An open-ended Constant Maturity Index Fund tracking the CRISIL-IBX Financial Services 3-6 Months Debt Index. A relatively low interest rate risk and relatively low credit risk.

An open-ended Constant Maturity Index Fund tracking the CRISIL-IBX Financial Services 3-6 Months Debt Index. A relatively low interest rate risk and relatively low credit risk.

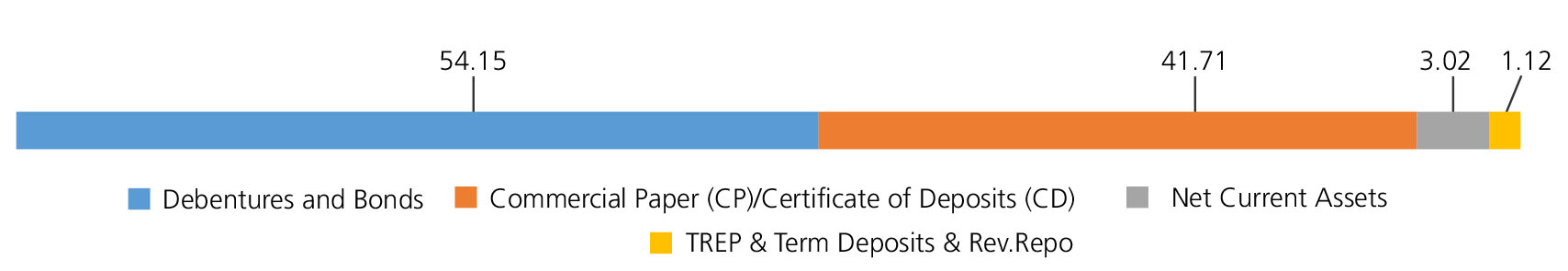

| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Debt Instruments | ||

| Debentures and Bonds | ||

| Public Sector Undertakings | ||

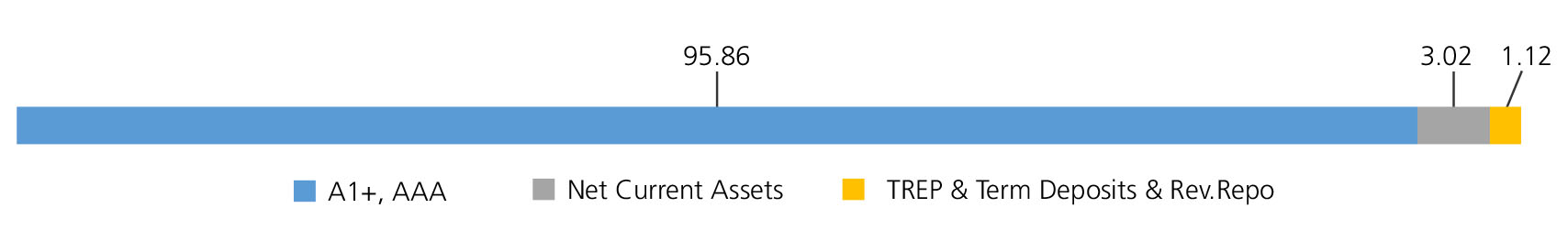

| REC LTD | ICRA AAA | 10.42 |

| SMALL INDUSTRIES DEVELOPMENT BANK OF INDIA | ICRA AAA | 10.41 |

| Public Sector Undertakings - Total | 20.83 | |

| Corporate Debt/Financial Institutions | ||

| BAJAJ FINANCE LTD. | CRISIL AAA | 11.45 |

| LIC HOUSING FINANCE LTD. | CRISIL AAA | 10.42 |

| TATA CAPITAL LTD. | CRISIL AAA | 10.41 |

| Kotak Mahindra Prime Ltd. | CRISIL AAA | 1.04 |

| Corporate Debt/Financial Institutions - Total | 33.32 | |

| Money Market Instruments | ||

| Commercial Paper(CP)/Certificate of Deposits(CD) | ||

| Public Sector Undertakings | ||

| CANARA BANK | CRISIL A1+ | 11.20 |

| UNION BANK OF INDIA | FITCH A1+ | 10.17 |

| PUNJAB NATIONAL BANK | CARE A1+ | 5.08 |

| INDIAN BANK | CRISIL A1+ | 2.03 |

| Public Sector Undertakings - Total | 28.48 | |

| Corporate Debt/Financial Institutions | ||

| HDFC BANK LTD. | CARE A1+ | 11.18 |

| AXIS BANK LTD. | CRISIL A1+ | 1.03 |

| ICICI BANK LTD. | ICRA A1+ | 1.02 |

| Corporate Debt/Financial Institutions - Total | 13.23 | |

| Triparty Repo | 1.12 | |

| Net Current Assets/(Liabilities) | 3.02 | |

| Grand Total | 100.00 | |

| Regular | Direct | |

| Growth | Rs10.3081 | Rs10.3176 |

| IDCW | Rs10.3080 | Rs10.3180 |

A) Regular Plan B) Direct Plan

Options: Growth and Income Distribution

cum Capital Withdrawal (IDCW) (Payout

and Reinvestment)

| Fund Manager* | Mr. Manu Sharma |

| Benchmark | CRISIL-IBX Financial Services 3-6 Months Debt Index |

| Allotment date | March 7, 2025 |

| AAUM | Rs413.49 crs |

| AUM | Rs481.96 crs |

| Folio count | 1,013 |

Trustee's Discretion

| Average Maturity | 0.31 yrs |

| Modified Duration | 0.30 yrs |

| Macaulay Duration | 0.31 yrs |

| Annualised YTM* | 6.10% |

| Tracking Error | 0.08% |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 3 months

Trustee’s Discretion

Entry Load:

NIL. (applicable for all plans)

Exit Load:

NIL.

| Regular Plan: | 0.35% |

| Direct Plan: | 0.12% |

Folio Count data as on 30th June 2025.

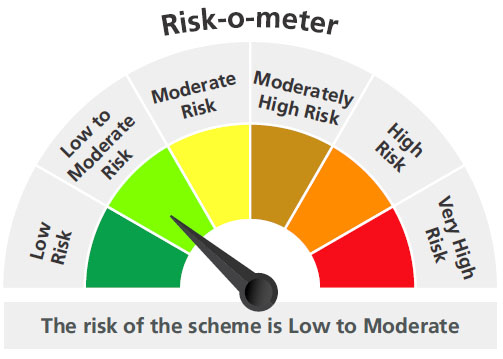

Fund

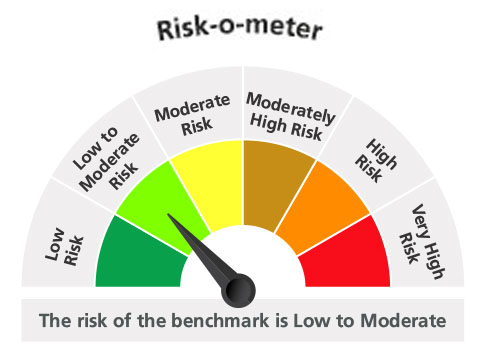

Benchmark : CRISIL-IBX Financial Services 3-6 Months Debt Index

This product is suitable for investors who are seeking*:

- Income generated from exposure to shorter-term maturities on the yield curve.

- An open-ended Constant Maturity Index Fund tracking CRISIL-IBX Financial Services 3-6 Months Debt Index.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The product labelling assigned during the New Fund Offer is based on internal assessment of the Scheme Characteristics or model portfolio and the same may vary post NFO when actual investments are made. An addendum may be issued or updated on the website for new riskometer.

**Total Expense Ratio includes applicable GST.

The scheme has not completed 6 month since inception

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'