| KOTAK ALL WEATHER DEBT FOF

An open-ended fund of fund scheme predominantly investing in debt oriented mutual fund schemes of Kotak Mahindra Mutual Fund

An open-ended fund of fund scheme predominantly investing in debt oriented mutual fund schemes of Kotak Mahindra Mutual Fund

| KOTAK ALL WEATHER DEBT FOF

An open-ended fund of fund scheme predominantly investing in debt oriented mutual fund schemes of Kotak Mahindra Mutual Fund

An open-ended fund of fund scheme predominantly investing in debt oriented mutual fund schemes of Kotak Mahindra Mutual Fund

Investment Objective

To generate long-term capital appreciation

from a portfolio created by investing in debt

oriented mutual fund schemes of Kotak

Mahindra Mutual Fund. However, there is no

assurance that the investment objective of

the scheme will be realized.

To generate long-term capital appreciation

from a portfolio created by investing in debt

oriented mutual fund schemes of Kotak

Mahindra Mutual Fund. However, there is no

assurance that the investment objective of

the scheme will be realized.

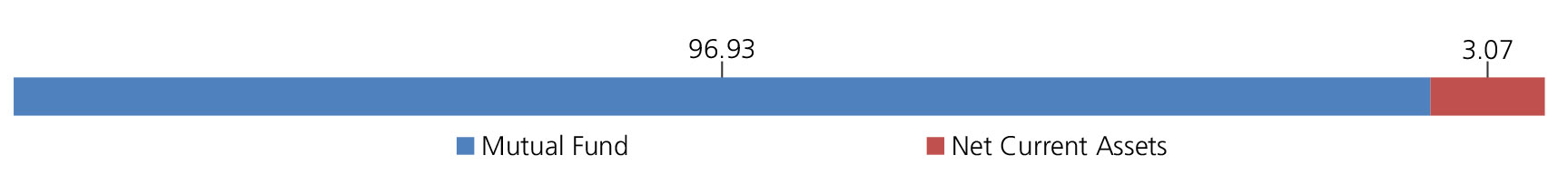

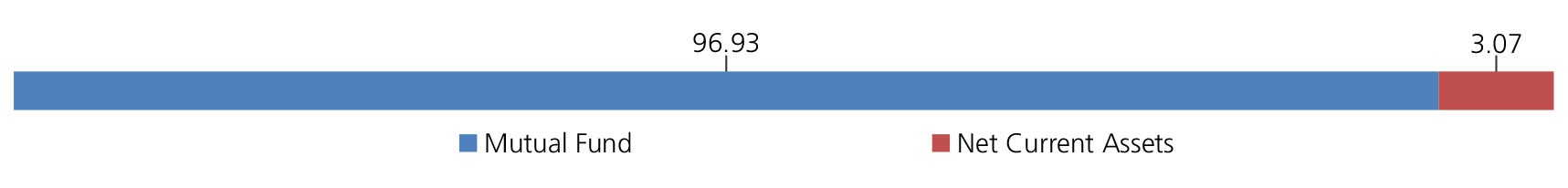

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Mutual Fund Units | ||

| Kotak Floating Rate Fund Direct Growth | Mutual Fund industry | 93.16 |

| Kotak Liquid Scheme Direct Plan Growth | Mutual Fund industry | 3.77 |

| Mutual Fund Units - Total | 96.93 | |

| Net Current Assets/(Liabilities) | 3.07 | |

| Grand Total | 100.00 | |

NAV

| Regular-Plan-Growth | Rs10.2384 |

| Direct-Plan-Growth | Rs10.2411 |

| Regular-Plan-IDCW | Rs10.2383 |

| Direct-Plan-IDCW | Rs10.2411 |

Available Plans/Options

A) Regular B) Direct Plan

Options: Growth and Income Distribution

cum capital withdrawal (IDCW) (Payout and

Reinvestment)

| Fund Manager* | Mr. Abhishek Bisen |

| Benchmark | NIFTY Composite Debt Index |

| Allotment date | November 17, 2022 |

| AAUM | Rs24.01 crs |

| AUM | Rs22.45 crs |

| Folio count | 607 |

IDCW Frequency

Trustee’s Discretion

Minimum Investment Amount

Initial Investment: Rs5000 and in multiple

of Rs1 for purchase and for Rs0.01 for

switches

Additional Investment: Rs1000 & in multiples

of Rs1 for purchase and for Rs0.01 for

switches

Ideal Investments Horizon: 1 year and Above

Load Structure

Entry Load: Nil. (applicable for all plans)

Exit Load: Nil

Total Expense Ratio**

Regular: 0.15%; Direct: 0.07%

Data as on March 31, 2023

Fund

Benchmark

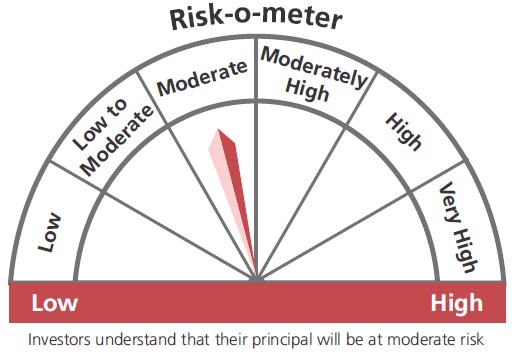

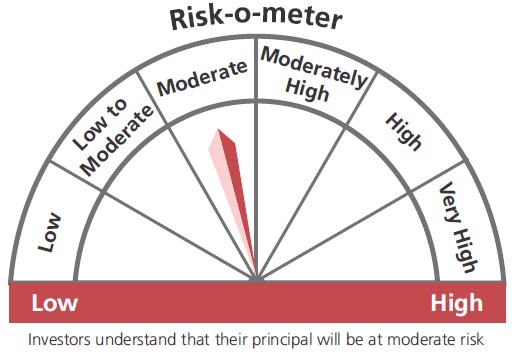

This product is suitable for investors who are seeking*:

- Long-term capital appreciation

- An open ended fund of fund scheme predominantly investing in debt oriented mutual fund schemes of Kotak Mahindra Mutual Fund

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st March, 2023.

**Total Expense Ratio includes applicable B30 fee and GST

Scheme has not completed 6 months since inception

* For Fund Manager experience, please refer 'Our Fund Managers'