An open ended equity scheme following Special Situations Theme

An open ended equity scheme following Special Situations Theme

The investment objective of the scheme is to generate long term capital appreciation by investing predominantly in opportunities presented by Special Situations such as Company Specific Event/Developments, Corporate Restructuring, Government Policy change and/or Regulatory changes, Technology led Disruption/ Innovation or companies going through temporary but unique challenges and other similar instances. However, there is no assurance that the objective of the scheme will be achieved.

The investment objective of the scheme is to generate long term capital appreciation by investing predominantly in opportunities presented by Special Situations such as Company Specific Event/Developments, Corporate Restructuring, Government Policy change and/or Regulatory changes, Technology led Disruption/ Innovation or companies going through temporary but unique challenges and other similar instances. However, there is no assurance that the objective of the scheme will be achieved.

| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

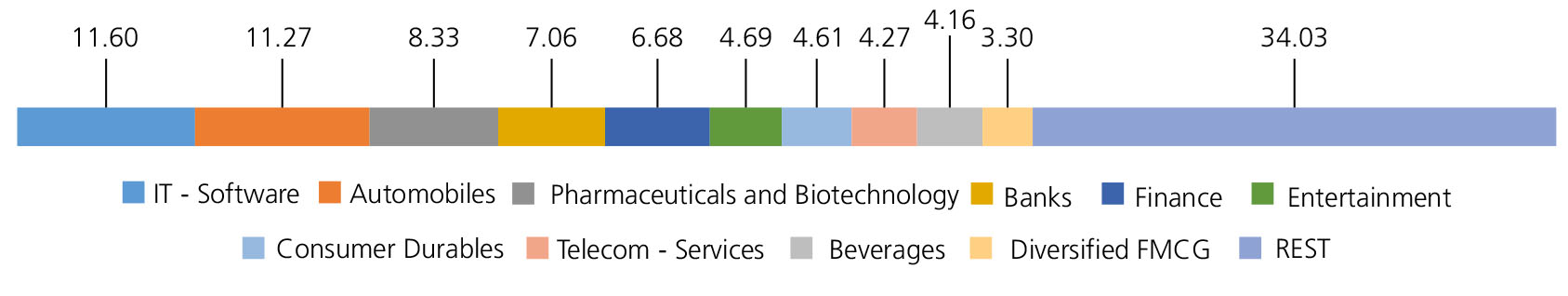

| IT - Software | 11.60 | |

| Wipro Ltd. | 4.03 | |

| Oracle Financial Services Software Ltd | 3.10 | |

| Mphasis Ltd | 2.62 | |

| Tech Mahindra Ltd. | 1.85 | |

| Automobiles | 11.27 | |

| Maruti Suzuki India Limited | 6.77 | |

| Hero MotoCorp Ltd. | 4.50 | |

| Pharmaceuticals and Biotechnology | 8.33 | |

| JUBILANT PHARMOVA LIMITED | 3.93 | |

| Marksans Pharma Ltd | 2.91 | |

| ORCHID PHARMA LTD. | 1.49 | |

| Banks | 7.06 | |

| IndusInd Bank Ltd. | 3.04 | |

| RBL Bank Ltd | 2.16 | |

| JAMMU AND KASHMIR BANK LTD. | 1.11 | |

| SOUTH INDIAN BANK LTD. | 0.75 | |

| Finance | 6.68 | |

| LIC Housing Finance Ltd. | 2.87 | |

| POONAWALLA FINCORP LTD. | 2.86 | |

| Piramal Enterprises Limited | 0.95 | |

| Entertainment | 4.69 | |

| PVR INOX LIMITED | 2.42 | |

| Sun TV Network Ltd. | 2.27 | |

| Consumer Durables | 4.61 | |

| Indigo Paints Limited | 2.74 | |

| Bata India Ltd. | 1.87 | |

| Telecom - Services | 4.27 | |

| Indus Towers Ltd. | 2.45 | |

| Bharti Airtel Ltd - Partly Paid Shares | 1.82 | |

| Beverages | 4.16 | |

| Radico Khaitan Ltd. | 4.16 | |

| Diversified FMCG | 3.30 | |

| ITC Ltd. | 3.30 | |

| Industrial Manufacturing | 3.14 | |

| JYOTI CNC AUTOMATION LTD | 3.14 | |

| Retailing | 3.13 | |

| AVENUE SUPERMARTS LTD. | 2.16 | |

| BRAINBEES SOLUTIONS LIMITED | 0.97 | |

| Power | 3.11 | |

| NLC India Ltd. | 3.11 | |

| Personal Products | 3.00 | |

| Dabur India Ltd. | 3.00 | |

| Leisure Services | 2.44 | |

| SAPPHIRE FOODS INDIA LTD. | 2.44 | |

| Auto Components | 2.42 | |

| SAMVARDHANA MOTHERSON INTERNATIONAL LIMITED | 2.42 | |

| Industrial Products | 2.24 | |

| Graphite India Ltd. | 1.16 | |

| Carborundum Universal Ltd. | 1.08 | |

| Aerospace and Defense | 2.23 | |

| MTAR Technologies Ltd. | 2.23 | |

| Chemicals and Petrochemicals | 2.20 | |

| SRF Ltd. | 1.54 | |

| NOCIL LTD | 0.66 | |

| Capital Markets | 1.86 | |

| Aditya Birla Sun Life AMC Ltd | 1.86 | |

| Electrical Equipment | 1.68 | |

| AZAD ENGINEERING LTD | 1.68 | |

| Construction | 1.63 | |

| KALPATARU PROJECTS INTERNATIONAL LIMITED | 1.63 | |

| Healthcare Services | 1.30 | |

| ASTER DM HEALTHCARE LTD | 1.30 | |

| Realty | 1.24 | |

| Oberoi Realty Ltd | 1.24 | |

| Transport Services | 1.15 | |

| MAHINDRA LOGISTICS LTD | 1.09 | |

| MAHINDRA LOGISTICS LTD RIGHTS | 0.06 | |

| Food Products | 0.86 | |

| AVANTI FEEDS LTD | 0.86 | |

| Equity & Equity related - Total | 99.60 | |

| Triparty Repo | 0.10 | |

| Net Current Assets/(Liabilities) | 0.30 | |

| Grand Total | 100.00 | |

| | ||

| Monthly SIP of Rs 10000 | Since Inception | 6 months |

| Total amount invested (₹) | 1,40,000 | 1,20,000 |

| Total Value as on July 31, 2025 (₹) | 1,36,388 | 1,17,805 |

| Scheme Returns (%) | -4.18 | -3.39 |

| Nifty 500 (TRI) Returns (%) | 4.10 | 5.07 |

| Alpha* | -8.27 | -8.47 |

| Nifty 500 (TRI) (₹)# | 1,43,508 | 1,23,239 |

| Nifty 50 (TRI) (₹)^ | 1,44,330 | 1,23,612 |

| Nifty 50 (TRI) Returns (%) | 5.06 | 5.66 |

| Regular | Direct | |

| Growth | Rs9.3846 | Rs9.5286 |

| IDCW | Rs9.3845 | Rs9.5296 |

A) Regular Plan B) Direct Plan

Options: Growth and Income Distribution

cum capital withdrawal (IDCW) (Payout and

Reinvestment)

| Fund Manager* |

Mr. Devender Singhal &

Mr. Abhishek Bisen |

| Benchmark | Nifty 500 TRI |

| Allotment date | June 29, 2024 |

| AAUM | Rs2,050.66 crs |

| AUM | Rs1,972.92 crs |

| Folio count | 1,10,596 |

Trustee's Discretion

| Portfolio Turnover | 22.97% |

| $Beta | 1.08 |

| $Sharpe ## | -0.55 |

| $Standard Deviation | 17.80% |

| ^^(P/E) | 26.57 |

| ^^P/BV | 3.00 |

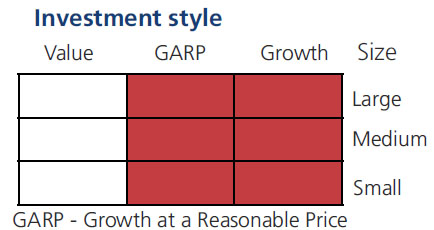

| Large Cap | 24.80% |

| Mid Cap | 29.18% |

| Small Cap | 45.62% |

| Debt & Money Market | 0.40% |

*% of Net Asset

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

• For redemption / switch out within 90

days from the date of allotment: 0.5%

• If units are redeemed or switched out on

or after 90 days from the date of allotment -

Nil

| Regular Plan: | 2.05% |

| Direct Plan: | 0.67% |

Folio Count data as on 30th June 2025.

Benchmark : Nifty 500 TRI

This product is suitable for investors who are seeking*:

- Long-term capital growth

- Investment in portfolio of predominantly equity & equity related securities following Special Situation Theme.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

For latest Riskometer, investors may refer to an addendum issued or updated on website at www.kotakmf.com

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'