | 1,20,30,702 | 25,49,389 | 14,39,504 | 8,55,947 | 4,37,497 | 1,23,612 |

| Nifty 50 (TRI) Returns (%) | 13.19 | 14.42 | 15.12 | 14.20 | 13.10 | 5.66 |

| Regular | Direct | |

| Growth | Rs339.9021 | Rs390.3319 |

| IDCW | Rs59.3001 | Rs68.8774 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Harsha Upadhyaya |

| Benchmark*** | NIFTY Large Midcap 250 TRI (Tier 1), Nifty 200 Index TRI (Tier 2) |

| Allotment date | September 9, 2004 |

| AAUM | Rs28,238.96 crs |

| AUM | Rs28,084.13 crs |

| Folio count | 7,12,615 |

Trustee's Discretion

| Portfolio Turnover | 14.57% |

| $Beta | 0.89 |

| $Sharpe ## | 1.06 |

| $Standard Deviation | 12.90% |

| (P/E) | 26.15 |

| P/BV | 3.60 |

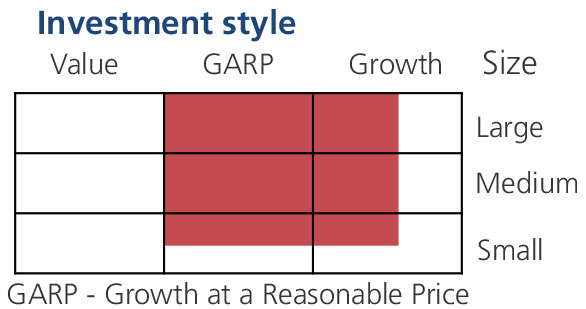

| Large Cap | 52.85% |

| Mid Cap | 39.72% |

| Small Cap | 5.61% |

| Debt & Money Market | 1.82% |

*% of Net Asset

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

• For redemption / switch out of upto 10%

of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

• If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%

• If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL.

| Regular Plan: | 1.57% |

| Direct Plan: | 0.53% |

Folio Count data as on 30th June 2025.

Benchmark- Tier 1: NIFTY Large Midcap 250 TRI

Benchmark- Tier 2: Nifty 200 Index TRI

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in portfolio of predominantly equity & equity related securities of large & midcap companies.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

***As per para 1.9 of of SEBI Master circular No. SEBI/HO/IMD/IMD-PoD-1/P/CIR/2024/90 dated June 27, 2024 The first tier benchmark is reflective of the category of the scheme and the second tier benchmark is demonstrative of the investment style / strategy of the Fund Manager within the category.

## Risk rate assumed to be 5.54% (FBIL Overnight MIBOR rate as on 31st July 2025).**Total Expense Ratio Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'