| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

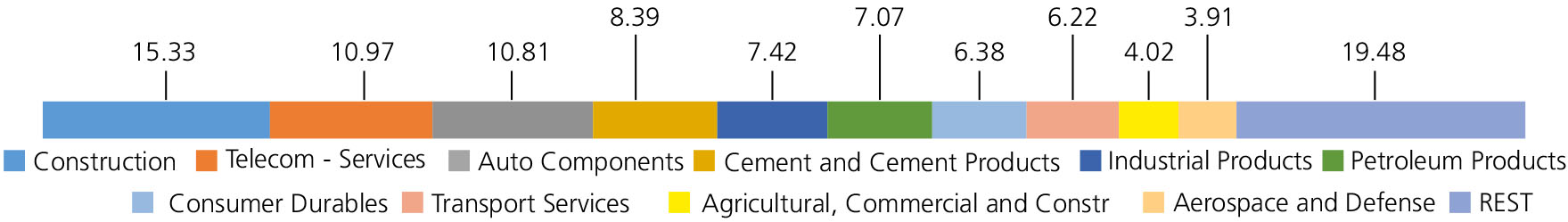

| Construction | 15.33 | |

| Larsen And Toubro Ltd. | 4.72 | |

| KALPATARU PROJECTS INTERNATIONAL LIMITED | 3.08 | |

| Ashoka Buildcon Limited | 2.11 | |

| G R Infraprojects Limited | 1.84 | |

| Engineers India Ltd. | 1.61 | |

| H G Infra Engineering Ltd. | 0.86 | |

| PNC Infratech Ltd | 0.71 | |

| CEIGALL INDIA LIMITED | 0.40 | |

| Telecom - Services | 10.97 | |

| Bharti Airtel Ltd | 7.43 | |

| BHARTI HEXACOM LTD. | 2.17 | |

| Indus Towers Ltd. | 1.37 | |

| Auto Components | 10.81 | |

| Bosch Ltd. | 2.96 | |

| Apollo Tyres Ltd. | 1.53 | |

| Schaeffler India Ltd | 1.47 | |

| SAMVARDHANA MOTHERSON INTERNATIONAL LIMITED | 1.43 | |

| Sansera Engineering Ltd. | 1.08 | |

| Exide Industries Ltd | 0.95 | |

| Bharat Forge Ltd. | 0.88 | |

| Rolex Rings Ltd. | 0.51 | |

| Cement and Cement Products | 8.39 | |

| Shree Cement Ltd. | 4.52 | |

| Ultratech Cement Ltd. | 3.08 | |

| M&B ENGINEERING LTD | 0.79 | |

| Industrial Products | 7.42 | |

| Cummins India Ltd. | 2.38 | |

| Ratnamani Metals & Tubes Ltd. | 1.66 | |

| AIA Engineering Limited. | 1.50 | |

| Carborundum Universal Ltd. | 1.05 | |

| WPIL LTD | 0.83 | |

| Petroleum Products | 7.07 | |

| RELIANCE INDUSTRIES LTD. | 5.24 | |

| Indian Oil Corporation Ltd | 1.83 | |

| Consumer Durables | 6.38 | |

| Kajaria Ceramics Ltd. | 2.51 | |

| GREENPANEL INDUSTRIES LTD | 2.43 | |

| V-Guard Industries Ltd. | 1.44 | |

| Transport Services | 6.22 | |

| Inter Globe Aviation Ltd | 2.45 | |

| MAHINDRA LOGISTICS LTD | 2.03 | |

| Container Corporation of India Ltd. | 1.63 | |

| MAHINDRA LOGISTICS LTD RIGHTS | 0.11 | |

| Agricultural, Commercial and Construction Vehicles | 4.02 | |

| V.S.T Tillers Tractors Ltd | 2.50 | |

| Ashok Leyland Ltd. | 1.52 | |

| Aerospace and Defense | 3.91 | |

| Bharat Electronics Ltd. | 1.60 | |

| ASTRA MICROWAVE PRODUCTS LTD. | 1.21 | |

| ZEN TECHNOLOGIES LTD | 1.10 | |

| Chemicals and Petrochemicals | 3.22 | |

| SOLAR INDUSTRIES INDIA LIMITED | 3.22 | |

| Industrial Manufacturing | 3.10 | |

| JYOTI CNC AUTOMATION LTD | 1.57 | |

| Tega Industries Ltd. | 1.18 | |

| JNK INDIA LIMITED | 0.35 | |

| Power | 2.65 | |

| NTPC GREEN ENERGY LIMITED | 2.02 | |

| NTPC LTD | 0.63 | |

| Electrical Equipment | 2.28 | |

| ABB India Ltd | 1.17 | |

| AZAD ENGINEERING LTD | 1.11 | |

| Realty | 2.05 | |

| Mahindra Lifespace Developers Ltd | 1.33 | |

| BRIGADE ENTERPRISES LIMITED | 0.72 | |

| Finance | 1.72 | |

| Power Finance Corporation Ltd. | 1.72 | |

| Gas | 1.31 | |

| Gujarat State Petronet Ltd. | 1.31 | |

| Consumable Fuels | 1.28 | |

| Coal India Ltd. | 1.28 | |

| Other Utilities | 0.92 | |

| CONCORD ENVIRO SYSTEMS LIMITED | 0.92 | |

| Equity & Equity related - Total | 99.05 | |

| Triparty Repo | 0.86 | |

| Net Current Assets/(Liabilities) | 0.09 | |

| Grand Total | 100.00 | |

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 21,00,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on July 31, 2025 (₹) | 1,02,52,216 | 32,41,511 | 19,33,748 | 10,91,286 | 4,74,601 | 1,21,243 |

| Scheme Returns (%) | 16.13 | 18.88 | 23.42 | 24.18 | 18.82 | 1.94 |

| Nifty Infrastructure (TRI) Returns (%) | 11.65 | 17.59 | 21.42 | 21.85 | 20.89 | 7.03 |

| Alpha* | 4.48 | 1.29 | 2.00 | 2.33 | -2.07 | -5.09 |

| Nifty Infrastructure (TRI) (₹)# | 64,34,174 | 30,23,883 | 18,01,057 | 10,31,738 | 4,88,538 | 1,24,475 |

| Nifty 50 (TRI) (₹)^ | 75,79,715 | 25,49,152 | 14,38,952 | 8,55,982 | 4,37,497 | 1,23,612 |

| Nifty 50 (TRI) Returns (%) | 13.24 | 14.42 | 15.11 | 14.19 | 13.10 | 5.66 |

| Regular | Direct | |

| Growth | Rs64.9760 | Rs76.7104 |

| IDCW | Rs51.9659 | Rs75.8330 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Nalin Rasik Bhatt |

| Benchmark | Nifty Infrastructure TRI (Tier 1) |

| Allotment date | February 25, 2008 |

| AAUM | Rs2,443.78 crs |

| AUM | Rs2,387.70 crs |

| Folio count | 1,49,852 |

Trustee's Discretion

| Portfolio Turnover | 19.67% |

| $Beta | 0.90 |

| $Sharpe ## | 1.00 |

| $Standard Deviation | 18.23% |

| ^^(P/E) | 27.24 |

| ^^P/BV | 3.97 |

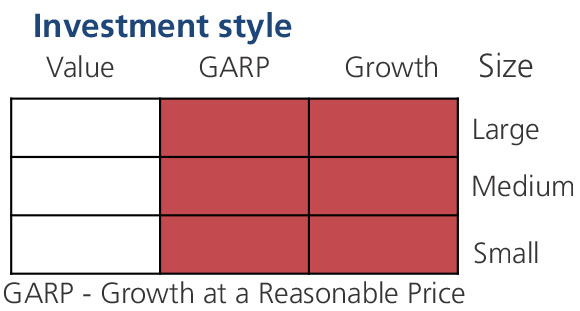

| Large Cap | 41.69% |

| Mid Cap | 17.48% |

| Small Cap | 39.88% |

| Debt & Money Market | 0.95% |

*% of Net Asset

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load:

Nil. (applicable for all plans)

Exit Load:

• For redemption / switch out within 90

days from the date of allotment: 0.5%

• If units are redeemed or switched out on

or after 90 days from the date of allotment -

Nil.

| Regular Plan: | 2.00% |

| Direct Plan: | 0.66% |

Folio Count data as on 30th June 2025.

Benchmark - Tier 1 : Nifty Infrastructure TRI

This product is suitable for investors who are seeking*:

- Long term capital growth

- Long term capital appreciation by investing in equity and equity related instruments of companies contributing to infrastructure and economic development of India.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

## Risk rate assumed to be 5.54% (FBIL Overnight MIBOR rate as on 31st July 2025).**Total Expense Ratio includes applicable GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'