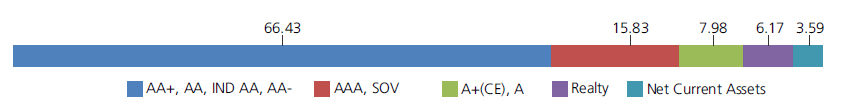

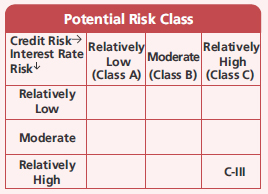

An open ended debt scheme predominantly investing in AA and below rated corporate bonds (Excluding AA+ rated corporate bonds).

A relatively high interest rate risk and relatively high credit risk.

An open ended debt scheme predominantly investing in AA and below rated corporate bonds (Excluding AA+ rated corporate bonds).

A relatively high interest rate risk and relatively high credit risk.

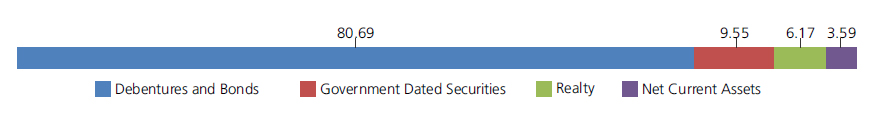

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Mutual Fund Units | ||

| Embassy Office Parks REIT | Realty | 4.67 |

| Brookfield India Real Estate Trust | Realty | 1.50 |

| Mutual Fund Units - Total | 6.17 | |

| Debt Instruments | ||

| Debentures and Bonds | ||

| Government Dated Securities | ||

| 8.51% Central Government | SOV | 7.36 |

| 7.38% Central Government | SOV | 2.19 |

| Government Dated Securities - Total | 9.55 | |

| Public Sector Undertakings | ||

| Power Finance Corporation Ltd. | CRISIL AAA | 4.16 |

| U P Power Corporation Ltd ( Guaranteed By UP State Government ) | CRISIL A+(CE) | 3.61 |

| THDC India Ltd. (THDCIL) | CARE AA | 2.15 |

| Public Sector Undertakings - Total | 9.92 | |

| Corporate Debt/Financial Institutions | ||

| Tata Power Company Ltd. | CARE AA | 9.32 |

| Aadhar Housing Finance Limited | CARE AA | 8.53 |

| DLF Cyber City Developers Ltd | CRISIL AA | 8.44 |

| Bahadur Chand Investments Private Limited | ICRA AA | 6.53 |

| Tata Projects Ltd. | FITCH IND AA | 6.43 |

| Godrej Industries Ltd | CRISIL AA | 6.32 |

| Godrej Industries Ltd | CRISIL AA | 5.12 |

| Vivriti Capital Private Limited | CARE A | 4.37 |

| JM Financial Products Limited | ICRA AA | 4.25 |

| AU Small Finance Bank Ltd. | CRISIL AA | 3.49 |

| Piramal Pharma Limited | CARE AA- | 2.58 |

| Century Textiles & Industries Ltd. | CRISIL AA | 2.14 |

| Bajaj Housing Finance Ltd. | CRISIL AAA | 2.12 |

| Muthoot Finance Ltd. | CRISIL AA+ | 1.13 |

| Corporate Debt/Financial Institutions - Total | 70.77 | |

| Net Current Assets/(Liabilities) | 3.59 | |

| Grand Total | 100.00 | |

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 15,50,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on Mar 31, 2023 (₹) | 24,35,211 | 16,41,984 | 10,08,078 | 6,72,516 | 3,78,954 | 1,22,395 |

| Scheme Returns (%) | 6.72 | 6.11 | 5.14 | 4.52 | 3.37 | 3.74 |

| NIFTY Credit Risk Bond Index C-III Returns (%) | 9.11 | 8.83 | 8.45 | 8.45 | 7.91 | 8.67 |

| Alpha | -2.39 | -2.72 | -3.31 | -3.94 | -4.54 | -4.93 |

| NIFTY Credit Risk Bond Index C-III (₹)# | 28,77,834 | 18,93,823 | 11,34,313 | 7,42,208 | 4,05,516 | 1,25,506 |

| NIFTY Credit Risk Bond Index Returns (%) | 8.80 | 8.52 | 8.17 | 8.16 | 7.47 | 8.07 |

| Alpha | -2.08 | -2.40 | -3.03 | -3.64 | -4.10 | -4.33 |

| NIFTY Credit Risk Bond Index (₹)# | 28,15,679 | 18,62,313 | 11,23,001 | 7,36,733 | 4,02,889 | 1,25,131 |

| CRISIL 10 Year Gilt Index (₹)^ | 23,20,524 | 16,08,160 | 9,96,014 | 6,71,085 | 3,74,898 | 1,24,278 |

| CRISIL 10 Year Gilt Index (%) | 6.02 | 5.71 | 4.80 | 4.43 | 2.66 | 6.72 |

Alpha is difference of scheme return with benchmark return.

| Growth Option | Rs24.8647 |

| Direct Growth Option | Rs27.3842 |

| Annual-Reg-Plan-IDCW | Rs10.8133 |

| Annual-Dir-Plan-IDCW | Rs20.5682 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Deepak Agrawal,

Mr. Sunit Garg &

Mr. Vihag Mishra (Dedicated fund manager for investments in foreign securities) |

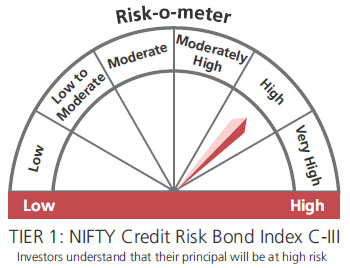

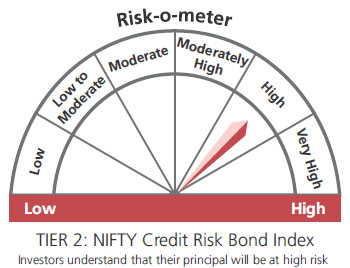

| Benchmark*** | Nifty Credit Risk Bond

Index C-III (Tier 1) Nifty Credit Risk Bond Index (Tier 2) |

| Allotment date | May 11, 2010 |

| AAUM | Rs1,182.54 crs |

| AUM | Rs1,150.35 crs |

| Folio count | 11,333 |

At discretion of trustees

| Portfolio Average Maturity | 3.00 yrs |

| IRS Average Maturity* | - |

| Net Average Maturity | 3.00 yrs |

| Portfolio Modified Duration | 1.75 yrs |

| IRS Modified Duration* | - |

| Net Modified Duration | 1.75 yrs |

| Portfolio Macaulay Duration | 1.88 yrs |

| IRS Macaulay Duration* | - |

| Net Macaulay Duration | 1.88 yrs |

| Annualised YTM* | 8.27% |

| $Standard Deviation | 2.84% |

*in case of semi annual YTM, it will be annualized.

Initial Investment:Rs5000 and in multiple

of Rs1 for purchase and for Rs0.01 for switches

Additional Investment: Rs1000 & in multiples of Rs1

Ideal Investments Horizon: 3 year & above

Entry Load: Nil. (applicable for all plans)

Exit Load: a) For redemption / switch out of

upto 6% of the initial investment amount

(limit) purchased or switched in within 1

year from the date of allotment: Nil.

b) If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%

c) If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL

Regular: 1.61%; Direct: 0.74%

Fund

Benchmark

Benchmark

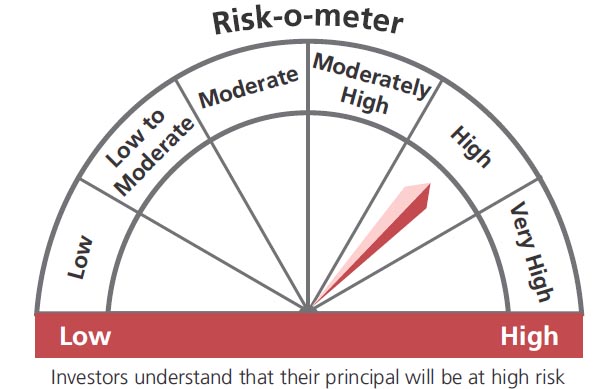

This product is suitable for investors who are seeking*:

- Income over a medium term investment horizon

- Investment predominantly in in AA and below rated corporate bonds (Excluding AA+ rated corporate bonds)

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st March, 2023.

**Total Expense Ratio includes applicable B30 fee and GST.

***As per SEBI circular no. SEBI/HO/IMD/IMD-11 DF3/P/CIR/2021 /652 dated October 27, 2021; AMFI letter no. 35P/MEM-COR/70/2021-22 dated November 25, 2021 and AMFI letter no. 35P/ MEM-COR/ 131 / 2021-22 dated March 31, 2022 with effect from April 01, 2022 ("Effective date"), the first tier benchmark index of the scheme. Existing benchmark will be Second Tier benchmark for aforementioned scheme.

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'