Investment Objective

The investment objective of the scheme is

to provide returns before expenses that

closely correspond to the total returns of

stocks as represented by the Nifty Bank

Index subject to tracking errors. There is no

assurance or guarantee that the investment

objective of the scheme will be achieved.

The investment objective of the scheme is

to provide returns before expenses that

closely correspond to the total returns of

stocks as represented by the Nifty Bank

Index subject to tracking errors. There is no

assurance or guarantee that the investment

objective of the scheme will be achieved.

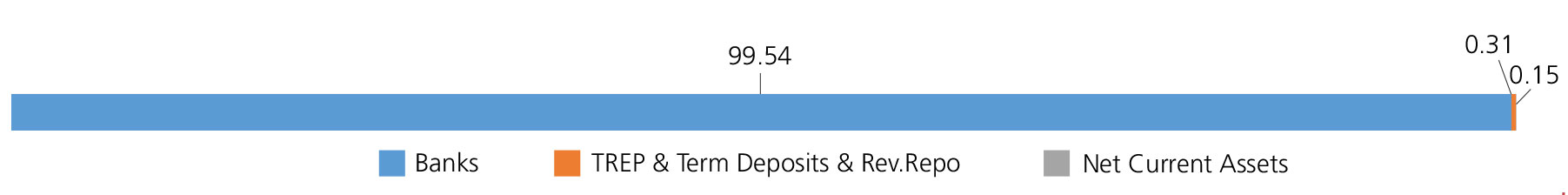

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity Related |

||

| HDFC Bank Ltd. | Banks | 27.49 |

| ICICI Bank Ltd. | Banks | 22.87 |

| State Bank Of India | Banks | 11.67 |

| Axis Bank Ltd. | Banks | 11.56 |

| Kotak Mahindra Bank Ltd. | Banks | 11.34 |

| IndusInd Bank Ltd. | Banks | 5.01 |

| AU Small Finance Bank Ltd. | Banks | 2.53 |

| Bandhan Bank Ltd. | Banks | 1.77 |

| Bank Of Baroda | Banks | 1.76 |

| Federal Bank Ltd. | Banks | 1.75 |

| IDFC First Bank Limited | Banks | 0.95 |

| Punjab National Bank | Banks | 0.84 |

| Equity & Equity Related - Total | 99.54 | |

| Triparty Repo | 0.31 | |

| Net Current Assets/(Liabilities) | 0.15 | |

| Grand Total | 100.00 | |

NAV

Rs338.9540

Available Plans/Options

Regular Plan

Option - Payout of IDCW

| Fund Manager | Mr. Devender Singhal & Mr. Satish Dondapati* |

| Benchmark | Nifty Bank Index TRI |

| Allotment date | December 04, 2014 |

| AAUM | Rs6,313.52 crs |

| AUM | Rs6,024.29 crs |

| Folio count | 30,516 |

Ratios

| Portfolio Turnover | 44.09% |

| Tracking Error: | 0.31% |

Minimum Investment Amount

Through Exchange: 1 Unit,

Through AMC: 15000 Units,

Ideal Investment Horizon: 5 years and

above

Load Structure

Entry Load: Nil. (applicable for all plans)

Exit Load:

Nil (applicable for all plans)

Total Expense Ratio**

Regular: 0.18%

Data as on June 30, 2022

Fund

Benchmark

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in stocks comprising the underlying index and endeavours to track the benchmark index

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'Our Fund Managers'

For scheme performance, please refer 'Scheme Performances'