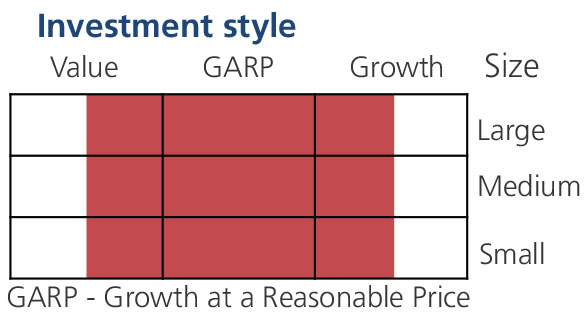

An open ended equity scheme investing across large cap, mid cap, small cap stocks

An open ended equity scheme investing across large cap, mid cap, small cap stocks

The investment objective of the scheme is to generate long-term capital appreciation from a portfolio of equity and equity related securities across market capitalization. There is no assurance that the investment objective of the Scheme will be achieved.

The investment objective of the scheme is to generate long-term capital appreciation from a portfolio of equity and equity related securities across market capitalization. There is no assurance that the investment objective of the Scheme will be achieved.

| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

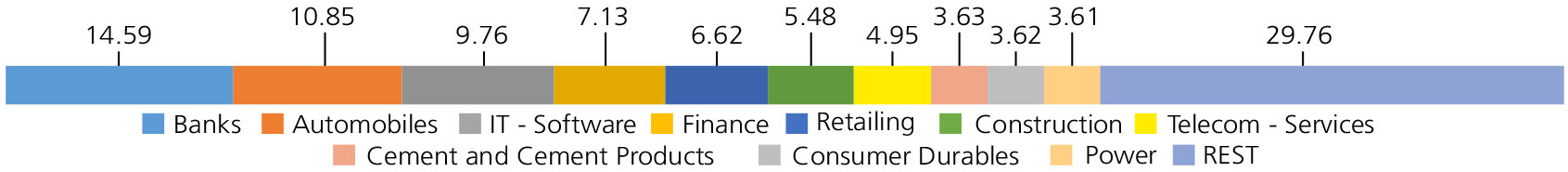

| Banks | 14.59 | |

| STATE BANK OF INDIA | 3.97 | |

| IndusInd Bank Ltd. | 2.28 | |

| Bank Of Baroda | 1.78 | |

| JAMMU AND KASHMIR BANK LTD. | 1.62 | |

| SOUTH INDIAN BANK LTD. | 1.62 | |

| CANARA BANK | 1.58 | |

| RBL Bank Ltd | 1.22 | |

| INDIAN BANK | 0.52 | |

| Automobiles | 10.85 | |

| Maruti Suzuki India Limited | 6.02 | |

| Hero MotoCorp Ltd. | 3.56 | |

| Bajaj Auto Ltd. | 1.27 | |

| IT - Software | 9.76 | |

| Mphasis Ltd | 2.52 | |

| Oracle Financial Services Software Ltd | 2.27 | |

| Infosys Ltd. | 2.11 | |

| Tech Mahindra Ltd. | 1.55 | |

| Wipro Ltd. | 1.31 | |

| Finance | 7.13 | |

| POONAWALLA FINCORP LTD. | 2.63 | |

| Power Finance Corporation Ltd. | 2.32 | |

| LIC Housing Finance Ltd. | 1.09 | |

| Piramal Enterprises Limited | 1.09 | |

| Retailing | 6.62 | |

| ETERNAL LIMITED | 2.61 | |

| FSN E-COMMERCE VENTURES LTD. | 2.17 | |

| SWIGGY LTD | 1.24 | |

| V-Mart Retail Ltd. | 0.60 | |

| Construction | 5.48 | |

| Engineers India Ltd. | 1.82 | |

| KALPATARU PROJECTS INTERNATIONAL LIMITED | 1.38 | |

| Ashoka Buildcon Limited | 1.10 | |

| G R Infraprojects Limited | 0.81 | |

| ISGEC HEAVY ENGINEERING LTD. | 0.37 | |

| Telecom - Services | 4.95 | |

| Indus Towers Ltd. | 1.94 | |

| Bharti Airtel Ltd | 1.86 | |

| Tata Communications Ltd. | 1.15 | |

| Cement and Cement Products | 3.63 | |

| Ambuja Cements Ltd. | 1.97 | |

| Shree Cement Ltd. | 1.66 | |

| Consumer Durables | 3.62 | |

| Kajaria Ceramics Ltd. | 1.76 | |

| Pokarna Ltd. | 1.18 | |

| Indigo Paints Limited | 0.68 | |

| Power | 3.61 | |

| NLC India Ltd. | 1.98 | |

| NTPC LTD | 1.63 | |

| Petroleum Products | 3.51 | |

| HINDUSTAN PETROLEUM CORPORATION LTD | 2.70 | |

| RELIANCE INDUSTRIES LTD. | 0.81 | |

| Beverages | 3.02 | |

| Radico Khaitan Ltd. | 2.80 | |

| United Breweries Ltd. | 0.22 | |

| Pharmaceuticals and Biotechnology | 3.00 | |

| JUBILANT PHARMOVA LIMITED | 1.14 | |

| ACUTAAS CHEMICALS LTD | 0.96 | |

| INNOVA CAPTABS LTD | 0.86 | |

| ORCHID PHARMA LTD. | 0.04 | |

| Diversified FMCG | 2.51 | |

| ITC Ltd. | 2.51 | |

| Gas | 2.25 | |

| GAIL (India) Ltd. | 1.46 | |

| Gujarat State Petronet Ltd. | 0.79 | |

| Entertainment | 2.00 | |

| PVR INOX LIMITED | 1.03 | |

| Sun TV Network Ltd. | 0.97 | |

| Industrial Manufacturing | 1.78 | |

| JYOTI CNC AUTOMATION LTD | 1.52 | |

| JNK INDIA LIMITED | 0.26 | |

| Insurance | 1.63 | |

| LIFE INSURANCE CORPORATION OF INDIA LTD. | 1.63 | |

| Leisure Services | 1.56 | |

| Jubilant Foodworks Limited | 1.13 | |

| JUNIPER HOTELS LIMITED | 0.43 | |

| Agricultural, Commercial and Construction Vehicles | 1.29 | |

| Ashok Leyland Ltd. | 1.29 | |

| Industrial Products | 1.11 | |

| Subros Ltd. | 1.11 | |

| Transport Services | 1.07 | |

| Container Corporation of India Ltd. | 1.07 | |

| Fertilizers and Agrochemicals | 0.97 | |

| P I Industries Ltd | 0.97 | |

| Healthcare Services | 0.80 | |

| YATHARTH HOSPITAL AND TRAUMA CARE SERVICES LTD | 0.80 | |

| Printing and Publication | 0.61 | |

| Navneet Education Ltd. | 0.61 | |

| Chemicals and Petrochemicals | 0.48 | |

| SRF Ltd. | 0.48 | |

| Food Products | 0.45 | |

| Heritage Foods Ltd | 0.45 | |

| Aerospace and Defense | 0.30 | |

| MTAR Technologies Ltd. | 0.30 | |

| Equity & Equity related - Total | 98.58 | |

| Mutual Fund Units | ||

| Kotak Liquid Direct Growth | 0.39 | |

| Mutual Fund Units - Total | 0.39 | |

| Triparty Repo | 1.01 | |

| Net Current Assets/(Liabilities) | 0.02 | |

| Grand Total | 100.00 | |

| | ||

| Monthly SIP of (₹) 10000 | Since Inception | 3 years | 1 year |

| Total amount invested (₹) | 4,70,000 | 3,60,000 | 1,20,000 |

| Total Value as on July 31, 2025 (₹) | 6,95,928 | 4,82,594 | 1,21,191 |

| Scheme Returns (%) | 20.42 | 20.01 | 1.86 |

| NIFTY500 MULTICAP 50:25:25 TRI (%) | 17.40 | 17.90 | 5.60 |

| Alpha* | 3.02 | 2.12 | -3.75 |

| NIFTY500 MULTICAP 50:25:25 TRI (₹)# | 6,57,902 | 4,68,476 | 1,23,574 |

| Nifty 50 (₹)^ | 6,02,983 | 4,37,497 | 1,23,612 |

| Nifty 50 (%) | 12.78 | 13.10 | 5.66 |

| Regular | Direct | |

| Growth | Rs18.5942 | Rs19.6786 |

| IDCW | Rs18.5939 | Rs19.6782 |

A) Regular Plan B) Direct Plan

Options: Growth and Income Distribution

cum capital withdrawal (IDCW) (Payout and

Reinvestment) (applicable for all plans)

| Fund Manager* | Mr. Devender Singhal & Mr. Abhishek Bisen |

| Benchmark | Nifty 500 Multicap 50:25:25 TRI |

| Allotment date | September 29, 2021 |

| AAUM | Rs 19,006.38 crs |

| AUM | Rs 18,854.40 crs |

| Folio count | 7,74,689 |

Trustee's Discretion

| Portfolio Turnover | 35.86% |

| $Beta | 1.05 |

| $Sharpe ## | 1.13 |

| $Standard Deviation | 15.44% |

| (P/E) | 17.08 |

| P/BV | 2.41 |

| Large Cap | 38.41% |

| Mid Cap | 31.02% |

| Small Cap | 29.15% |

| Debt & Money Market | 1.42% |

*% of Net Asset

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

• For redemption / switch out of upto 10%

of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

• If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%

• If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL.

| Regular Plan: | 1.63% |

| Direct Plan: | 0.42% |

Folio Count data as on 30th June 2025.

Benchmark : Nifty 500 Multicap 50:25:25 TRI

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in equity and equity related securities across market capitalisation.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'