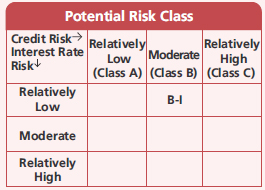

An open ended debt scheme investing in money market instruments. A relatively low interest rate risk and moderate credit risk.

An open ended debt scheme investing in money market instruments. A relatively low interest rate risk and moderate credit risk.

| Issuer/Instrument | Industry/Rating | % to Net Assets |

|---|---|---|

| Government Dated Securities | ||

| 5.15% Central Government | SOV | 1.42 |

| 8.28% Karnataka State Govt-Karnataka | SOV | 0.56 |

| 8.07% Tamil Nadu State Govt-Tamil Nadu | SOV | 0.39 |

| 8.24% Tamil Nadu State Govt-Tamil Nadu | SOV | 0.33 |

| 8.59% Karnataka State Govt-Karnataka | SOV | 0.30 |

| 8.39% Madhya Pradesh State Govt-Madhya Pradesh | SOV | 0.22 |

| 8.15% Gujarat State Govt-Gujarat | SOV | 0.21 |

| 7.96% Gujarat State Govt-Gujarat | SOV | 0.14 |

| 8.27% Madhya Pradesh State Govt-Madhya Pradesh | SOV | 0.14 |

| 8.38% Haryana State Govt-Haryana | SOV | 0.14 |

| 6.90% Tamil Nadu State Govt-Tamil Nadu | SOV | 0.10 |

| 7.97% Tamil Nadu State Govt-Tamil Nadu | SOV | 0.04 |

| 8.16% Maharashtra State Govt-Maharashtra | SOV | 0.04 |

| 8.29% Maharashtra State Govt-Maharashtra | SOV | 0.02 |

| 8.29% Tamil Nadu State Govt-Tamil Nadu | SOV | 0.01 |

| GS 5.63% CG 12/04/2026 - (STRIPS) | SOV | 0.00 # |

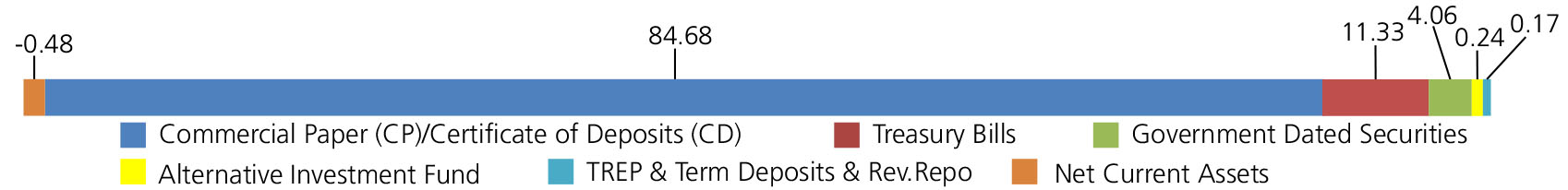

| Government Dated Securities - Total | 4.06 | |

| Money Market Instruments | ||

| Commercial Paper(CP)/Certificate of Deposits(CD) | ||

| Corporate Debt/Financial Institutions | ||

| HDFC BANK LTD. | CARE A1+ | 8.23 |

| INDUSIND BANK LTD. | CRISIL A1+ | 4.96 |

| AXIS BANK LTD. | CRISIL A1+ | 4.24 |

| MUTHOOT FINANCE LTD. | CRISIL A1+ | 2.75 |

| BHARTI TELECOM LTD. | CRISIL A1+ | 2.50 |

| IDBI BANK LTD. | CRISIL A1+ | 1.86 |

| PIRAMAL FINANCE LTD | CRISIL A1+ | 1.65 |

| ICICI SECURITIES LIMITED | CRISIL A1+ | 1.51 |

| MOTILAL OSWAL FINANCIAL SERVICES LIMITED | ICRA A1+ | 1.37 |

| FEDERAL BANK LTD. | CRISIL A1+ | 1.35 |

| BIRLA GROUP HOLDING PRIVATE LIMITED | CRISIL A1+ | 1.16 |

| Panatone Finvest Ltd. | CRISIL A1+ | 1.10 |

| AU SMALL FINANCE BANK LTD. | FITCH A1+ | 1.09 |

| HERO FINCORP LTD. | CRISIL A1+ | 0.97 |

| STANDARD CHARTERED CAPITAL LTD. | CRISIL A1+ | 0.97 |

| 360 ONE PRIME LTD. | CRISIL A1+ | 0.95 |

| TATA CAPITAL LTD. | CRISIL A1+ | 0.95 |

| MANKIND PHARMA LTD | CRISIL A1+ | 0.81 |

| TORRENT ELECTRICALS LIMITED | CRISIL A1+ | 0.71 |

| LIC HOUSING FINANCE LTD. | CRISIL A1+ | 0.48 |

| NUVAMA WEALTH AND INVESTMENT LTD | CRISIL A1+ | 0.42 |

| CHOLAMANDALAM INVESTMENT AND FINANCE COMPANY LTD. | CRISIL A1+ | 0.40 |

| Muthoot Fincorp Ltd. | CRISIL A1+ | 0.40 |

| BARCLAYS INVESTMENTS & LOAN (INDIA) PVT. LTD. | CRISIL A1+ | 0.34 |

| JULIUS BAER CAPITAL (INDIA) PVT. LTD | CRISIL A1+ | 0.28 |

| TATA PROJECTS LTD. | CRISIL A1+ | 0.28 |

| GODREJ HOUSING FINANCE LTD | CRISIL A1+ | 0.27 |

| GODREJ INDUSTRIES LTD | CRISIL A1+ | 0.21 |

| Bahadur Chand Investments Private Limited | ICRA A1+ | 0.14 |

| Corporate Debt/Financial Institutions - Total | 42.35 | |

| Public Sector Undertakings | ||

| SMALL INDUSTRIES DEVELOPMENT BANK OF INDIA | CARE A1+ | 8.09 |

| CANARA BANK | CRISIL A1+ | 5.71 |

| PUNJAB NATIONAL BANK(^) | CARE A1+ | 4.20 |

| UNION BANK OF INDIA | FITCH A1+ | 4.02 |

| NATIONAL BANK FOR AGRICULTURE & RURAL DEVELOPMENT | CRISIL A1+ | 3.78 |

| NATIONAL BANK FOR AGRICULTURE & RURAL DEVELOPMENT | FITCH A1+ | 3.70 |

| INDIAN BANK | CRISIL A1+ | 3.50 |

| NATIONAL BANK FOR AGRICULTURE & RURAL DEVELOPMENT | ICRA A1+ | 2.20 |

| PUNJAB NATIONAL BANK | CRISIL A1+ | 1.38 |

| SMALL INDUSTRIES DEVELOPMENT BANK OF INDIA | CRISIL A1+ | 1.37 |

| UNION BANK OF INDIA | ICRA A1+ | 1.10 |

| UCO BANK | CRISIL A1+ | 0.95 |

| PUNJAB & SIND BANK | ICRA A1+ | 0.69 |

| PUNJAB NATIONAL BANK | FITCH A1+ | 0.68 |

| BANK OF BARODA | FITCH A1+ | 0.62 |

| Export-Import Bank of India | CRISIL A1+ | 0.27 |

| BANK OF INDIA | CRISIL A1+ | 0.07 |

| Public Sector Undertakings - Total | 42.33 | |

| Treasury Bills | ||

| 364 DAYS TREASURY BILL 21/05/2026 | SOV | 1.84 |

| 364 DAYS TREASURY BILL 05/02/2026 | SOV | 1.79 |

| 364 DAYS TREASURY BILL 29/01/2026 | SOV | 1.38 |

| 364 DAYS TREASURY BILL 04/12/2025 | SOV | 1.12 |

| 364 DAYS TREASURY BILL 12/02/2026 | SOV | 0.83 |

| 364 DAYS TREASURY BILL 19/03/2026 | SOV | 0.78 |

| 364 DAYS TREASURY BILL 20/02/2026 | SOV | 0.69 |

| 364 DAYS TREASURY BILL 27/02/2026 | SOV | 0.69 |

| 364 DAYS TREASURY BILL 12/03/2026 | SOV | 0.62 |

| 91 DAYS TREASURY BILL 30/10/2025 | SOV | 0.56 |

| 182 DAYS TREASURY BILL 18/12/2025 | SOV | 0.39 |

| 364 DAYS TREASURY BILL 04/06/2026 | SOV | 0.31 |

| 364 DAYS TREASURY BILL 21/11/2025 | SOV | 0.27 |

| 364 DAYS TREASURY BILL 06/11/2025 | SOV | 0.06 |

| Treasury Bills - Total | 11.33 | |

| Triparty Repo | 0.17 | |

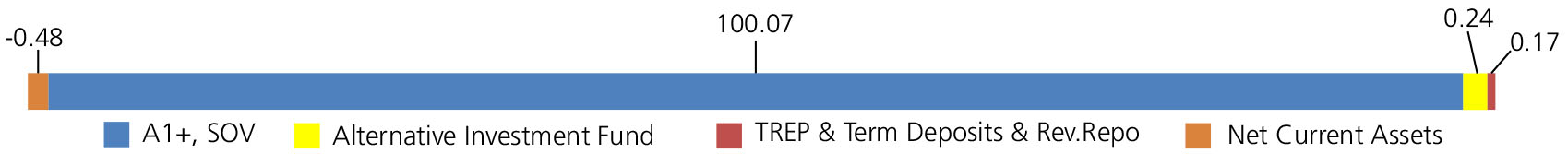

| Alternative Investment Fund | ||

| CORPORATE DEBT MARKET DEVELOPMENT FUND - CLASS A2 | Alternative Investment Fund | 0.24 |

| Alternative Investment Fund - Total | 0.24 | |

| Net Current Assets/(Liabilities) | -0.48 | |

| Grand Total | 100.00 | |

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 26,50,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on July 31, 2025 (₹) | 62,98,349 | 16,84,110 | 10,61,270 | 7,14,943 | 4,04,872 | 1,25,186 |

| Scheme Returns (%) | 7.19 | 6.60 | 6.58 | 6.95 | 7.79 | 8.16 |

| CRISIL Money Market A-I Index Returns (%) | 7.01 | 6.38 | 6.36 | 6.72 | 7.39 | 7.37 |

| Alpha* | 0.18 | 0.21 | 0.22 | 0.23 | 0.40 | 0.80 |

| CRISIL Money Market A-I Index (₹)# | 61,55,623 | 16,65,467 | 10,53,035 | 7,10,920 | 4,02,498 | 1,24,686 |

| NIFTY 1 Year T-Bill Index (₹)^ | 58,03,188 | 16,46,615 | 10,42,007 | 7,02,924 | 4,00,509 | 1,24,550 |

| NIFTY 1 Year T-Bill Index Returns (%) | 6.55 | 6.16 | 6.07 | 6.27 | 7.06 | 7.15 |

| Regular | Direct | |

| Growth | Rs4526.8972 | Rs4569.2897 |

| Monthly IDCW | Rs1055.1255 | Rs1226.0528 |

A)Regular Plan B)Direct Plan

Options: Payout of IDCW (Under Monthly

IDCW option only), Reinvestment of IDCW

& Growth applicable for all plans

| Fund Manager* | Mr. Deepak Agrawal, Mr. Manu Sharma |

| Benchmark*** | CRISIL Money Market A-I Index |

| Allotment date | July 14, 2003 |

| AAUM | Rs34,390.87 crs |

| AUM | Rs35,214.67 crs |

| Folio count | 16,227 |

Monthly (2nd of every month - effective April 01, 2025).

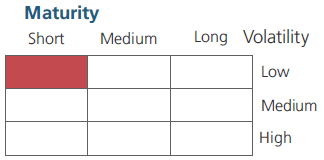

| Average Maturity | 0.53 yrs |

| Modified Duration | 0.53 yrs |

| Macaulay Duration | 0.53 yrs |

| Annualised YTM* | 6.14% |

| $Standard Deviation | 0.39% |

Source: $ICRA MFI Explorer.

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 3-6 months

Entry Load:

Nil. (applicable for all plans)

Exit Load:

Nil. (applicable for all plans)

| Regular Plan: | 0.36% |

| Direct Plan: | 0.24% |

Folio Count data as on 30th June 2025.

Fund

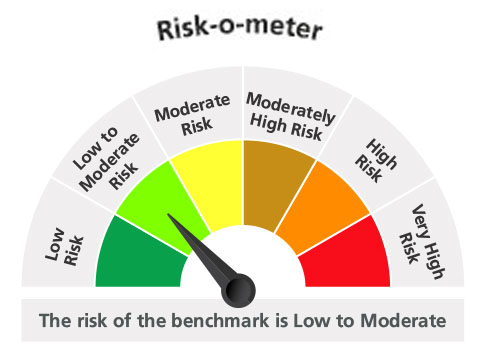

Benchmark: CRISIL Money Market A-I Index

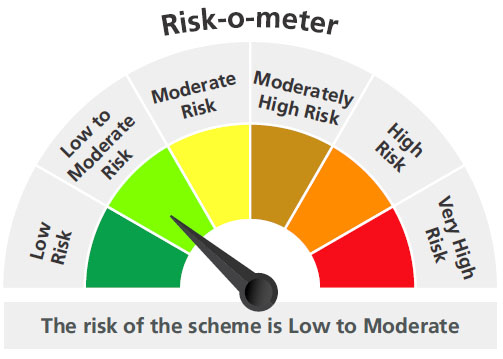

This product is suitable for investors who are seeking*:

- Income over a short term investment horizon

- Investment in money market securities

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st January, 2025. An addendum may be issued or updated on the website for new riskometer

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'