The investment objective of the scheme is to generate capital appreciation and income by predominantly investing in arbitrage opportunities in the cash and derivatives segment of the equity market, and enhance returns with a moderate exposure in equity & equity related instruments. However, there is no assurance that the objective of the scheme will be achieved.

The investment objective of the scheme is to generate capital appreciation and income by predominantly investing in arbitrage opportunities in the cash and derivatives segment of the equity market, and enhance returns with a moderate exposure in equity & equity related instruments. However, there is no assurance that the objective of the scheme will be achieved.

| Issuer/ Instrument |

Industry/ Rating |

% to Net Assets |

% to Net Assets Derivatives |

|---|---|---|---|

| Equity & Equity related

|

|||

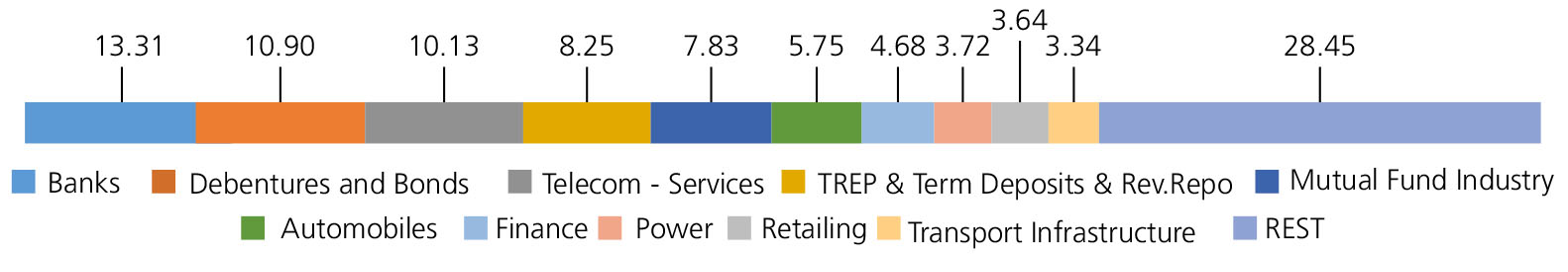

| STATE BANK OF INDIA | Banks | 3.90 | |

| Bharti Airtel Ltd | Telecom - Services | 3.88 | -3.88 |

| CNX NIFTY-AUG2025 | -3.53 | ||

| STATE BANK OF INDIA | Banks | 2.80 | -2.80 |

| Maruti Suzuki India Limited | Automobiles | 2.63 | |

| Hero MotoCorp Ltd. | Automobiles | 2.52 | |

| Adani Port and Special Economic Zone Ltd. | Transport Infrastructure | 2.45 | -2.47 |

| RELIANCE INDUSTRIES LTD. | Petroleum Products | 2.06 | |

| Indus Towers Ltd. | Telecom - Services | 2.06 | -2.06 |

| Radico Khaitan Ltd. | Beverages | 1.94 | |

| Others | 41.80 | -15.28 | |

| Equity & Equity related - Total | 66.04 | -30.02 | |

| Mutual Fund Units | 7.83 | ||

| Debt Instruments | |||

| Debentures and Bonds | 10.90 | ||

| Money Market Instruments | 2.67 | ||

| Commercial Paper(CP)/Certificate of Deposits(CD) | 0.64 | ||

| Triparty Repo | 8.25 | ||

| Real Estate & Infrastructure Investment Trusts | 0.88 | ||

| Net Current Assets/(Liabilities) | 2.79 | ||

| Grand Total | 100.00 | ||

For detailed portfolio log on to

https://www.kotakmf.com/mutual-funds/hybrid-funds/kotak-equity-savings-fund/dir-g

Mutual Fund Units as provided above is towards margin for derivatives transactions Equity Derivative Exposuer is 30.02%

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 13,00,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on July 31, 2025 (₹) | 22,51,193 | 20,03,235 | 12,22,803 | 7,83,261 | 4,20,628 | 1,23,336 |

| Scheme Returns (%) | 9.74 | 9.89 | 10.55 | 10.61 | 10.39 | 5.23 |

| Nifty Equity Savings TRI (%) | 9.43 | 9.56 | 9.82 | 9.62 | 9.89 | 7.44 |

| Alpha* | 0.31 | 0.34 | 0.73 | 0.99 | 0.50 | -2.21 |

| Nifty Equity Savings TRI (₹)# | 22,10,731 | 19,67,590 | 11,91,321 | 7,64,230 | 4,17,579 | 1,24,731 |

| CRISIL 10 Year Gilt Index (₹)^ | 18,88,169 | 16,87,555 | 10,71,411 | 7,20,636 | 4,13,657 | 1,25,864 |

| CRISIL 10 Year Gilt Index (%) | 6.68 | 6.63 | 6.85 | 7.27 | 9.24 | 9.24 |

| Regular | Direct | |

| Growth | Rs25.9633 | Rs28.5295 |

| Monthly IDCW | Rs19.0094 | Rs20.4814 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Devender Singhal, Mr. Abhishek Bisen & Mr. Hiten Shah |

| Benchmark*** | Nifty Equity Savings TRI |

| Allotment date | October 13, 2014 |

| AAUM | Rs8,428.95 crs |

| AUM | Rs8,452.12 crs |

| Folio count | 51,173 |

Monthly (12th of every month)

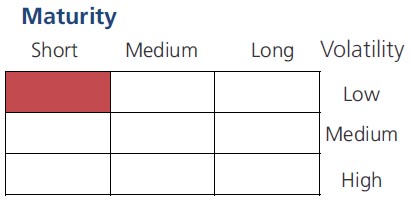

| Average Maturity | 2.40 yrs |

| Modified Duration | 1.75 yrs |

| Macaulay Duration | 1.83 yrs |

| Annualised YTM* | 6.17% |

| $Standard Deviation | 5.10% |

| $Beta | 0.51 |

| $ Sharpe## | 1.09 |

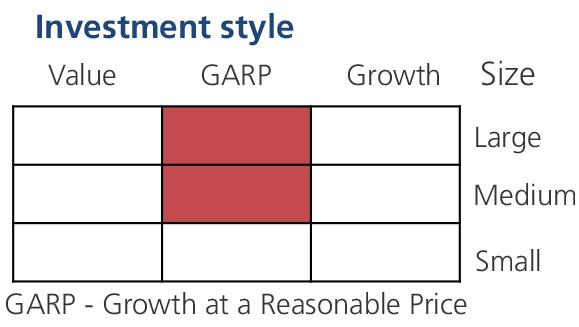

| ^^P/E$$ | 19.65 |

| ^^P/BV$$ | 2.93 |

| Portfolio Turnover | 402.82% |

$$Equity Component of the Portfolio.

| Large Cap | 21.23% |

| Mid Cap | 11.23% |

| Small Cap | 3.50% |

| Debt & Money Market | 64.04% |

*% of Net Asset

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 3 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

• For redemption / switch out of upto 8% of

the initial investment amount (limit)

purchased or switched in within 90 days

from the date of allotment: Nil.

• If units redeemed or switched out are in

excess of the limit within 90 days from the

date of allotment: 1%

• If units are redeemed or switched out after

90 days from the date of allotment: NIL

| Regular Plan: | 1.76% |

| Direct Plan: | 0.66% |

Folio Count data as on 30th June 2025.

Fund

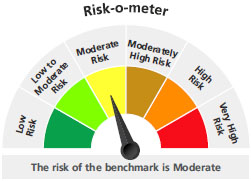

Benchmark - Tier 1: NIFTY Equity Savings TRI

This product is suitable for investors who are seeking*:

- Income from arbitrage opportunities in the equity market & long term capital growth

- Investment predominantly in arbitrage opportunities in the cash & derivatives segment of the equity market and equity & equity related securities

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

## Risk rate assumed to be 5.54% (FBIL Overnight MIBOR rate as on 31st July 2025).**Total Expense Ratio includes applicable GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'